Anew “Star Wars” film hit theaters over the holiday season. “The Force Awakens” hearkened back to the original, beloved trilogy from the late 1970s and early 1980s and not the prequels. That original trilogy began with a fi lm called “A New Hope,” which was filled with a great deal of optimism.

It’s safe to say that if the current commodity market were anything like “Star Wars” it would be the second film in the trilogy, “The Empire Strikes Back,” which was a decidedly darker tale than the first.

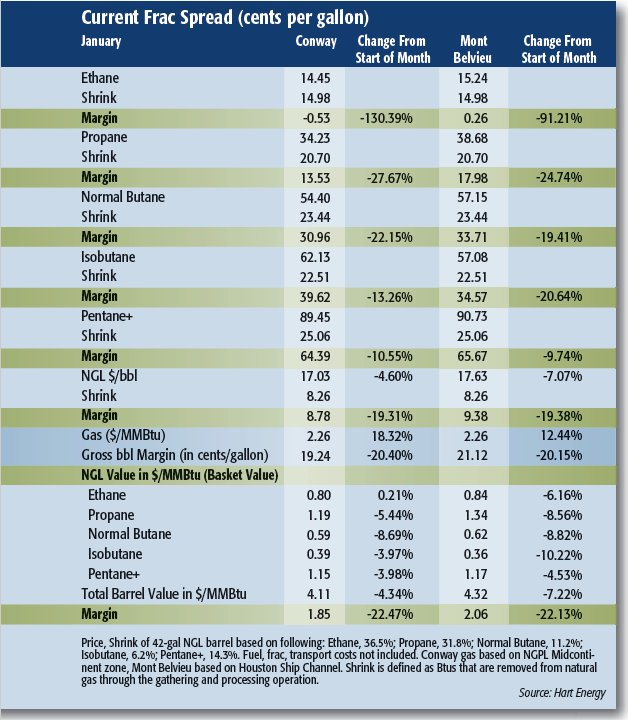

Indeed, the 2015 holiday season introduced another series of lows for NGL and natural gas prices with several products reaching a new bottom. Though prices largely improved the final full week of 2015, it wasn’t a cause for celebration as frac spread margins continued their decline as 2016 began.

There are many reasons for the negative outlook for prices, but the primary one is that markets are oversupplied across the board. It is impossible for liquids, crude or gas prices to improve for very long because supplies are saturating each of these markets.

The one positive takeaway is that the old saying of low prices being the remedy for low prices is still true. There will come a point, likely this year, when prices reach a level that they create a market dynamic where demand exceeds supply for an extended period.

The question is when this occurs, which unfortunately won’t be this winter given that there are less than three months left in the season.

This year’s El Niño is unlikely to cause a sustained cold front that will be necessary to work off the gas storage levels that have amassed this injection season, especially since injections ran longer with a mild fall.

Gasoline demand may increase with prices reaching their lowest levels in more than a decade, but the prospect of an abundance of Iranian crude reaching the global market dims this outlook somewhat. There is a positive to the warm weather on this front as the lack of snowfall is likely to result in more driving demand throughout the season.

Though NGL prices have decoupled somewhat from crude and gas in the past decade, liquids prices still require improvements in both crude and gas markets to see major upticks. The most volatility is being experienced by ethane, which is being influenced by low natural gas prices and increased ethylene cracking competition from propane and butane due to lower prices for those products. The ethane market has nowhere to go but up given that prices closed the year at their lowest levels.

Until that turnaround, market participant will be hoping for a new sequel to the current atmosphere: “Return of Demand.”

Recommended Reading

E&P Highlights: Dec. 2, 2024

2024-12-02 - Here’s a roundup of the latest E&P headlines, including production updates and major offshore contracts.

E&P Highlights: Jan. 6, 2025

2025-01-06 - Here’s a roundup of the latest E&P headlines, including company resignations and promotions and the acquisition of an oilfield service and supply company.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: Dec. 9, 2024

2024-12-09 - Here’s a roundup of the latest E&P headlines, including a major gas discovery in Colombia and the creation of a new independent E&P.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.