Anticipating a reduction in oil prices, the EIA lowered its U.S. oil production forecast for 2025. (Source: Shutterstock)

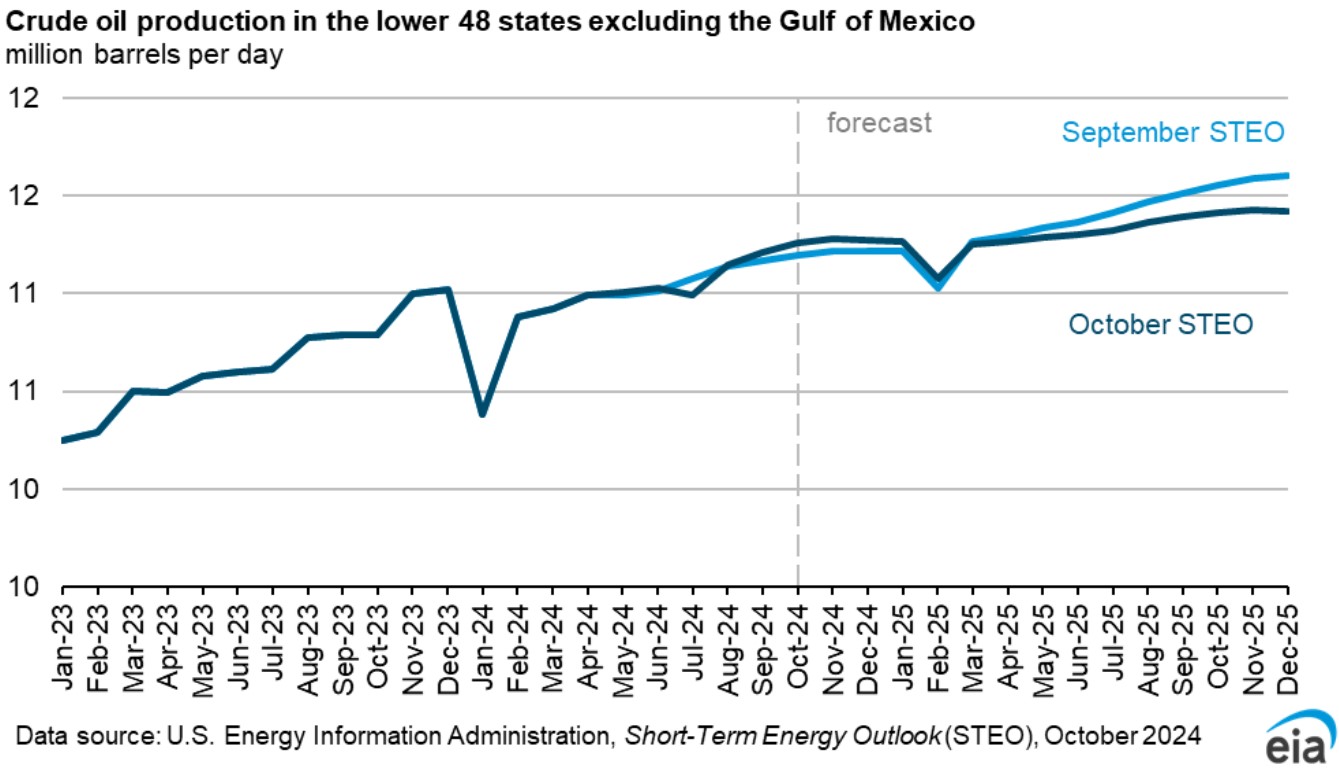

The U.S. Energy Information Administration (EIA), anticipating lower crude oil prices, reduced its Lower 48 production forecast for next year.

The EIA expects Lower 48 crude oil production to average 11.3 MMbbl/d in 2025, according to the latest Short-Term Energy Outlook published Oct. 8—a 1% reduction over the EIA’s September forecast.

WTI crude prices are expected to average $72/bbl in the fourth quarter, a $6/bbl reduction compared to September forecasts.

“Because there is about a six-month lag between price changes and producer activity, the recent price declines will begin reducing U.S. crude oil production in mid-2025,” the EIA wrote.

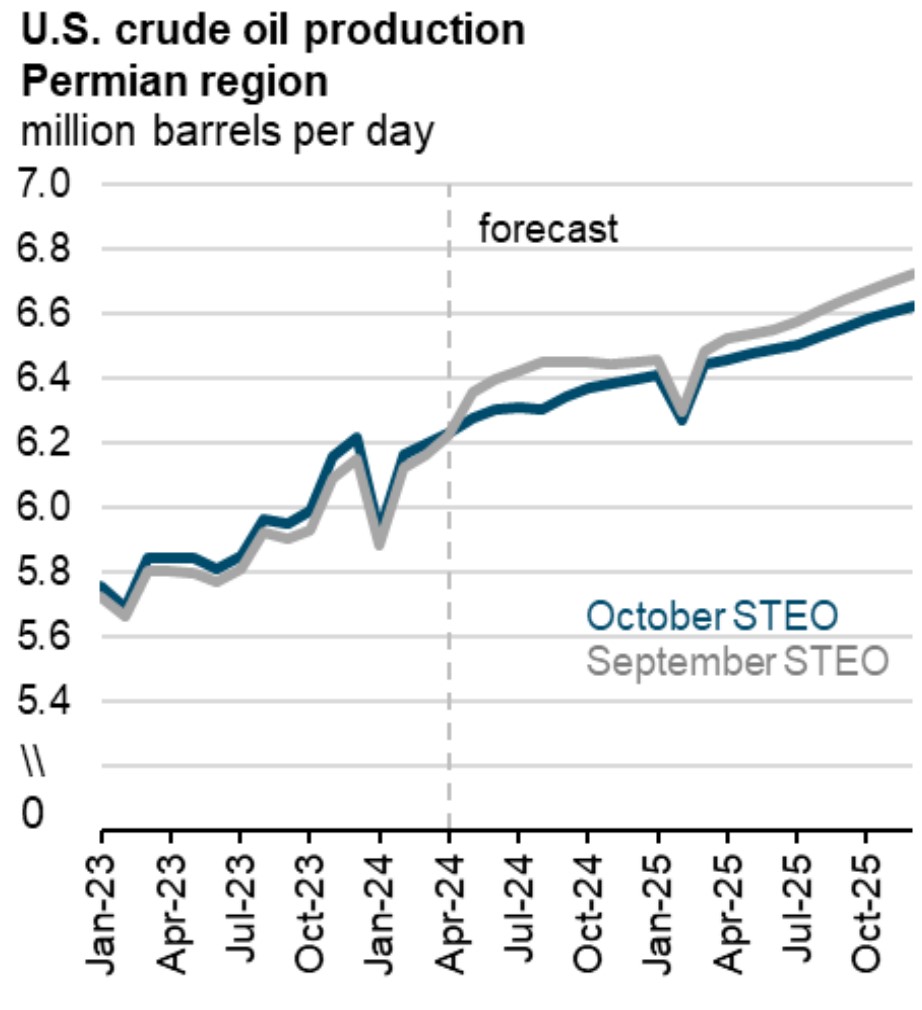

The slowdown will be most evident in the Permian Basin, the nation’s top oil-producing region. Permian crude output is projected to average 6.5 MMbbl/d in 2025, a 3.6% increase over 6.27 MMbbl/d this year.

In September, the EIA expected Permian oil output to average 6.32 MMbbl/d this year and 6.57 MMbbl/d in 2025, a 4% increase.

The EIA still expects the Permian to drive U.S. oil production growth over time. The basin is seeing “ongoing improvements in oil well productivity,” and the startup of the Matterhorn Express pipeline should help alleviate constrained associated natural gas takeaway capacity—allowing for more crude production, the report notes.

Basins outside the Permian, namely the Bakken and Eagle Ford, are also expected to slow output because of softening oil prices.

The Bakken will grow to 1.34 MMbbl/d in 2025 from an average of 1.26 MMbbl/d this year, a 6% increase. Eagle Ford output is expected to drop to 1.11 MMbbl/d in 2025 from 1.16 MMbbl/d, a 4% reduction.

The EIA cited results from the third-quarter Dallas Fed Energy Survey, which indicated a contraction in business activity in the U.S. oil and gas sector. This contraction is the first in the survey’s activity index since third-quarter 2020.

More than a third of survey respondents in the Permian reported curtailing oil production in response to persistently low associated natural gas prices. Slumping oil prices, along with uncertainties in how the November presidential election will shape up, are also weighing on industry decision makers.

RELATED

Growing Natgas Supply Up for Grabs, but Extra NGL Headed Overseas

Price pains

Oil prices declined across the globe in September as concerns over global demand growth outweighed inventory declines and OPEC+ members’ decision to delay production increases until December, the EIA said.

Crude prices have swung up more recently, fueled by geopolitical instability in the Middle East. Brent crude prices rose to $79/bbl on Oct. 4, an 11% week-over-week increase, in response to military actions involving Israel, Lebanon and Iran.

But some analysts argue that the oil market isn’t reacting to Middle East risk as strongly as it once did, and that the “war premium” is much smaller and more fleeting.

No oil supplies had been affected by increased military action in the Middle East when the EIA published its October STEO report.

While geopolitical risk certainly remains, “we assess that significant surplus crude oil production capacity is available, which could be brought online in the event of a disruption,” the EIA said.

Production continues to grow from the U.S., Guyana, Brazil and Canada—and the OPEC+ cartel is projected to increase production by mid-2025.

RELATED

Dallas Fed: Low Natgas Prices Force Permian E&Ps to Curtail Output

Recommended Reading

US House Schedules Hearing on LNG Pause

2024-12-03 - A Department of Energy official has been reported to testify at the Dec. 4 hearing on the harmful effects of production and export of LNG.

DOE Report on LNG Pause Climate to Arrive Before January

2024-12-08 - The White House said it implemented a permit pause on export facilities to allow time for an analysis of LNG climate impacts.

Sources: LNG Pause Report Will Critique Sector on Prices, Environment

2024-12-16 - The Department of Energy study tied to the yearlong pause on LNG permits may be released as soon as Dec. 17.

DOE: ‘Astounding’ US LNG Growth Will Raise Prices, GHG Emissions

2024-12-17 - The Biden administration released Dec. 17 a long-awaited report analyzing the effects of new LNG export projects, which was swiftly criticized by the energy industry.

Trump’s DOE Issues First LNG Permit of Term to Commonwealth LNG

2025-02-14 - The former administration of President Joe Biden had halted permitting for all of 2024.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.