The company continues to look for bolt-on oil opportunities in the Austin Chalk and Eagle Ford formations. (Source: Shutterstock)

Magnolia Oil & Gas Corp. added more leasehold to its Giddings position in South Texas— the latest in a series of deals focused on expansion in the field.

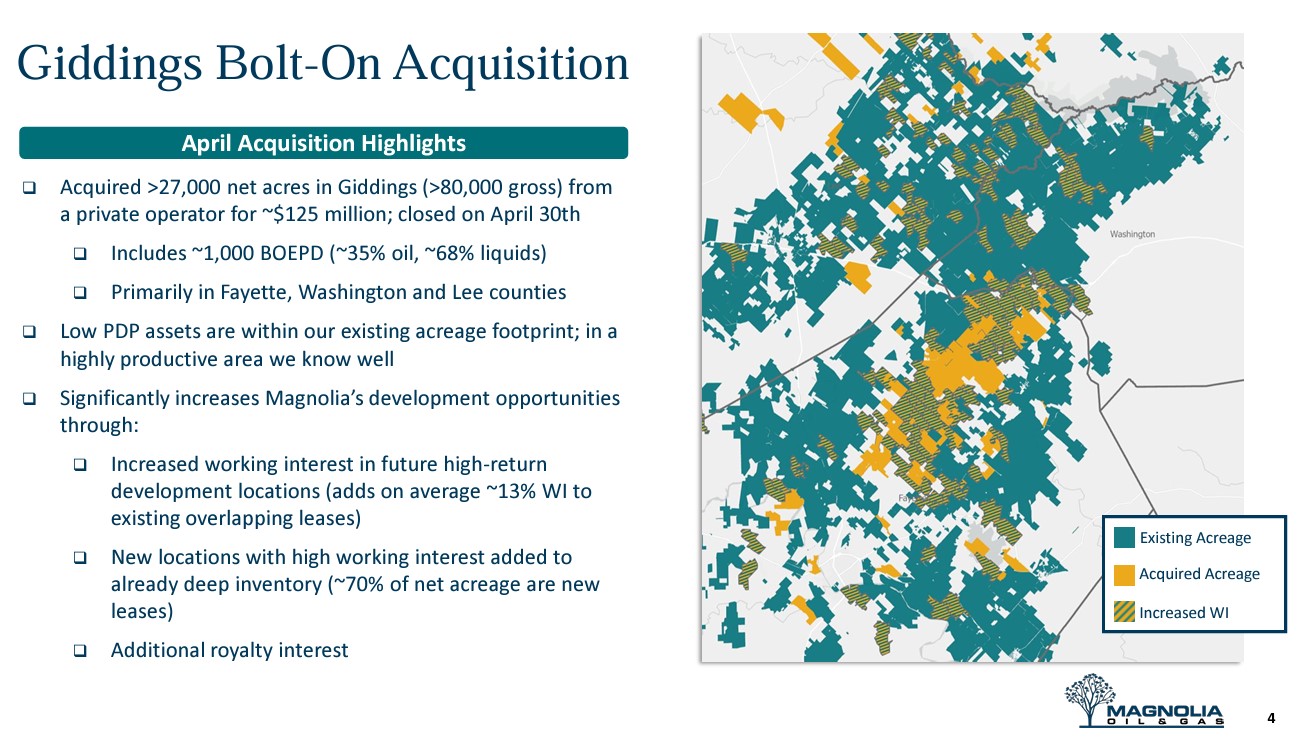

Magnolia said in a May 7 earnings report that it acquired roughly 27,000 net acres from a private operator for $125 million. The transaction closed on April 30, the company said. The assets included total production of approximately 1,000 boe/d (~35% oil), in addition to leasehold and royalty acres.

The leasehold is primarily in Fayette, Washington and Lee counties, Texas. Magnolia’s investor presentation said the acquisition adds new locations with high working interest.

“The acquisition significantly increases Magnolia’s working interest in future high-return development areas and adds new acreage which further expands the company’s leading position in the Giddings area,” Magnolia said in a Securities and Exchange Commission filing.

“A key objective of Magnolia’s business plan and strategy is to utilize some of the excess cash generated by the business to pursue attractive bolt-on oil and gas property acquisitions,” said Chris Stavros, Magnolia’s president and CEO. “Properties are targeted not to simply replace the oil and gas that has already been produced but importantly, to improve the future opportunity set of our overall business and enhance the sustainability of our high returns.”

Stavros said the $125 million acquisition leverages the significant knowledge “we have gained through operating in the field.”

“While these properties come with a relatively small amount of current production, they have similar attractive operational characteristics to our core acreage position in Giddings,” he said. “The acquisition further lengthens our already deep inventory of high return locations in Giddings while adding duration to our overall portfolio as well as significantly increasing our working interest in some of our existing inventory.”

The company continues to look for bolt-on oil opportunities in the Austin Chalk and Eagle Ford formations.

Magnolia spent about $400 million on acquisitions in 2023.

Recommended Reading

Nabors Closes $370MM Parker Wellbore Acquisition

2025-03-12 - The acquisition of Parker Wellbore adds a large-scale, high performance tubular rental and repairs services operation in the Lower 48 and offshore U.S. to the Nabors portfolio.

Nabors SPAC, e2Companies $1B Merger to Take On-Site Powergen Public

2025-02-12 - Nabors Industries’ blank check company will merge with e2Companies at a time when oilfield service companies are increasingly seeking on-site power solutions for E&Ps in the oil patch.

Prairie Operating to Buy Bayswater D-J Basin Assets for $600MM

2025-02-07 - Prairie Operating Co. will purchase about 24,000 net acres from Bayswater Exploration & Production, which will still retain assets in Colorado and continue development of its northern Midland Basin assets.

Atlas Energy Solutions to Acquire OFS Power Company Moser for $220MM

2025-01-27 - Atlas Energy Solutions said it will purchase Moser Energy Systems in a cash-and-stock deal that adds power services in the company’s core Permian Basin operating area.

Appalachia, Haynesville Minerals M&A Heats Up as NatGas Prices Rise

2025-04-03 - Several large Appalachia and Haynesville minerals and royalties packages are expected to hit the market as buyer interest grows for U.S. natural gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.