Kosmos anticipates a notable increase in free cash flow—executives estimate between $100 million and $150 million per quarter. (Source: Shutterstock)

Kosmos Energy’s progress across its development projects in the second quarter has set the company on a path toward a robust finish to 2024, executives said.

The company is making headway toward its increased production goals in the U.S. Gulf of Mexico (GoM). Kosmos has also made advancements on the Greater Tortue Ahmeyim Project (GTA) project in Mauritania and Senegal, which operator BP launched drilling campaigns in Ghana and Equatorial Guinea.

“Two years ago, we announced a target to grow production by around 50%, driven largely by the delivery of three important projects, Jubilee Southeast in Ghana, Winterfell in the Gulf of Mexico and GTA in Mauritania and Senegal,” Kosmos CEO Andrew Inglis said during the company’s Aug. 5 earnings call. “We’re around halfway to achieving that target with the successful startup of Jubilee Southeast and Winterfell, alongside production enhancement projects in the Gulf of Mexico.”

As projects become fully operational, Kosmos anticipates a notable increase in free cash flow—executives estimate between $100 million and $150 million per quarter.

GoM projects get started

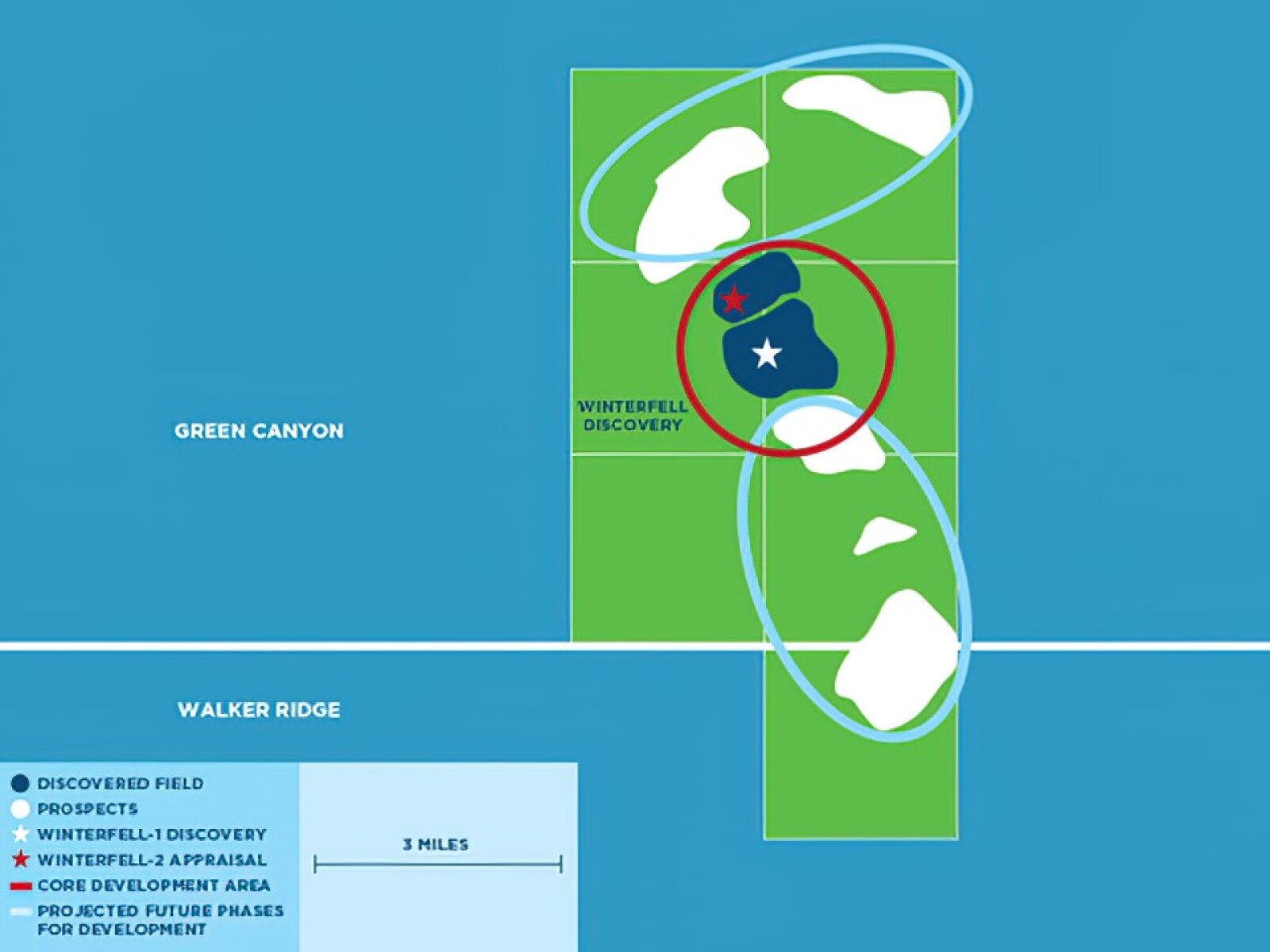

In the GoM, the startup of Winterfell, operated by Beacon Offshore Energy LLC, marked a milestone for the company, Inglis said, as the development’s first two wells came online in early July and the third is anticipated by the end of the third quarter. Beacon holds a 35.08% interest in Winterfell and Kosmos Energy 25.04% with other partners holding the rest of the project’s stakes. Winterfell was discovered in 2021.

As operator, Kosmos also successfully completed the Kodiak-3 well workover and its Odd Job subsea pump project came online in late July, with both performing ahead of company expectations. Together, the Kosmos’ GoM production is up 20,000 boe/d, a 40% increase from the first quarter.

Kosmos is planning two additional GoM wells. Kosmos also have further upside potential from Tiberius in Keathley Canyon Block 964, which the company said has an estimate gross resource of 100 MMboe.

“On Tiberius, our next ILX [infrastructure-led exploration] development where Kosmos is operator, we have ordered the long lead items and secured a rig with the project sanction expected later this year. We continue to make good progress and anticipate first oil around 18 months to 24 months after [final investment decision],” Inglis said.

Africa ops update

The BP-led GTA project offshore Mauritania and Senegal also recently achieved significant infrastructure milestones as the gas province and envisioned LNG hub are built out. Kosmos, a partner in the project, reported that a floating LNG vessel has been moored to the hub terminal, and an FPSO unit is secured to the seabed with risers installed and final connection work ongoing.

The project is anticipated to produce first gas in August, and the inaugural LNG cargo is expected by the fourth-quarter. Concept development work has been completed on the Yakaar-Teranga in Senegal. Kosmos said it will now transition toward finalizing the partnership to support the project’s advancement.

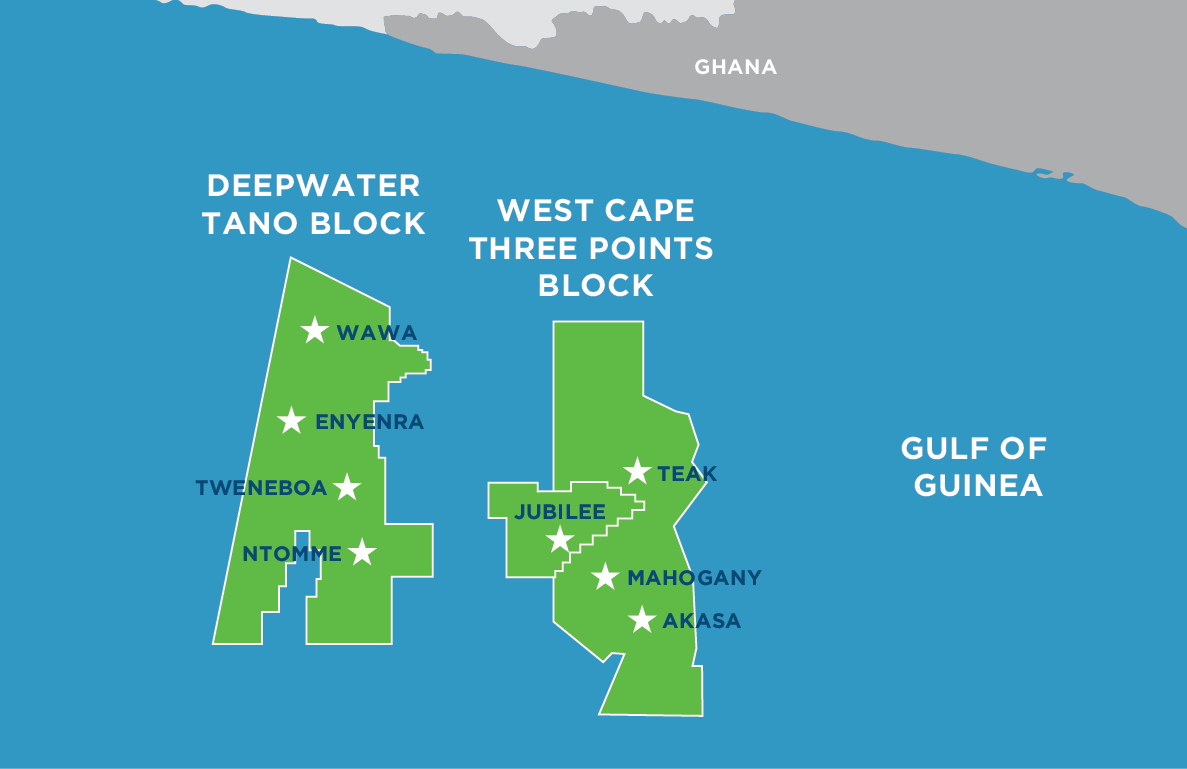

Kosmos’ operations in Ghana have seen the completion of a three-year drilling campaign at Jubilee, with the final producer and water injection wells now online. Despite a dip in production due to underperformance of well J-69, and some water injection challenges, “full year gross Jubilee production is now expected to be around 90,000 barrels of oil per day,” Inglis said. The TEN Field in Ghana is exceeding expectations, producing about 19,300 bbl/d with high facility uptime. Currently, Kosmos’ Ghana operations produce 87,000 boe/d.

The company is also on track in developing its TEN Field offshore Ghana, Inglis said.

“The next step is clearly the finishing of all of the TEN, all the work by technique, to pre-commission, hand over to BP so they can take operational control of the FPSO. That, again, is targeted in September with first gas shortly thereafter,” Inglis said.

In Equatorial Guinea, the company averaged 24,000 bbl/d in gross production. Kosmos has begun its drilling campaign, with a rig recently arriving to initiate the drilling of two infill wells. Early results from the first well are promising, and Kosmos estimated an additional 3,000 bbl/d net increase from production by year-end. Gross production in the region was 24,200 bbl/d, aligning with initial expectations.

“Looking at 3Q and the full year more broadly… we have lowered our full year production guidance to 67,000 [boe] to 71,000 boe, reflecting the impacts of J-69 on Jubilee and the delay in Winterfell,” Inglis said. “We expect to lift two fewer Ghana cargoes this year. This should be partially offset by an additional half cargo we now expect in Equatorial Guinea, as new production is added in the fourth quarter.”

Earnings, results

Kosmos reported $451 million in revenue, an increase from last year’s second quarter revenues of $273 million. Production saw a 7% year-on-year increase for the quarter, although at the lower end of company guidance due to lower Jubilee output and a delay in the Winterfell startup.

Kosmos reported capex of $215 million, which was lower than expected due to timing issues related to the GTA project. However, capex is expected to align with annual guidance of $750 million.

Recommended Reading

Vitol Boosts Upstream Presence in West Africa with $1.65B Deal

2025-03-19 - Vitol is acquiring oil and gas E&P assets in Cote d’Ivoire and the Republic of Congo from Eni for $1.65 billion.

After Big, Oily M&A Year, Upstream E&Ps, Majors May Chase Gas Deals

2025-01-29 - Upstream M&A hit a high of $105 billion in 2024 even as deal values declined in the fourth quarter with just $9.6 billion in announced transactions.

Constellation Energy Nearing $30B Deal for Calpine, Sources Say

2025-01-08 - Constellation Energy is nearing a roughly $30 billion deal to acquire power producer Calpine that could be announced as early as Jan. 13, sources familiar with the matter said.

Sources: Citadel Buys Haynesville E&P Paloma Natural Gas for $1.2B

2025-03-13 - Hedge fund giant Citadel’s acquisition includes approximately 60 undeveloped Haynesville locations, sources told Hart Energy.

Report: Diamondback in Talks to Buy Double Eagle IV for ~$5B

2025-02-14 - Diamondback Energy is reportedly in talks to potentially buy fellow Permian producer Double Eagle IV. A deal could be valued at over $5 billion.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.