(Source: Shutterstock.com)

Kosmos Energy reported on July 3 the successful startup of oil production at the Winterfell development in the Green Canyon area of the U.S. Gulf of Mexico.

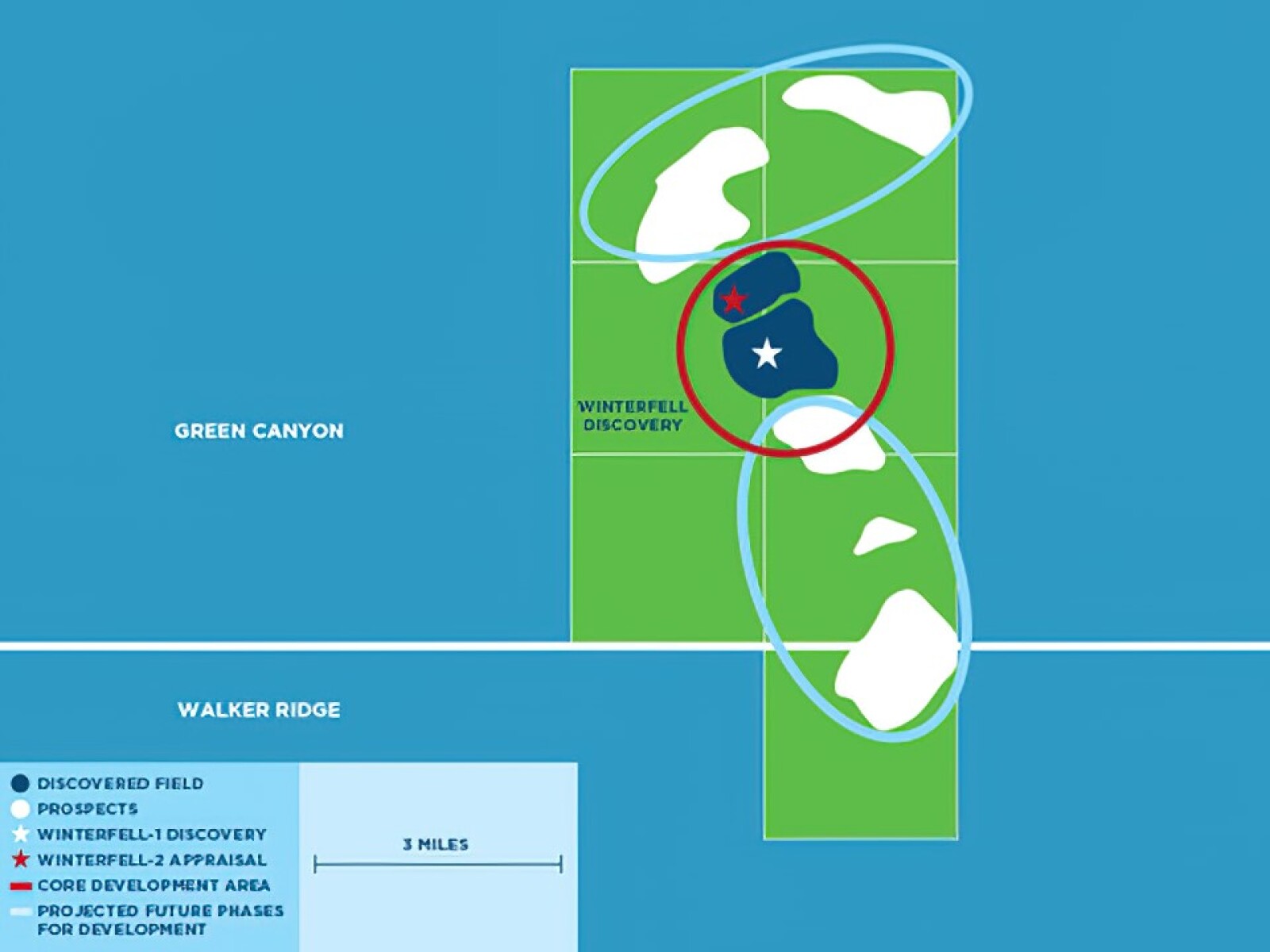

Winterfell, operated by Beacon Offshore Energy, is a phased development with the initial two production wells. Kosmos said the first phase is now online and ramping up production. A third well being drilled is expected to come online by the end of third-quarter 2024.

The three initial wells are expected to deliver gross production of approximately 20,000 boe/d.

Andrew G. Inglis, Kosmos chairman and CEO, said the Winterfell startup is another significant milestone for the company to achieve growth targets by year-end 2024.

“With high margin barrels, low carbon intensity and a quick expected payback, Winterfell has the right characteristics for Kosmos' portfolio,” Inglis said. “Kosmos is eager to continue developing the Greater Winterfell area which we believe has significant future upside potential."

Beacon holds a 35.08% interest in Winterfell and Kosmos Energy 25.04%. Other partners are Westlawn GOM Asset 3 Holdco LLC 15% percent, Red Willow Offshore LLC with 12.5%, Alta Mar Energy (Winterfell) LLC with 7.55%, CSL Exploration LP with 4.5% and BOE with 0.33%.

Discovered in 2021, Winterfell is a Miocene-aged field in water depth of approximately 5,400 ft (~1,600 m), Kosmos said.

The field has been developed via a 13-mile subsea tieback to the host platform. Following the successful drilling and completion of the first two wells and subsea hookup in April 2024, delays in subsequent work resulted in first oil slightly later than initially anticipated, Kosmos said.

The first phase of the development, with five wells in total, is expected to deliver around 100 MMboe from subsequent phases. The Winterfell unit consists of Green Canyon blocks 899, 900, 943, 944, 987 and 988 with follow-on opportunities in adjacent blocks where Kosmos also holds interests.

Recommended Reading

Scott Sheffield Sues FTC for Abuse of Power Over Exxon-Pioneer Deal

2025-01-21 - A Federal Trade Commission majority opinion in May barred former Pioneer Natural Resources CEO Scott Sheffield from serving in any capacity with Exxon Mobil Corp. following its acquisition of the Permian Basin E&P.

Chevron’s Wirth: Rapid Transitions in Energy Strategy ‘Not the Right Policy Approach’

2025-03-10 - Relying on the president, whoever it is, leads to a wildly inconsistent energy policy in the U.S., Chevron CEO Mike Wirth said at CERAWeek by S&P Global.

Pickering Prognosticates 2025 Political Winds and Shale M&A

2025-01-14 - For oil and gas, big M&A deals will probably encounter less resistance, tariffs could be a threat and the industry will likely shrug off “drill, baby, drill” entreaties.

Burgum: Yes to US Power Supply, Reliability; No on Sage Grouse

2025-01-16 - Interior Secretary nominee Doug Burgum said the sage grouse is neither endangered nor threatened; he'll hold federal leases as scheduled; and worries the U.S. is short of electric power and at risk of losing the “AI arms race” to China and other adversaries.

VanLoh: US Energy Security Needs ‘Manhattan Project’ Intensity

2025-02-06 - Quantum Capital Group Founder and CEO Wil VanLoh says oil and gas investment, a modernized electric grid and critical minerals are needed to meet an all of the above energy strategy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.