(Source: Hart Energy)

The following information is provided by EnergyNet, RedOaks Energy Advisors and TenOaks Energy Advisors. All inquiries on the following listings should be directed to EnergyNet, RedOaks Energy Advisors and TenOaks Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

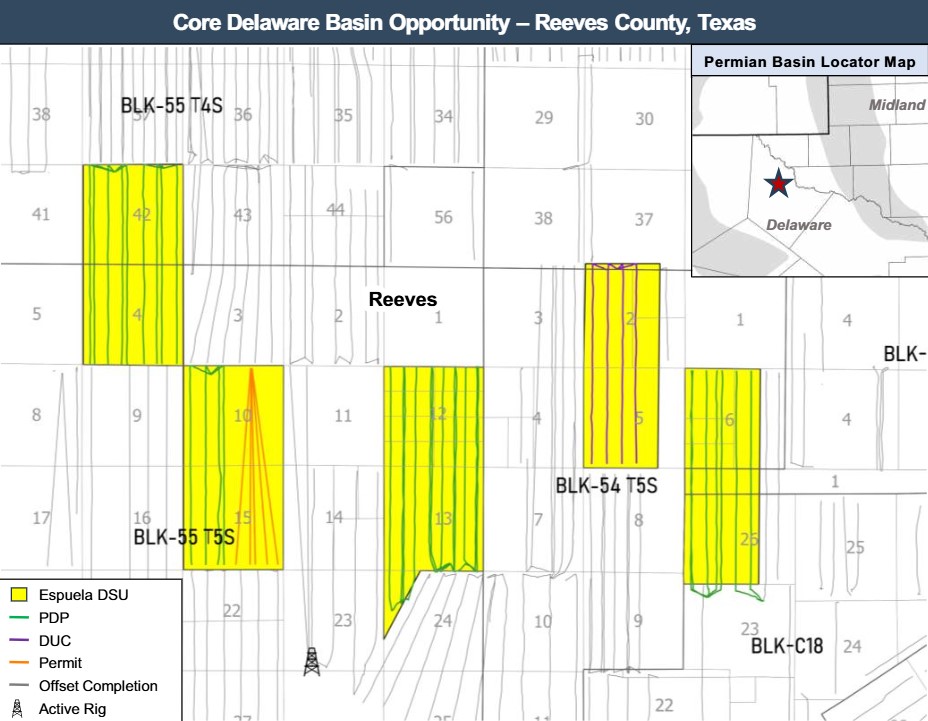

Espuela Tier 1 Delaware Basin Non-Op Opportunity

Espuela Energy LLC has retained RedOaks Energy Advisors for the sale of non-operated working interest (WI) properties located in Reeves County, Texas.

Opportunity highlights:

• 454 net acres of non-operated working interest across five drilling spacing units (DSUs) in the core of the Delaware Basin

○ NTM PDP CF: $20 million

• Portfolio is under rapid development by leading Delaware Basin operators: Permian Resources, Mewbourne Oil and Gas & EOG Resources.

○ 32 recently completed PDPs | nine DUCs/Permits; and

○ PDP/DUC/Permit PV10: $35MM

• Meaningful growth potential from remaining Wolfcamp & Bone Spring inventory.

Bids are due Feb. 19 at noon CT. For complete due diligence, please visit redoaksenergyadvisors.com or email David Carter, partner, at david.carter@redoaksadvisors.com or Austin Cain, associate, at austin.cain@redoaksadvisors.com.

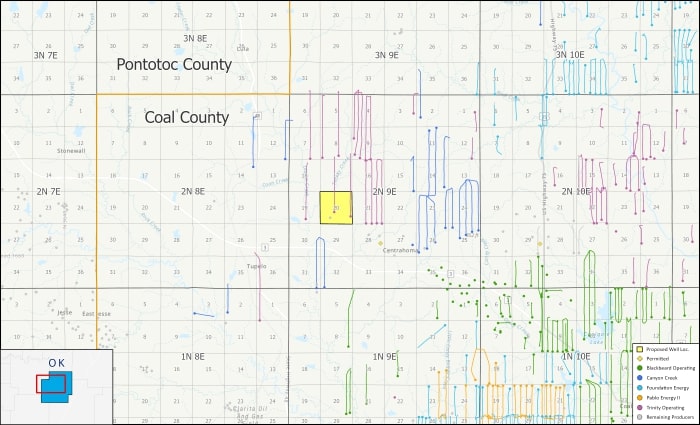

Owl Realty Woodford Shale Opportunity

Owl Realty LLC has retained EnergyNet for the sale of a Woodford Shale WI participation in Coal, County Oklahoma. Lot #125027.

Opportunity highlights:

- WI Participation in the Lloyd 1-20 Wellbore:

- 2.294891% WI / 1.767066% NRI

- Projected formation: Oil Creek

- Total participation cost: $51,272.11

- Operator: Command Energy LLC

- Offset activity:

- 2 permits

- Select offset operators:

Bids are due Feb. 20 at 4 p.m. CST. For complete due diligence, please visit energynet.com, or email Zachary Muroff, managing director, at Zachary.Muroff@energynet.com.

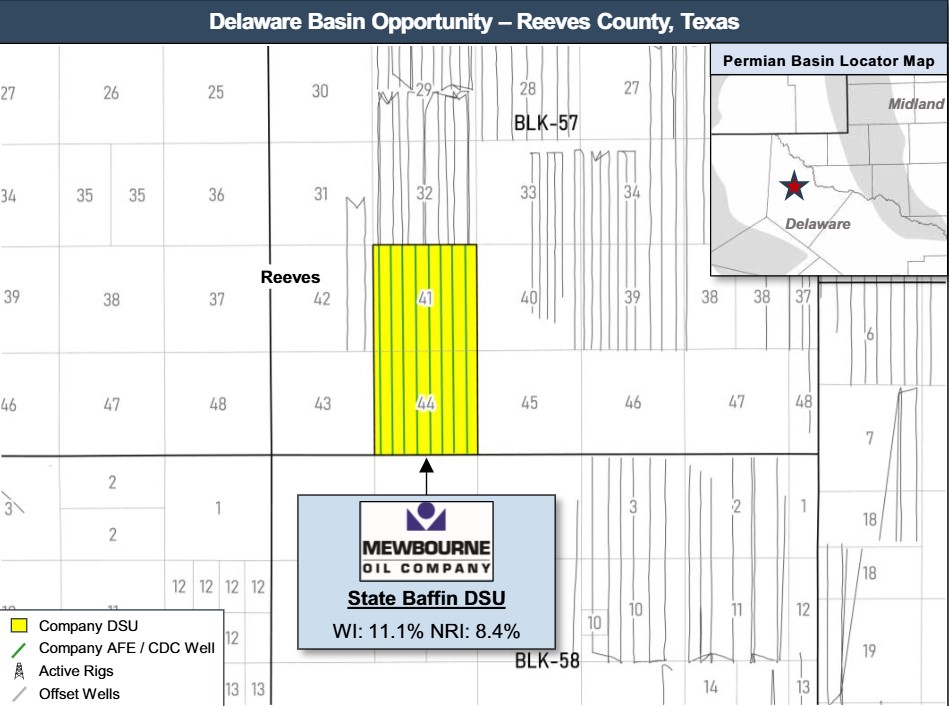

Red River Working Interest in Delaware Basin

Red River Energy Partners LLC has retained RedOaks Energy Advisors for the sale of certain non-operated WI properties located in Reeves County, Texas.

Opportunity highlights:

• Core Delaware Basin non-operated WI opportunity with substantial near-term development under Mewbourne.

○ 1,284 gross / 143 net acres in the State Baffin DSU; and

○ Total PV10: $20 million

• Line of sight to future growth with drilling CDC in place

○ AFE & CDC Location PV10: $10 million

• Significant remaining inventory across the Wolfcamp & Bone Spring formations.

Bids are due Feb. 25 at noon CT. For complete due diligence, please visit redoaksenergyadvisors.com or email Will McDonald, director, at will.mcdonald@redoaksadvisors.com or Austin Cain, associate, at austin.cain@redoaksadvisors.com.

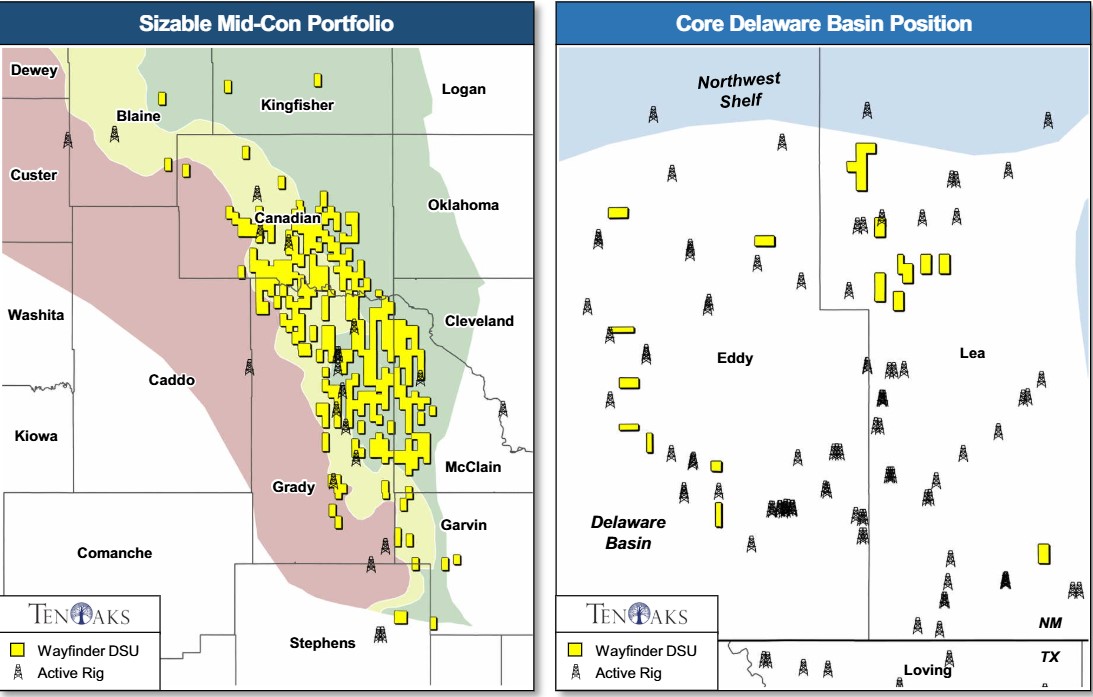

Wayfinder Mid-Con, Permian Royalty Properties

Wayfinder Resources Holdings LLC has retained TenOaks Energy Advisors for the sale of certain non-operated and royalty properties in the mid-continent and Delaware Basin.

Opportunity highlights:

- Position spanning ~9,900 net acres (100% HBP);

- Strong NTM OCF of $48 million underpinned by a solid PDP base and near-term activity;

- Net Production: 4,746 boe/d (48% liquids);

- Imminent growth expected from high-impact WIP inventory and consistent regulatory activity across the portfolio

- Significant development cadence on position with >70 spuds in the last 12 months; - Assets are operated by tenured operators: Validus, Camino, Coterra, Devon, Matador and ConocoPhillips; and

- De-risked inventory targeting proven, highly productive benches with low breakeven costs (>1,200 locations).

Bids are due Feb. 27 at noon CT. For complete due diligence, please visit tenoaksenergyadvisors.com or email B.J. Brandenberger, partner, at bj.brandenberger@tenoaksadvisors.com, or Forrest Salge, director, at forrest.salge@tenoaksadvisors.com.

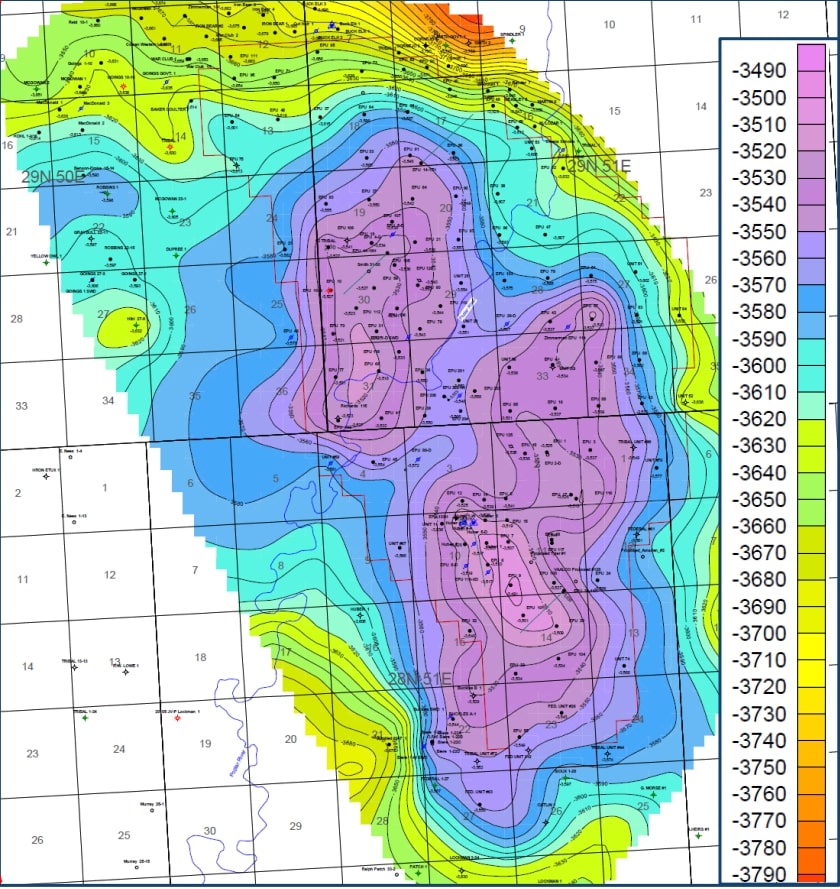

Poplar Resources Montana Gas Flood Opportunity

Poplar Resources LLC has retained EnergyNet for the sale of a gas flood investment opportunity in Roosevelt County, Montana. Lot# 125024.

Opportunity highlights:

- Poplar Dome is redeveloped through IGF to unlock 50-100 MMbbls of additional oil reserves;

- Large anticline feature w/ 18,000 unitized HBP acres;

- Limestone / dolomite reservoir w/ 3 targets;

- 6,000' subsurface

- 5-15% porosity

- 1-15 md permeability

- <1 cp viscosity

- P50 OOIP = 550 MMbbls

- <10% OOIP recovered to date

- Operated Working Interest in 95 well bores:

- Avg. 100% WI / Avg. NRI 87%

- 18 active producers for ~150 bbl/d of oil & 10,000 bbl/d of water

- 7 water disposal wells (4 active) and 1 nitrogen injection well and 1 water source well;

- 67 wells SI or TA on active leases; and

- Project-level IRR of >80% (at $80 WTI Flat).

Bids are due Feb. 27 at 4 p.m. CST. For complete due diligence, please visit energynet.com, or email Zachary Muroff, managing director, at Zachary.Muroff@energynet.com, or Krystin Gilbert, buyer relations manager, at Krystin.Gilbert@energynet.com.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.