Energy news from the Appalachian Basin has been dominated for the last decade by the natural gas behemoth that is the Marcellus Shale. Singlehandedly, this super-giant natural gas reservoir has transformed the North American energy markets with its vast reserve potential and production rates. Recently, the deeper Utica Shale has been getting a lot of notice with its consistent high production rates in the wet gas window of Ohio and some attention-grabbing high IP rates in the dry gas windows in eastern Ohio, extending into Pennsylvania and West Virginia.

A third resource shale play, the Burket/Geneseo Shale, is being developed in much of the same geographic areas as the current Marcellus Shale development in Pennsylvania and West Virginia. This reservoir has not produced the same eye-popping production numbers as the other “Big 2” shales to date, but the play is still in its early field development stage, and it is certainly likely that operators will improve and fine-tune their completion and drilling techniques as the play moves into the full development stage. This reservoir will never challenge the Marcellus or Utica in its productivity or size of resource potential, although total reserves may be significant.

It is likely that the play will benefit from several advantages, including its stacked pay potential, liquids-rich production in some areas and possible flat decline rates.

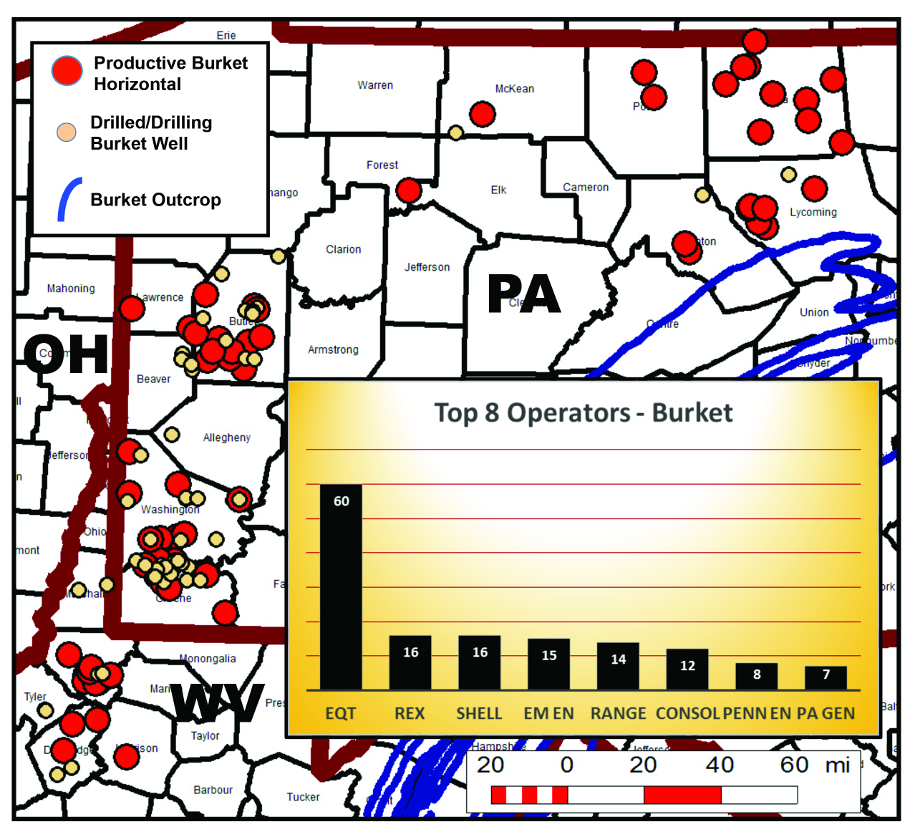

As of mid-April 2015, a total of 85 Burket/Geneseo horizontal wells have been completed as productive, with an additional 99 wells either in the drilling phase or awaiting completion. Nineteen companies have drilled Burket tests in the two identified core areas; however, most are concentrated in the southwest part of the play (Figure 1). EQT Production has been the leader in development of this resource with more than 60 wells either completed or in the process of drilling/completion, with an additional 40 Burket wells planned for 2015.

Geology

The Upper Devonian Burket/Geneseo Shale is the organic-rich mudstone that lies immediately above the Tully Limestone (Figure 2) and 6.1 m to more than 245 m (20 ft to more than 800 ft) above the Marcellus. The correct scientific name for this shale is Burket across most of West Virginia and Pennsylvania, while Geneseo is accepted terminology in northwest Pennsylvania and New York.

The thickness of the shale expands from only a few feet in western West Virginia to more than 46 m (150 ft) in its depocenter in central Pennsylvania. Drilling depths increase from less than 1,392 m (4,500 ft) in northwest Pennsylvania to more than 2,286 m (7,500 ft) in the center of the basin. Net thickness of the organic-rich portion of the Burket is shown in Figure 3. Two sweet spots of better-quality reservoir are mapped, with most of the current productive wells located within these southwest and northern pods of increased reservoir quality.

The key geologic controls on production are projected to be similar to those that control the Marcellus Shale, with rock quality (porosity and permeability) directly related to total organic carbon (TOC) percent. There are no reliable hard data available publicly on pressure gradients at this time, but early indications and personal communication indicate that the unit is significantly overpressured, enhancing production capabilities. As with the Marcellus, structural complexity is a key negative to production performance and complicates geosteering. Additionally, since the Burket/Geneseo is significantly thinner than the Marcellus, additional geosteering challenges are presented to the operator to stay in the sweet zone of high TOC, and rotary steerable drilling may be the optimal solution.

Production

Long-term production data are available for a relatively small database via state reporting agencies but provide enough information that some early projections can be advanced. Analysis of the available production combined with geologic mapping allows operators to identify the northern and southwestern core areas within which the highest performing Burket/Geneseo wells are located. Figure 4 outlines these proposed core areas and provides peak daily production rates for many of the wells. Only 27 wells have at least one full year of production available, and prediction of good decline curves from this limited public dataset is not possible at this time.

The southwest core area encompasses an area of 1.4 million acres and is the better of the two areas based on limited data. Five wells have at least one year of production data and averaged 42.5 MMcme (1.5 Bcfe) in their first 12 months online. Additional analysis of peak daily production confirms the general outline of this area. Wells surrounding the southwest core area have significantly reduced production volumes and average 13.3 MMcme (470 MMcfe) in 12 months.

The northern core area covers about 800,000 acres but is less proven and may not reach the production potential of the southwest area. Six wells on production had average first-year production of about 19.8 MMcm (700 MMcf). Wells surrounding this area produced less than 7.1 MMcm (250 MMcf) during the time period. Only two Burket wells have been permitted in this northern area since 2010, which may be a good indication that companies are not enamored of the production potential of the Burket in this area.

Economics and resource potential

Production rates from the Burket/Geneseo, while strong, lag significantly when compared to the Marcellus and Utica results. Economic analysis using a well cost of $5.5 million (1,460-m or 4,800-ft lateral), Marcellus-type decline and gas price of $3/28 cu. m (1,000 cf, dry gas) indicate that only the “core of the core” is economic in today’s depressed market conditions.

Potential considerations exist that may significantly affect economic viability for the reservoir:

- Flat decline. Analysis of the early Burket/Geneseo wells in the southwest core area show production declines may be flatter than published Marcellus decline rates. In a recent presentation, Consol reported that its first Burket/Geneseo well, located in Washington County, Pa., had an EUR of 255 MMcme (9 Bcfe)—51 MMcme (1.8 Bcfe) per 305 m (1,000 ft)—based on actual production, compared to predicted type decline curve estimates of 164 MMcme (5.8 Bcfe)—34 MMcme (1.2 Bcfe) per 305 m;

- Lower AFE costs. Drilling and completion costs can likely be reduced via utilization of existing drilling pads and infrastructure;

- Liquids/wet gas. Much of the southwest core area has wet to very rich wet gas, and the economics of these wells can by significantly enhanced through liquids production and increased Btu;

- Fracture growth upward. Upward fracture growth into the overlying Middlesex and Rhinestreet shales may add to the available productive capacity;

- Maturation of the play. Production from early wells in other resource shale plays pales in comparison to the later wells that were developed using practices that were fine-tuned to the specific reservoir. It is likely that similar increases will be realized in this play; and

- Fracture mechanics negatively affected. Significant downside may exist in delayed development of the Burket in the southwest core area. Development and production of the underlying Marcellus would likely create a negative pressure sink, leading to downward fracture growth into the drawdown Marcellus reservoir from the later completions in the Burket/Geneseo.

Technically recoverable reserves in the core of the core are projected to be 934 Bcme (33 Tcfe), with another possible 1.64 Tcme (58 Tcfe) if the remaining core areas prove viable. These numbers are likely to expand with increases in EURs through advances in completions and if the flatter decline is confirmed.

It is likely that most companies will continue to focus the bulk of their capex on the more lucrative Marcellus and Utica reservoirs to get their best “bang for the buck” in the short term, but the Burket/Geneseo holds good potential for substantial additions to the Appalachian resource base.

The Marcellus and Utica have changed industry’s perceptions and market-driven economics. The Burket is another possible super-giant natural gas field (more than 850 Bcm [30 Tcf]) in an area with well-developed pipeline infrastructure and near to the largest markets in North America. Yet few companies are rushing to develop it. The industry apparently is cursed by its own success.

Recommended Reading

Oxy CEO: US Oil Production Likely to Peak Within Five Years

2025-03-11 - U.S. oil production will likely peak within the next five years or so, Oxy’s CEO Vicki Hollub said. But secondary and tertiary recovery methods, such as CO2 floods, could sustain U.S. output.

E&P Highlights: March 31, 2025

2025-03-31 - Here’s a roundup of the latest E&P headlines, from a big CNOOC discovery in the South China Sea to Shell’s development offshore Brazil.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

CNOOC Starts Production at Two Offshore Projects

2025-03-17 - The Caofeidian 6-4 Oilfield and Wenchang 19-1 Oilfield Phase II projects by CNOOC Ltd. are expected to produce more than 20,000 bbl/d of crude combined.

Black Gold, LGX Find Multiple Pay Zones in Western Indiana

2025-04-04 - Black Gold Exploration Corp. and LGX Energy Corp. are working to start production at the Fritz 2-30 oil and gas well in Indiana within 60 days.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.