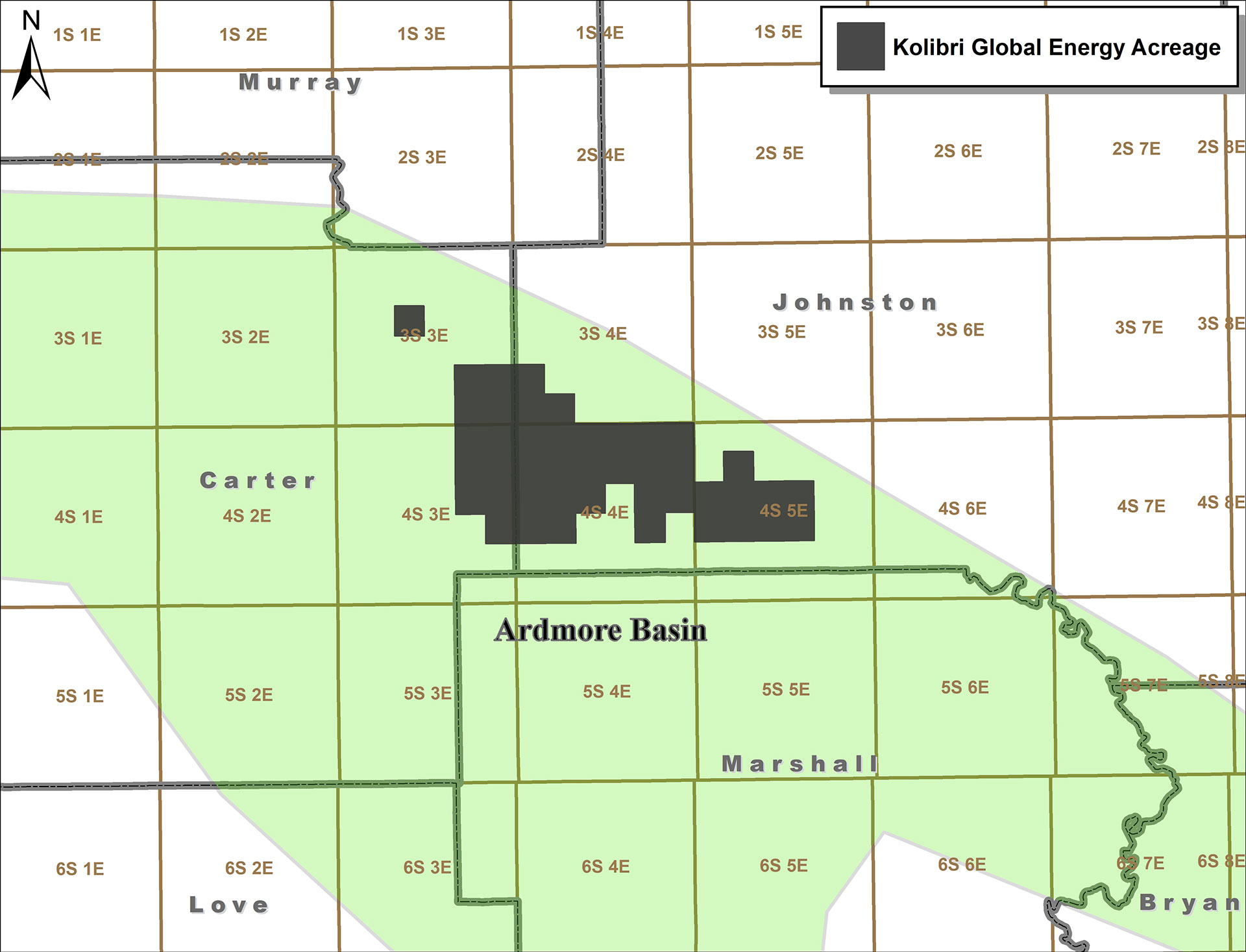

Kolibri holds about 17,100 net contiguous acres in the SCOOP, with reserves sources from the Caney Formation. (Source: Shutterstock/ Kolibri Global Energy)

California’s Kolibri Global Energy has drilled its first three 1.5-mile lateral wells in the company’s Tishomingo Field in Oklahoma’s SCOOP region.

Kolibri reported drilling the Alicia Renee 2-11-3H, 2-11-4H and 2-11-5H wells safely and under budget. Each well was drilled in an average 14 days each compared to a budgeted 20-day duration. The wells will be simultaneously completed beginning in early October, with flowback anticipated in early November, the company said in a Sept. 18 press release.

Kolibri holds a 100% working interest in all three wells. The company holds about 17,100 net contiguous acres in the SCOOP, with reserves sources from the Caney Formation, according to the company’s website. The company has 31 operated horizontal Caney Shale wells and reported proved and probable (2P) reserves of 54.1 MMboe gross.

The company also reported 170 additional Caney locations with reserves comprising 72% oil.

“We are looking forward to getting these wells on production in the fourth quarter to further increase our cash flow and to evaluate the economic benefits of these longer lateral wells,” Wolf Regener, Kolibri president and CEO, said in the release. “With the wells being drilled so quickly, we are hopeful that these longer laterals can have a material impact in improving the economics and value of the field.”

Kolibri Global Energy is listed on the Toronto Stock Exchange.

Recommended Reading

BYOP (Bring Your Own Power): The Great AI Race for Electrons

2025-01-06 - Data-center developers, scrambling to secure 24/7 power, are calling on U.S. producers to meet demand as natgas offers the quickest way to get more electrons into the taps.

Exclusive: Novi Labs’ Ludwig on AI Preventing Costly Drilling Mistakes

2024-12-12 - Novi Labs President and Co-Founder Jon Ludwig gives insight on how AI and machine learning allow diverse applications for oil and gas operations and less risk for cataclysmic failure, in this Hart Energy Exclusive interview.

E&P Seller Beware: The Buyer May be Armed with AI Intel

2025-02-18 - Go AI or leave money on the table, warned panelists in a NAPE program.

Small Steps: The Continuous Journey of Drilling Automation

2024-12-26 - Incremental improvements in drilling technology lead to significant advancements.

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.