The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

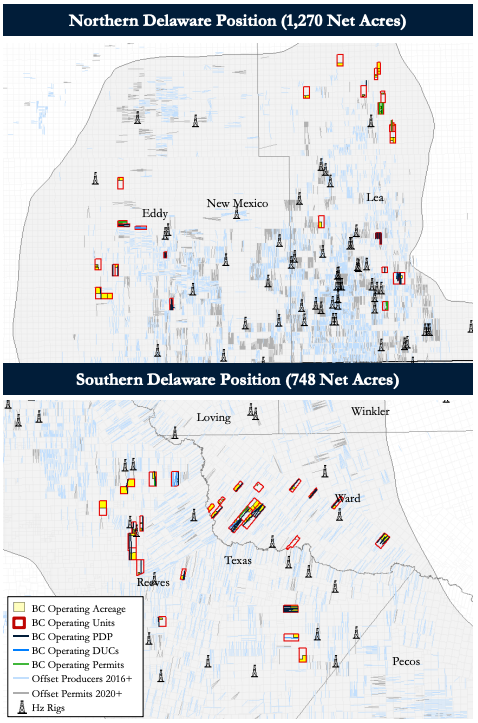

BC Operating Inc. retained Detring Energy Advisors to market for sale its oil and gas nonoperated working interests located in the Permian Basin in New Mexico’s Lea and Eddy counties and Reeves and Ward counties, Texas.

The assets comprise roughly 2,000 net acres spanning the core of the Delaware Basin with exposure to 50 or more drilling units with substantial near-term cash flow from 69 horizontal PDP locations. Additionally, the offering also includes seven DUCs and 25 recently permitted wells driving near-term growth and multi-decade inventory of highly-economic development locations across four or more benches, according to Detring.

Highlights:

- 2,017 Net Acres (~76% HBP)

- 53 drilling units covering an ~50,000 gross acre footprint

- Average ~4.3% Working Interest | ~79% Net Revenue Interest (8/8ths)

- Minimal near-term acreage expirations

- <200 net acres at risk of expiration prior to year-end 2022

- Majority of acreage located in units that accommodate 10,000+ ft lateral development

- 53 drilling units covering an ~50,000 gross acre footprint

- ~560 boe/d Net Production With Line-of-Site Growth

- 69 horizontal PDP locations

- PDP next 12-month cash flow: ~$6 million

- PDP PV-10: ~$20 million

- Seven DUC anticipated online second-half 2021 and 25 recent permits driving continued growth through 2022

- DUC/Permit PV-10: ~$5 million

- Forecast 2021 exit rate of ~620 boe/d (~10% growth relative to current)

- 69 horizontal PDP locations

- World-Class Stacked-Pay Under Active Pad Development

- 750+ high-returning development locations across multiple de-risked Bone Spring and Wolfcamp targets

- 3P PV-10: $60 million+

- 3P Net Reserves: ~13 MMboe

- Sustainably high activity levels by well-capitalized operators underscore predictable long-term growth

- Exposure to premier operators including Occidental Petroleum Corp., Colgate Energy, Mewbourne Oil Co. and Cimarex Energy Co.

- 750+ high-returning development locations across multiple de-risked Bone Spring and Wolfcamp targets

Process Summary:

- Evaluation materials available via the Virtual Data Room June 30

- Proposals due on July 28

The seller anticipates executing a purchase and sale agreement by mid-August and closing by September, Detring said.

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

Exclusive: Tariff Agenda Forms Muddy Waters for Oil, Gas Decision-Makers

2025-03-20 - Paul Gruenwald, the global chief economist for S&P Global Ratings, discusses growing concerns with global demand and the impact of tariff uncertainties on the oil and gas industry, in this Hart Energy Exclusive interview.

Segrist: Permit Reform Rumbles as US Seeks to ‘Unleash American Energy’

2025-03-19 - The White House has called for changes to a heavily criticized system, but new rules require a lot more work.

South Texas LNG Projects Get FERC Permits Back

2025-03-19 - The court that vacated Glenfarne’s Texas LNG and NextDecade’s Rio Grande LNG permits in the summer has reinstated the documents while the government amends the originals.

Trump to Host Top US Oil Chief Executives as Trade Wars Loom

2025-03-19 - U.S. President Donald Trump will host top oil executives at the White House on March 19 as he charts plans to boost domestic energy production in the midst of falling crude prices and looming trade wars.

China Stops US LNG Imports Following Shipping Tariff

2025-03-18 - The country, which put a 15% tariff on U.S. LNG imports, has gone more than 40 days without a delivery, the longest gap since 2023, according to a report from Bloomberg.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.