Pure-play operator Lonestar Resources acquired producing properties in an area of the Sugarkane Field that CEO Frank D. Bracken III said features some of the thickest Lower Eagle Ford shale in South Texas. (Source: Hart Energy/Shutterstock.com)

Editor's note: This story was updated at 2:03 p.m. CST Nov. 20.]

Pure-play Eagle Ford operator Lonestar Resources US Inc. (NASDAQ: LONE) said Nov. 19 it acquired bolt-on properties to its DeWitt County position in South Texas as the company’s liquidity reached new heights.

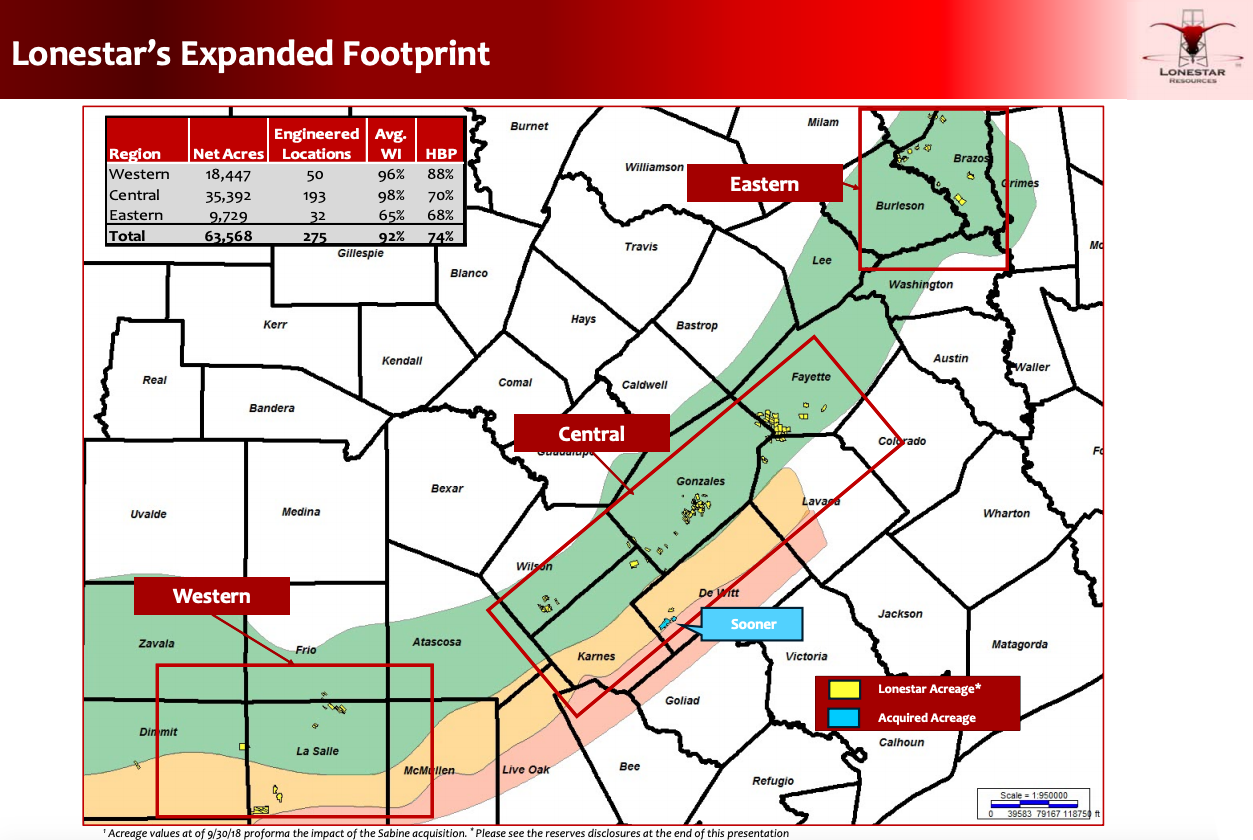

Lonestar acquired 3,084 gross (2,706 net) acres of producing properties in DeWitt from Sabine Oil & Gas Corp. and Alerion Gas AXA LLC for $38.7 million. The properties, 95% of which are operated, are located in the Sugarkane Field in an area that CEO Frank D. Bracken III said features some of the thickest Lower Eagle Ford shale.

“This acquisition is a continuation of Lonestar’s core strategy of accretively expanding its Eagle Ford Shale position while maintaining a returns-focused investment approach,” Bracken said in a statement Nov. 19.

The acquired properties currently produce 800 barrels of oil equivalent per day (boe/d) from 20 wells. Estimated annualized EBITDAX from this level of production is $6 million, the company said.

Lonestar paid about $3,200 per acre, assuming $40,000 per flowing boe, for the acquired properties, according to John Aschenbeck, senior analyst with Seaport Global Securities LLC.

“We are fans of this acquisition as it once again demonstrates Lonestar’s ability to consistently tack on blocks of high-quality Eagle Ford acreage at attractively priced valuations,” Aschenbeck said in a Nov. 19 research note.

Additionally, Lonestar identified about 26 Lower Eagle Ford drilling locations on the acquired properties, which Aschenbeck said amounts to about $335,000 per location. The company also sees additional potential upside in the Upper-Lower Eagle Ford, Upper Eagle Ford and Austin Chalk intervals.

Lonestar plans to apply its geo-engineered drilling and completion design on the acquired properties where the company continues to see improved results.

“We believe the application of our geo-engineered drilling and completion process can yield highly productive wells that yield attractive rates of return on invested capital,” Bracken said. “As is typically the case with our acquisitions, we see potential to increase lateral lengths and further enhance returns.”

Pro forma for the deal, Aschenbeck estimates Lonestar now has about 63,600 net acres in the Eagle Ford with roughly 13,300 boe/d of production.

In addition to the acquisition, Lonestar said Nov. 19 it has increased the borrowing base on its credit facility to $275 million, up from the prior $190 million. The company also reduced the facility’s interest rate grid by 0.5% and extended its terms out from July 2020 to November 2023.

“In combination with our expanded and enhanced credit facility, we have financed the acquisition in a manner that leaves Lonestar with the highest level of liquidity in the company’s history while expanding our Eagle Ford Shale position in an attractive part of the play,” Bracken said.

Pro forma for the acquisition, Aschenbeck estimates Lonestar currently has $163.7 million in borrowings outstanding on its revolver and liquidity of $111.1 million, which he said is “more than ample given our expectations for Lonestar to fund its fiscal-year 2019 capital program within cash flow.”

“Lonestar remains a Seaport Global small-cap favorite given its strong debt-adjusted growth despite and high returns despite possessing a discounted valuation,” Aschenbeck said.

Lonestar internally estimates that proved reserves associated with its recent acquisition total 13 million boe, 3.2 million of which is proved developed producing and 100% associated with the Lower Eagle Ford Shale. Based on the Nymex Strip on Nov. 15 (the day of closing), the proved reserves have PV-10 value of $77 million.

To account for the additional volumes associated with the acquired producing wells, Lonestar is raising its 2019 outlook.

Lonestar bumped up its 2019 production outlook to between 13,700 and 14,700 boe/d from a range of 13,000 to 14,000 boe/d. The company also increased its 2019 EBITDAX outlook to $145 million to $165 million from a range of $140 million to $160 million.

The acquisition had an effective date of Aug. 1. Gibson, Dunn & Crutcher LLP represented Lonestar in the deal. UBS Investment Bank was exclusive transaction adviser to Sabine.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

South Bow Shuts Down Keystone Pipeline After Oil Release

2025-04-09 - South Bow Corp. reported a release of approximately 3,500 bbl near Fort Ransom, North Dakota, and it is evaluating the return-to-service plans.

Targa Buys Back Bakken Assets After Strong 2024

2025-02-20 - Targa Resources Corp. is repurchasing its interest in Targa Badlands LLC for $1.8 billion and announced three new projects to expand its NGL system during its fourth-quarter earnings call.

Canadian Province Gives Environmental Warning to Pipeline Project

2025-03-19 - The Prince Rupert Gas Transmission Project is a 497-mile project that would ship up to 3.6 Bcf/d of natural gas to an LNG facility on the Canadian west coast.

Brookfield Infrastructure Partners Buys Colonial Pipeline for $9B

2025-04-04 - Brookfield Infrastructure Partners LP has agreed to acquire Colonial Enterprises, the owner of the Colonial Pipeline, in a deal valued at $9 billion.

Intensity Infrastructure Partners Pitches Open Season for Bakken NatGas Egress

2025-02-04 - Analysts note the Bakken Shale’s need for more takeaway capacity as Intensity Infrastructure Partners launches an open season for a potential 126-mile natural gas transport line out of the basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.