Laredo plans to use proceeds from the Medallion pipeline sale to cut its debt by half, though some analysts think the company could have gotten more. (Source: Hart Energy)

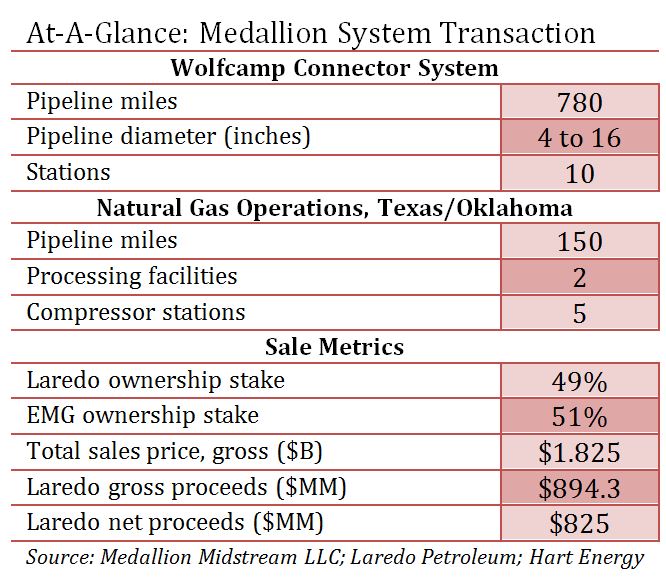

Laredo Petroleum Inc. (NYSE: LPI) will sell its 49% stake in the Medallion Gathering & Processing LLC to a global infrastructure investment group for net proceeds of about $825 million, the Tulsa, Okla.-based company said Oct. 2.

Laredo and The Energy & Minerals Group (EMG)—the 51% stakeholder—entered an overall agreement for $1.825 billion, falling in the midpoint of some analysts’ expectations. Laredo’s gathering contracts with Medallion will remain as is.

The sale includes a contingency that may provide additional cash depending on buyer Global Infrastructure Partners’ (GIP) realized profits upon its own exit from the Medallion.

Randy A. Foutch, Laredo’s chairman and CEO, said the company made its initial investment in late 2013 to provide a company with multiple points of sale for its oil. Its sale is the equivalent of a 65% internal rate of return on its overall investment. However, analysts disagreed over whether Laredo received the full value of the midstream asset.

Medallion is the largest privately-held crude oil transportation system in the Permian, with 800 miles of pipeline, about 670,000 dedicated acres and total areas of mutual interest approaching 4 million acres. The line has grown into the premier pipeline system in the Midland Basin, Foutch said.

“Upon the closing of this transaction, Laredo will recognize proceeds of more than three times its invested capital,” he said, “and through our various ongoing contracts with Medallion, [Laredo] retains the strategic benefits that were the initial goal for building the system.”

Foutch said Laredo has viewed infrastructure spending as strategic investments, which required borrowing money. The company intends to apply its proceeds to debt repayment, which “should cut our outstanding debt by more than half.”

Laredo’s debt in second-quarter 2017 was about $1.39 billion.

Should Laredo use proceeds to pay down its debt, the company’s leverage falls to an estimated 1.3x by the fourth quarter from about 3x as of the second quarter, Gordon Douthat, Wells Fargo Securities senior analyst, said in a research report.

Douthat’s estimates assume the transaction closes by year-end. The deal is expected to wrap up by Nov. 1, the companies said.

Estimates by Jeffrey W. Robertson, Barclays’ analyst, were in line with Wells Fargo. Debt could fall to 1.2x and save Laredo $48 million in cash interest annually, Robertson said. Barclays’ modeled Laredo’s stake in Medallion at a net value of $708 million.

Laredo expects to pay minimal federal income on the asset sale gain due to the utilization of net operating loss carry-forwards. There will be a small amount of alternative minimum tax and Texas margin tax.

RELATED: All Systems Go: Laredo Launches Midland Pipeline Sale

However, Seaport Global Securities had expected Laredo’s share of the Medallion sale to be much higher—about $1.25 billion, analyst Mike Kelly said in a report.

“The actual sale removes about $1.75 per share of NAV on a preliminary basis,” Kelly said in an Oct. 2 report. Seaport’s revised 2018 net debt/EBITDA is now estimated at 2x instead of about 1x, he said.

Should GIP exit from the Medallion, additional cash consideration linked to GIP’s realized profits will be divided between Laredo (49%) and EMG (51%).

Based on current commodity prices, service costs and production growth, Foutch said: “we expect operating cash flow to increase sequentially with the company anticipating being approximately cash flow neutral by the end of 2019.”

“This will afford Laredo additional flexibility in our development plan as we test tighter spacing to add premium locations in the Upper and Middle Wolfcamp formations,” he said.

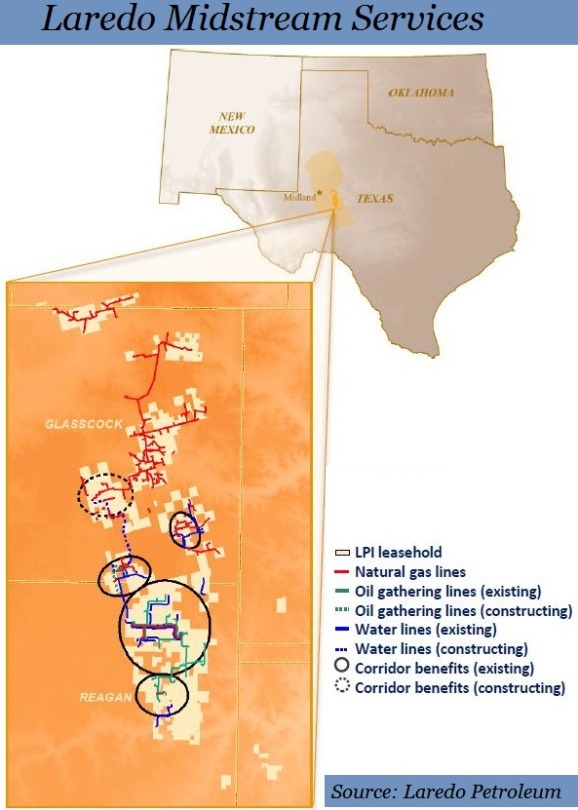

Laredo continues to operate infrastructure through Laredo Midstream Services LLC, which includes 45 miles of crude gathering lines and about 188 miles of natural gas gathering and distribution. As of July, Laredo estimated that more than 165,000 truckloads were removed from roads due to Laredo Midstream’s water and crude gathering system.

Medallion will retain its name and operate as a GIP portfolio company in Irving, Texas. The pipeline system’s leadership team will remain in their current roles and are investing alongside GIP in the transaction. EMG will continue to own Medallion Delaware Basin LLC.

“This transaction is an exciting and transformational moment in Medallion’s evolution,” said Randy Lentz, Medallion’s president and CEO. “Combining Medallion’s current team and best-in-class service with GIP’s financial strength and commitment to operational excellence will be the catalyst for further expansion of Medallion’s midstream infrastructure in the Permian Basin and ability to provide an even greater level of service to our producer customers.”

John Raymond, CEO and majority owner of EMG, said GIP is acquiring a “tremendous business and affiliating itself with a talented team of energy executives and a dedicated, focused group of employees.”

Adebayo Ogunlesi, chairman and managing partner of GIP, said deal typifies its strategy of investing in superior quality platforms that deliver the highest level of customer service.

Jefferies LLC and Wells Fargo Securities LLC were Medallion’s financial advisers. Jefferies was also the sole provider of committed debt financing. Locke Lord LLP was Medallion’s legal counsel to Medallion; Akin Gump Strauss Hauer & Feld LLP was Laredo’s legal counsel; and White & Case LLP was legal counsel to GIP.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Vitol Boosts Upstream Presence in West Africa with $1.65B Deal

2025-03-19 - Vitol is acquiring oil and gas E&P assets in Cote d’Ivoire and the Republic of Congo from Eni for $1.65 billion.

NOG Spends $67MM on Midland Bolt-On, Ground Game M&A

2025-02-13 - Non-operated specialist Northern Oil & Gas (NOG) is growing in the Midland Basin with a $40 million bolt-on acquisition.

Obsidian to Sell Cardium Assets to InPlay Oil for US$225MM

2025-02-19 - Calgary, Alberta-based Obsidian Energy is divesting operated assets in the Cardium to InPlay Oil for CA$320 million in cash, equity and asset interests. The company will retain its non-operated holdings in the Pembina Cardium Unit #11.

TG Natural Resources Wins Chevron’s Haynesville Assets for $525MM

2025-04-01 - Marketed by Chevron Corp. for more than a year, the 71,000-contiguous-net-undeveloped-acreage sold to TG Natural Resources is valued by the supermajor at $1.2 billion at current Henry Hub futures.

Validus Pays $850MM for 89 Energy as Midcon M&A Heats Up

2025-03-24 - Elliott Investment Management-backed Validus Energy continues to roll up Midcontinent assets, closing an $850 million acquisition of 89 Energy III.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.