Dennis Kissler is senior vice president of trading for BOK Financial Services. Steve Wyett is chief investment strategist for BOK Financial Services.

The question on many people’s minds starting 2024 was how soon the U.S. Federal Reserve and other central banks would start cutting rates and whether they would move in lockstep. Now, kicking off 2025, a significant focus is on the nature and magnitude of proposed U.S. tariffs and how the U.S. economy—and the world—will react.

Through the U.S. presidential campaigns, election and now transition, many of the details surrounding tariffs remained unknown. When Donald Trump takes office, however, experts are expecting more clarity. While we wait for new tariffs to be announced and new details to be shared, experts and economists can help paint a picture of what the road ahead may look like.

Inflation or growth?

Big picture, it’s not the use of tariffs in general that has had some economists concerned, but rather how broad or large the tariffs might be.

During his campaign, Trump’s proposals included imposing a blanket tariff of 10% to 20% on all imports, with additional tariffs of 60% to 100% on goods imported from China, and a 25% to 100% tariff on goods from Mexico if the Mexican government doesn’t take steps on its end to close the U.S.-Mexico border. However, in late November, he proposed a 25% tariff on goods imported from Mexico and Canada, and a 10% tariff on imports from China.

Targeted tariffs can help keep China from dumping steel on the global market, for example, or something of that nature, but the broad use of tariffs probably damages the economy as much as it helps it.

RELATED

Canadian Premiers Urge Strong Response to Trump Tariff Threat, Minister Says

If you’re using tariffs to protect domestic producers, inevitably, what you’re saying is, “I’m going to raise the price of this foreign good that can be imported cheaper, so it can be made here.” However, that means consumers are now going to be asked to pay a higher price for the good either by paying the tariff on what’s imported or by paying a little bit higher price for a domestic producer to produce the good. The domestic producer is going to price it as close to the tariff price as possible.

But proponents of broad tariffs argue the opposite. For instance, the Washington International Trade Association (WITA)—a nonprofit, nonpartisan organization that includes the president and CEO of the American Apparel & Footwear Association as president of its board—publicized a trade model that predicts broad tariffs would benefit U.S. consumers and businesses in multiple ways.

Specifically, the 2022 model looks at the impact of a 15% revenue tariff increase on all imported goods, and a 35% tariff increase on some imports that are significant for economic reasons or for “national resilience,” such as imports from Non-Free Trade Agreement (NFTA) countries. With those in place, the model predicted a 7% boost to the U.S. economy, 10 million new jobs, a 10% rise in inflation-adjusted household income and $603 billion generated in federal revenue.

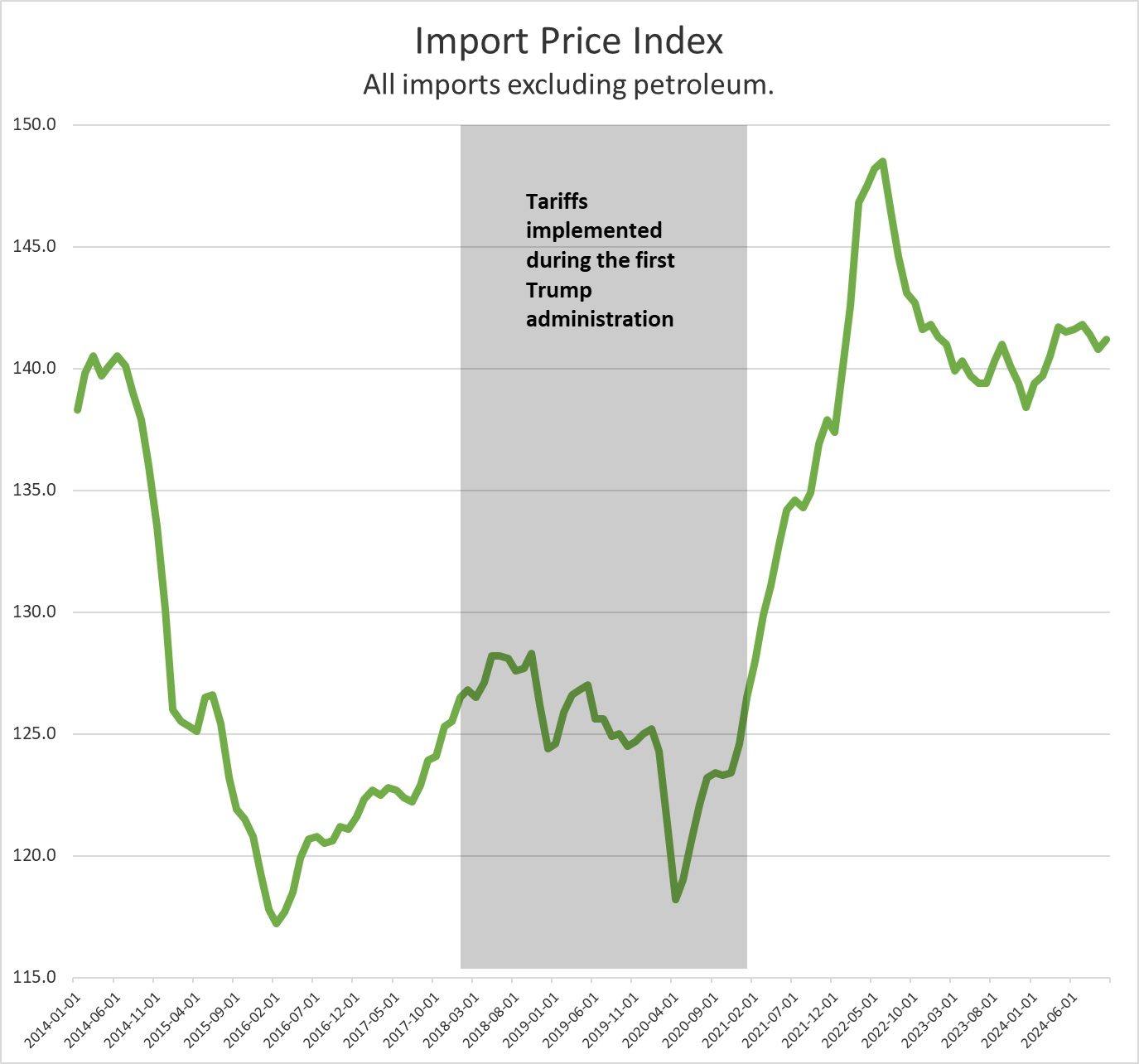

Also, keep in mind that during the first Trump administration, tariffs were implemented on imports from China and overall inflation remained subdued. The real question this round will be the amount or percentage that will be imposed.

The model from the Federal Reserve Bank of St. Louis uses tariff figures that differ significantly from the ones Trump suggested during his campaign. To put all of these numbers into perspective, you have to go back nearly 200 years to 1830, when the highest tariff in U.S. history, a near-62% tax on all dutiable imports, was imposed and received strong political opposition within the U.S.

The second-highest tariff was the 1930 Smoot-Hawley Tariff Act, which raised around 900 import tariffs by an average of 40% to 60%. This act is believed to have been a driver of the Great Depression, but it’s unlikely the U.S. is in the same position now.

How will other countries react?

One reason the Smoot-Hawley Tariff Act is believed to have helped cause the Great Depression is because of its significant reduction in global trade. In response to the act, around two dozen countries enacted high tariffs of their own within two years of its passage, causing a 65% drop in international trade between 1929 and 1934.

Experts are saying that Trump’s proposed tariffs on China and Mexico, in particular, could have serious effects on those countries—on top of the struggles they are already having—and no one knows how they and other countries would react.

RELATED

Trump Tariff Threat Raises Consternation Among Oil Lobbying Groups

As our colleague, Pete Tibbles, senior vice president of foreign exchange trading at BOK Financial, told us: if Trump does come in and put those tariffs into place, then that’s obviously going to have a detrimental effect on China because that country has been trying to grow its economy but it’s been a struggle.

China has a lot of housing problems. There is a middle class now in China, which is great, but it’s gotten to the stage where housing is a little saturated and they have all these zombie towns where they can’t sell the property, so many of the massive property conglomerates are in a lot of trouble.

In turn, China’s reaction to high U.S. tariffs could also impact the energy market. In retaliation, the Chinese government could come against U.S. crude imports into their country. It also would weaken their economy. Remember that they’re the largest crude importer, so if we weaken their economy, the biggest demand puller is going to be coming down and that could be a problem for U.S. crude exports in general.

Another question is how Chinese exporters themselves will react. People say, “It’s going to hurt Chinese exporters.” Well, if that's true, then do they slow down their exports? Do they export to other places in the world where there are no tariffs? Until we know more details from Trump on how it’s going to look, it’s very difficult to come up with good answers.

Mexico, meanwhile, is dealing with controversial judicial reforms which could impact the United States-Mexico-Canada Agreement (USMCA). It’s not just a U.S. story; it’s a Mexico story as well.

However, until more is known about Trump’s tariff policy, it’s hard to know what that story is, experts stressed time and time again. Obviously, it’s going to affect trade, but how it affects trade can be very different, depending on the specific policies. Does it move the needle a lot for oil and natural gas prices? It will have an effect, but past history of a Trump administration (pre-COVID) actually points to more price stability.

Recommended Reading

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

Oxy CEO: US Oil Production Likely to Peak Within Five Years

2025-03-11 - U.S. oil production will likely peak within the next five years or so, Oxy’s CEO Vicki Hollub said. But secondary and tertiary recovery methods, such as CO2 floods, could sustain U.S. output.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Burleson: Rockcliff Energy III Builds on Past Successes

2025-04-09 - Rockcliff Energy III is building on past experiences as it explores deeper in the Haynesville, CEO Sheldon Burleson told Hart Energy at DUG Gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.