There's an adage in the business that the best places to look for oil and gas are where they have already been found. But notable exceptions certainly exist: one is the Raton Basin, in southeastern Colorado and northeastern New Mexico. This basin failed to produce from traditional reservoirs, but has grown to become a coalbed-methane powerhouse.

Now, another basin with a frustrating history may find a bright future in unconventional gas production, this time from shales. At least that's the hope of a new cadre of explorers working in the Marfa Basin.

The little-known Marfa is tucked along the great Ouachita Thrust trend, which stretches 1,500 miles from Mexico, through Texas, Oklahoma and Arkansas and into Mississippi. The Marfa is a deep, tectonically complicated basin that's largely covered in Tertiary volcanic sediments. But, it contains some 15,000 feet of Paleozoic sediments, and is a little brother to the prolific Delaware Basin of West Texas.

Big and small companies have broken picks in the Marfa attempting to find fields like those in the mighty Delaware. Wildcats were drilled between the 1940s and 1980s by operators including Gulf Oil, Arco, Exxon and Amoco. But, results were acutely disappointing. There were lots of structures, but fresh-to-brackish water and dead oil were pervasive in the potential reservoir rocks.

In the mid-1990s, independent Alpine Inc., doing business as Steve Knox Oil Co., drilled a 5,120-foot well that ignited a flame of interest. The #1-480 Barrett, about 14 miles south of the town of Marfa, found commercial oil in the Canyon sands. But Alpine's attempts to offset the well were unsuccessful.

"We had about 40,000 acres in our lease block, and we drilled five wells," says Steve Knox, chief executive of Alpine Inc. The private firm, based in Edmond, Oklahoma, is active in the Woodford and Barnett shale plays in the Delaware Basin. "We were looking for hydrocarbon traps in conventional reservoirs along the shelf edge of basin."

Knox did find some oil of good quality, but the play was challenging. The volcanic cover played havoc with seismic imaging, and it was hard to drill through. "The basin has an active tectonic history, and seals are an issue."

Although the #1-480 Barrett was the first commercial well in the basin, it made marginal volumes of oil from a small drainage area. "We couldn't drill a successful 80-acre offset, and it was so remote we finally let the leases expire about three years ago." Cumulative production was just a couple thousand barrels of oil.

Fresh Activity

Today, the potential of the Mississippian Barnett Shale has sparked new interest in the Marfa Basin. Dan Jarvie, president of Humble Geochemical Services, based in Humble, Texas, typed the oil produced in Knox's Barrett well and determined it was from the Barnett Shale. (For more on the Barnett and Woodford in West Texas, see "Far West Texas," Oil and Gas Investor, January 2006.)

"We have evaluated the Marfa Basin Barnett Shale and found it to be organic rich and thermally mature in some areas," says Jarvie.

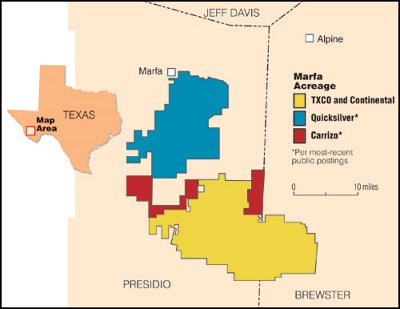

The Exploration Co. (TXCO), based in San Antonio, is making a shale-gas play in the basin, targeting both the Barnett Shale of North Texas fame and the deeper Woodford Shale. In October 2005, the company acquired 140,000 acres of leases in eastern Presidio County and western Brewster County from Peacock Oil & Gas, a private firm also based in San Antonio.

"The acreage we bought was in a graben, and the shales are clearly in the gas window," says Roberto Thomae, vice president, TXCO. "We targeted acreage that had defined depths, pressures and total organic carbon contents, and that we believed had high potential to be productive."

And, there is plenty of section to work with: logs from old, deep wells show Pennsylvanian and Mississippian shales, including Woodford and Barnett, that reach 400 to 1,200 feet in thickness. "There is everything we need to make a shale-gas play in this area."

TXCO has benchmarked the Marfa Basin shales encountered in old wells on its lease block to the Barnett: "We have comparable porosity, and we're a little deeper with higher pressures and temperatures as compared with the Barnett shales from Newark East Field in the Fort Worth Basin."

In April of this year, TXCO brought in Continental Resources Inc., based in Enid, Oklahoma, as operator and 50% partner in its entire Marfa Basin project. The latter company has filed an S-1 to go public and is currently in its quiet period.

At present, the partners have reentered their first well, a Woodford test, in northeastern Presidio County, about 20 miles southeast of Marfa. The #1 Simpson was originally drilled in 1972 to 12,017 feet and was plugged and abandoned by El Paso Natural Gas Co.

"This initial well will be a vertical reentry, and we will perforate and fracture the shales. We want to establish a baseline," says Thomae. A second test-a grassroots well-is also planned for this year, based on the results of the first one.

"Seismic will be an issue," he says. "There's very little seismic available in the Marfa, even 2-D data." The partners want to acquire seismic, and will pace their drilling accordingly.

The lack of infrastructure in this nonproducing basin brings to mind an obvious question: how will any gas that is discovered be moved to markets? "If we are successful, we intend to put in an initial 23-mile line to the West Texas gas line," he says. "We are already working on the right-of-way." That line can take about 25 million cubic feet of gas per day. Beyond that, the giant Waha hub lies another 25 miles east.

In addition to TXCO and Continental, other companies are interested in the Marfa. Based on courthouse records, Fort Worth-based Quicksilver Resources Inc. has amassed a large acreage position close to TXCO's. Houston-based Carrizo Oil & Gas Inc. has also acquired leases in the area.

Additionally, Ascent Energy Inc., based in Plano, has drilled a 7,700-foot well about 10 miles northeast of the city of Alpine in northern Brewster County. The #1 Pate-Parker East has 4.5-inch casing set on bottom, according to IHS Energy, and is waiting on completion tools.

The company, an unconventional gas player, is in a quiet period after filing an S-1 registration for an initial public offering. As of March 31, 2006, Ascent had acquired interests in 79,108 gross (54,770 net) acres in the West Texas Barnett/Woodford play, primarily in Brewster County.

"We are currently drilling our initial test wells," the company reported. "We believe the depths of these formations range from 4,400 to 10,000 feet and the thickness ranges from 80 to 400 feet."

Ascent is also at work on another Brewster County wildcat, the #1 Stroud Parker North, about 14 miles northeast of Alpine. Projected depth is 7,550 feet. The well was temporarily abandoned in late July after reaching just 1,560 feet. No other information has been released, according to IHS Energy.

"The Marfa play is very exciting," says Thomae. "We know the shales are present, and they are prospective. The driver is figuring out the correct drilling and completion technologies we need to use."

Recommended Reading

Midstream M&A Adjusts After E&Ps’ Rampant Permian Consolidation

2024-10-18 - Scott Brown, CEO of the Midland Basin’s Canes Midstream, said he believes the Permian Basin still has plenty of runway for growth and development.

Post Oak-backed Quantent Closes Haynesville Deal in North Louisiana

2024-09-09 - Quantent Energy Partners’ initial Haynesville Shale acquisition comes as Post Oak Energy Capital closes an equity commitment for the E&P.

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

2024-09-20 - After buying more than 13.4 million Comstock shares in August, analysts wonder if Dallas Cowboys owner Jerry Jones might split the tackles and run downhill toward a go-private buyout of the Haynesville Shale gas producer.

Aethon, Murphy Refinance Debt as Fed Slashes Interest Rates

2024-09-20 - The E&Ps expect to issue new notes toward redeeming a combined $1.6 billion of existing debt, while the debt-pricing guide—the Fed funds rate—was cut on Sept. 18 from 5.5% to 5%.

Dividends Declared Sept.16 through Sept. 26

2024-09-27 - Here is a compilation of dividends declared from select upstream, midstream and service and supply companies.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.