(Source: Shutterstock, Hart Energy)

The following information is provided by TenOaks Energy Advisors and Detring Energy Advisors. All inquiries on the following listings should be directed to TenOaks Energy Advisors and Detring Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Below is a roundup of marketed oil and gas leaseholds in Appalachia and the Central Basin from select E&Ps.

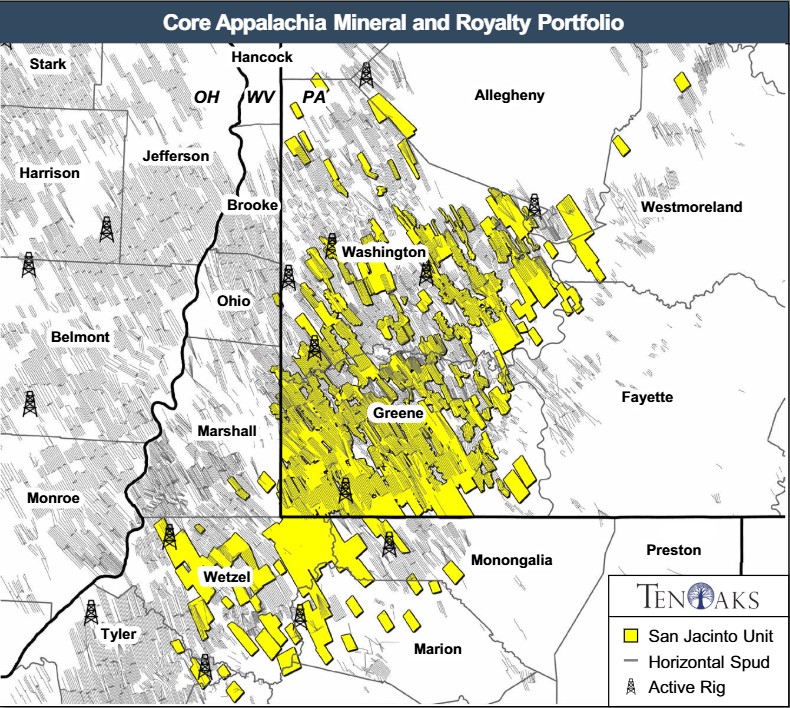

San Jacinto Minerals Appalachia Mineral, Royalty Sale

San Jacinto Minerals I LLC has retained TenOaks Energy Advisors for the sale of certain mineral and royalty properties in Appalachia.

Opportunity Highlights

• Rare opportunity to acquire a best-in-class mineral and royalty portfolio spanning 13,708 NRA in the heart of the Marcellus and Utica plays;

• Stable development cadence with >100 TILs per year across the position over the last 10 years;

• $85MM PDP PV10 | $264MM total PV10;

• $22MM NTM cash flow; and

• Line of sight to future growth with 100 WIPs/Permits and >1,300 remaining Marcellus/Utica locations.

Bids are due March 6 at noon CST. For complete due diligence, please visit tenoaksenergyadvisors.com, or email B.J. Brandenberger, partner, at bj.brandenberger@tenoaksadvisors.com, or Forrest Salge, director, at forrest.salge@tenoaksadvisors.com.

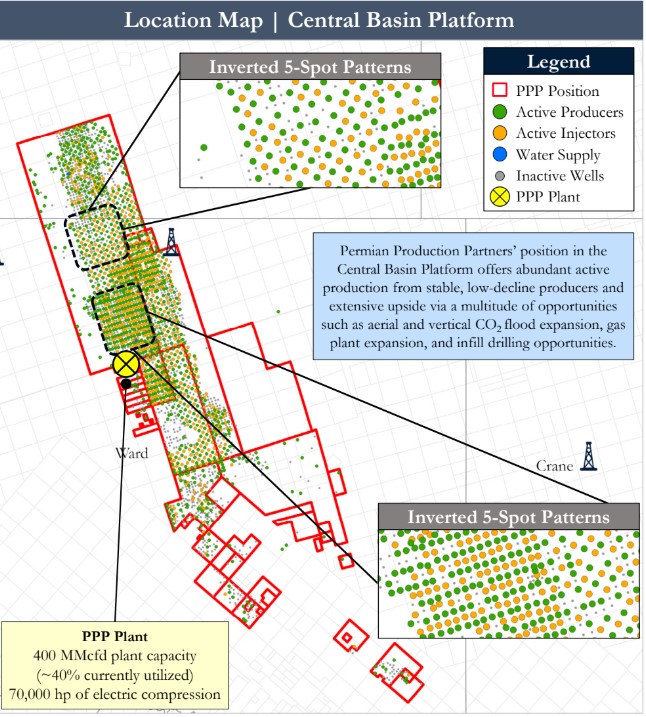

Permian Production Partners Central Basin CO2 Opportunity

Permian Production Partners has retained Detring Energy Advisors for the sale of its oil and gas leasehold, conventional properties and related infrastructure in Ward and Winkler counties, Texas.

Opportunity Highlights

- Oil-rich conventional production from stable, low decline wells

- Robust liquids-weighted production (~100% oil) generating ~2,900 boe/d

- PDP PV10: $68 million

- ~1,000 active producers, ~600 active injectors, and 2 water supply wells

- Average WI of 99% and average NRI of 81%, with an elevated lease NRI of 82%

- Steady low-decline production from long-life fields with both primary production and active EOR operations

- 8% NTM production decline

- Robust liquids-weighted production (~100% oil) generating ~2,900 boe/d

- ~60,000 concentrated net acres, both 100% operated and 100% held-by-production

- Future development opportunities can be 100% funded through PDP cash flow

- 3P PV10: $1.4Bn

- 3P Net Reserves: 144 MMBoe

- Future development opportunities can be 100% funded through PDP cash flow

Bids are due March 19. For complete due diligence, please visit detring.com, or email Derek Detring, president, at derek@detring.com, or Melinda Faust, managing director, mel@detring.com.

Recommended Reading

E&P Highlights: April 21, 2025

2025-04-21 - Here’s a roundup of the latest E&P headlines, from new LNG production offshore Africa to new seismic maps offshore Mauritania.

Money Talks: UMB Bank on Impacts of Upstream Consolidation

2025-04-21 - Guardrails in place allow banks to support energy businesses through all economic cycles, says Zachary Leard, vice president for the energy group at UMB Bank.

Aris Takes on the Permian’s ‘Wall of Water’

2025-04-21 - Aris Water Solutions CEO Amanda Brock rings the alarm bell on the Permian’s water takeaway and recycling challenges and how they can be solved.

US NatGas Prices Drop 7% to 5-Month Low on Record Output, Lower Demand Forecasts

2025-04-21 - U.S. gas stockpiles were currently around 7% below normal levels for this time of year after cold weather in January and February.

Phillips 66 Fires Back at Elliott Over Citgo Conflict of Interest Amid Board Fight

2025-04-21 - The salvo is the latest in a bitter spat between Phillips 66 and Elliott that is due to come to a head at a shareholder meeting next month.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.