At a time when crude production remains flat and the natural gas Henry Hub price struggles to stay above $2/MMBtu, NGLs have provided midstream companies a lucrative stream of income. (Source: Shutterstock)

Midstream players in the Permian Basin are sharpening their M&A knives to win the fight to secure NGLs and add capacity, according to industry experts watching midstream deals play out.

In 2023, some of the biggest names in the midstream market, Crestwood and Magellan, were bought out in M&A deals worth north of $10 billion.

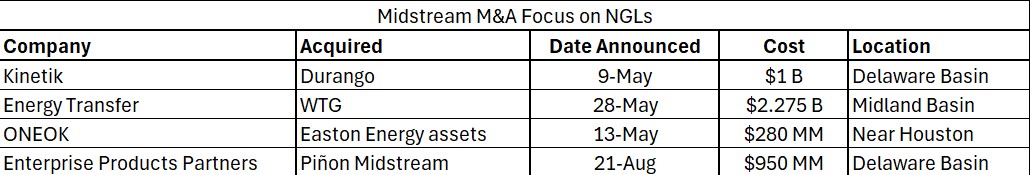

In the summer of 2024, the midstream M&A market ball has continued to roll, though it may be losing steam. Major companies are focused on developing natural gas gathering and processing (G&P) assets, and deals have generally stayed in or below the $2 billion range.

“Gas processing is an evolving kind of space, especially with the shortage of gas capacity in the crude basins because of the growth in associated gas,” said Sunil Sibal, analyst for Seaport Research Partners.

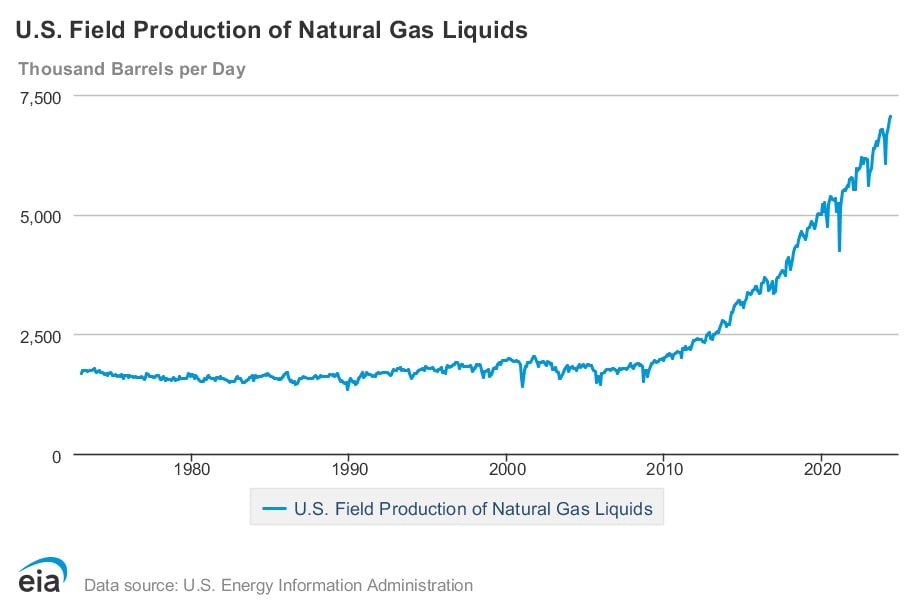

In the crowded Permian, a shrinking group of competitors continue to search for more natural gas capacity and more processing facilities for NGLs—a sector of the market that’s shown strong demand growth over the last two years.

On Aug. 21, Enterprise Products Partners (EPD) announced it would acquire Piñon Midstream, an independent company with gas pipelines and processing assets in the eastern Delaware Basin in New Mexico.

It was the third Permian Basin deal this summer that included a large company buying out a smaller private with primarily natural gas gathering and processing facilities. In early May, Kinetik (KNTK) bought Durango Midstream in the Delaware. Energy Transfer (ET) bought WTG Midstream before the month ended.

In a June analysis article, East Daley Analytics referred to Permian M&A activity as a “knife fight for the NGL barrel.”

“All of these [companies] are targeting G&P [gathering and processing] for the NGL production to secure the bbl for the tariff fee on pipes, storage, fracs, LPG export and the ability to market NGLs using infrastructure,” East Daley’s Rob Wilson wrote in an email to Hart Energy on Aug. 27.

At a time when crude production remains flat and the natural gas Henry Hub price struggles to stay above $2/MMBtu, NGLs have provided midstream companies a lucrative stream of income.

“Enverus has tracked $22 billion in U.S. midstream M&A year-to-date 2024, with substantially all of that focused on gas and NGLs,” said Andrew Dittmar, principal analyst at Enverus Intelligence Research, in an email to Hart Energy. “Large midstream and integrated firms want more exposure to the Permian as a growth area for their business as associated gas production volumes continue to rise and inventory life is sufficient to justify acquisition pricing.”

It's currently a buyers’ market for midstream companies looking to add capacity, said Hinds Howard of CBRE. After a substantial build-out period in the late 2010s, larger midstream companies focused on financial discipline in the early parts of the 2020s.

“Midstream companies have done a great job in recent years of reducing debt on balance sheets, such that leverage is at or below target levels, creating optionality for excess cash flow,” Howard said. “The options are to raise dividends, to buy back stock, to invest capital in growth projects or to pursue M&A.”

In the Permian, G&P facilities are attractive thanks to the volume of associated gas produced in the crude-focused basin. Natural gas, thanks to low prices, only provides income to the midstream players via toll prices.

NGLs, however, provide multiple ways for large midstream companies to make money.

“Being integrated as a midstream company across the NGL value chain is very lucrative because there is a gathering fee, a processing fee, a transportation fee, a fractionation fee and an export fee for NGL volumes,” Howard said. “So, getting more G&P assets upstream of an integrated system has a network effect. That’s why NGLs are valuable.”

The majors are also playing hard ball. With fewer competitors in the area vying for fewer already-built assets, executives are moving to protect the current streams flowing on their networks.

“There is an element of defensive strategy in these M&A deals,” Howard said. “You want volumes flowing on your system, so you don’t want some other big midstream company to get control of NGL volumes and potentially direct them to another company. So, for an EPD or an ET, it could make sense to buy a smaller company that may be shipping NGLs on your pipeline ahead of the expiration of the contracts where those volumes could go elsewhere.”

Deal review

All three of the acquired Permian Basin companies—Durango, WTG Midstream and Piñon—were in the midst of expanding their gas processing facilities in the year leading up to their mergers.

In November 2023, Durango announced it received funding to support ongoing construction at its Kings Landing Gas Processing Complex in Eddy County, New Mexico.

And WTG Midstream had boasted a processing capacity of 1 Bcf/d for natural gas prior to its merger with ET and continues to build two new processing plants, according to RBN Energy.

Piñon offered Enterprise a different type of processing capacity. The company had recently completed work on a sour gas processing plant and disposal wells on the eastern side of the Delaware Basin. The plant gives Enterprise a foothold in a rapidly developing area where sour gas is a known problem.

“With room for expansion on both the treating and injection side, this could spur more development in this highly prolific area, given producers will have greater access to treating and injection facilities,” said James Taylor, East Daley analyst, in an email to Hart Energy.

Outside of G&P producing basins, ONEOK bought assets to expand its access to NGLs, prior to further processing and export. In May, the company spent $280 million in a deal to acquire 450 miles of NGL pipelines serving customers and exporters in the Houston area. The pipes had belonged to Easton Energy, a Houston-based midstream company.

The largest midstream deal of the year was an outlier. EQT spent a little over $11 billion to buy back its old midstream company Equitrans, according to Enverus. The deal was different, Dittmar said, owing to the fact that EQT made the purchase to lower its cost structure and generate more cash while the price of natural gas remains low.

Recommended Reading

Q&A: Where There’s a Williams, There’s a Way for Gas

2025-04-09 - Midstream giant Williams Cos. leads the natural gas bulls on the great infrastructure buildout, President and CEO Alan Armstrong tells Hart Energy.

Phillips 66 Urges Shareholders to Vote Against Elliott at Annual Meeting

2025-04-08 - Phillips 66’s board of directors is again pushing against one of its largest investors—Elliott Investment Management—with a letter to shareholders detailing how to vote against the investment company at its upcoming annual meeting.

NRG’s President of Consumer Rasesh Patel to Retire

2025-04-07 - NRG Energy anticipates naming a successor during the second quarter. Patel will remain in an advisory role during the transition.

PE Firm Andros Capital Partners Closes $1 Billion Energy Fund

2025-04-07 - Andros Capital Partners maintains a flexible investment mandate, allowing the firm to invest opportunistically across the capital structure in both public and private equity or debt securities.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.