The Laredo transaction represents NOG’s second meaningful bolt-on acquisition of 2022. (Source: Oil and Gas Investor / Laredo Petroleum Inc.)

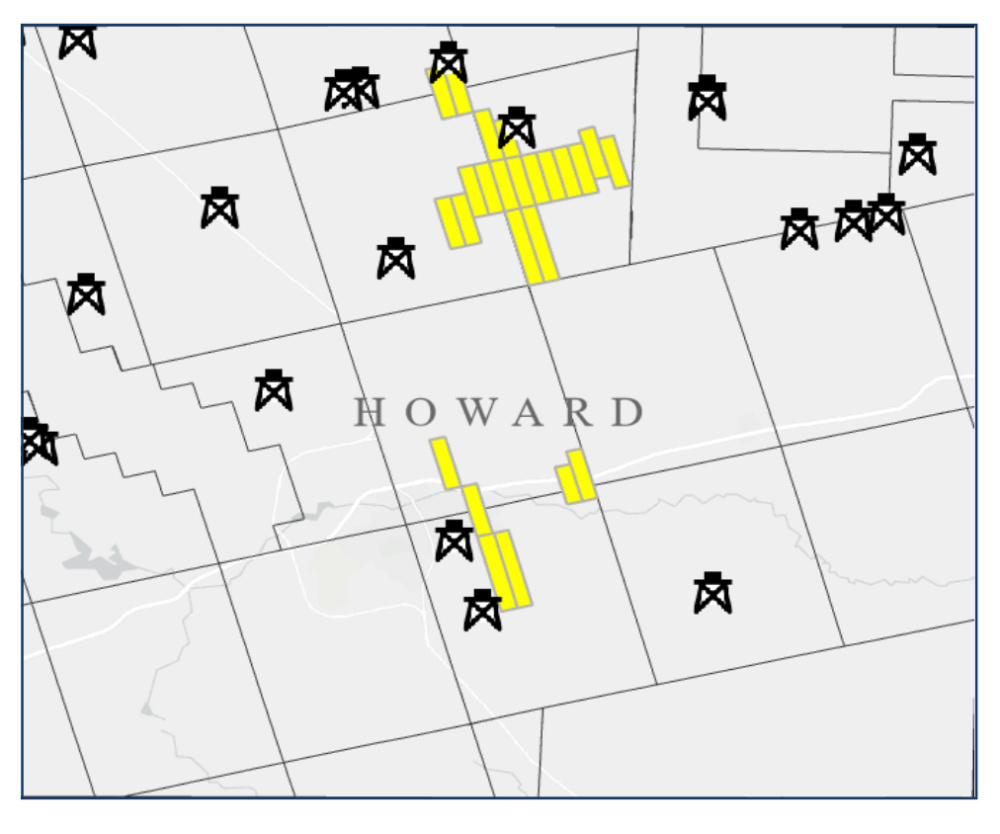

Laredo Petroleum Inc. agreed on Aug. 17 to divest certain nonoperated properties from its Permian Basin position in Howard County, Texas, to Northern Oil and Gas Inc. (NOG) for $110 million in cash.

The sale does not reduce Laredo’s eight-year inventory of operated, high-quality drilling locations, according to a company release.

“We have built a deep portfolio of high-quality development locations, which we consistently optimize through the acquisition of high-return assets and sale of certain noncore properties,” Jason Pigott, president and CEO of Laredo Petroleum, commented in the release.

The nonoperated assets comprise about 1,650 net acres and have expected full-year 2023 average net production of 1,800 boe/d (roughly 72% oil). Laredo plans to adjust production guidance post the closing of the transaction expected in October.

“The implied value of this divestiture is accretive to our net asset value per share and raises proceeds that support the repurchase of our equity and debt,” Pigott added.

During the second quarter, Laredo introduced a plan to return capital to shareholders through a $200 million equity repurchase program and repurchased more than $40 million of equity and debt.

For NOG, the Laredo transaction represents the company’s second meaningful bolt-on acquisition of 2022.

“Anchored by highly economic inventory, high oil cuts, and a strong operator, this transaction helps continue to build out the Permian Basin as an area of growth for NOG,” NOG President Adam Dirlam commented in a release.

The acquired Laredo assets are located in the Midland Basin in Howard County, Texas, and include approximately 6.4 net producing wells, 1.6 net wells-in-process and 8 net undeveloped locations. Substantially all of the assets are operated by SM Energy, according to the NOG release.

NOG expects to fund the acquisition with cash on hand, operating free cash flow and borrowings under NOG’s revolving credit facility.

Earlier this year, NOG closed a $406.5 million acquisition of Veritas Energy’s nonop position in the Permian Basin, marking the company’s largest acquisition to date.

Based in Minnetonka, Minn., Northern aims to be the go-to resource for operators that want to offload nonoperated working interests in leasehold. Originally focused in the Williston Basin, the company has within the last year begun to branch out into the Marcellus Shale and Permian Basin.

“We continue to focus on a balanced approach to growing our enterprise, with a focus on quality and low-breakeven economics,” commented NOG CEO Nick O’Grady. “NOG continues to build a stronger, more diversified company built to drive higher shareholder returns for the long term.”

The effective date for the transaction is Aug. 1. Kirkland & Ellis LLP is serving as legal adviser to NOG. Truist Securities Inc. acted as financial adviser to Laredo on this transaction.

Recommended Reading

Phillips 66’s Brouhaha with Activist Investor Elliott Gets Testy

2025-03-05 - Mark E. Lashier, Phillips 66 chairman and CEO, said Elliott Investment Management’s proposals have devolved into a “series of attacks” after the firm proposed seven candidates for the company’s board of directors.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Buying Time: Continuation Funds Easing Private Equity Exits

2025-01-31 - An emerging option to extend portfolio company deadlines is gaining momentum, eclipsing go-public strategies or M&A.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.