The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

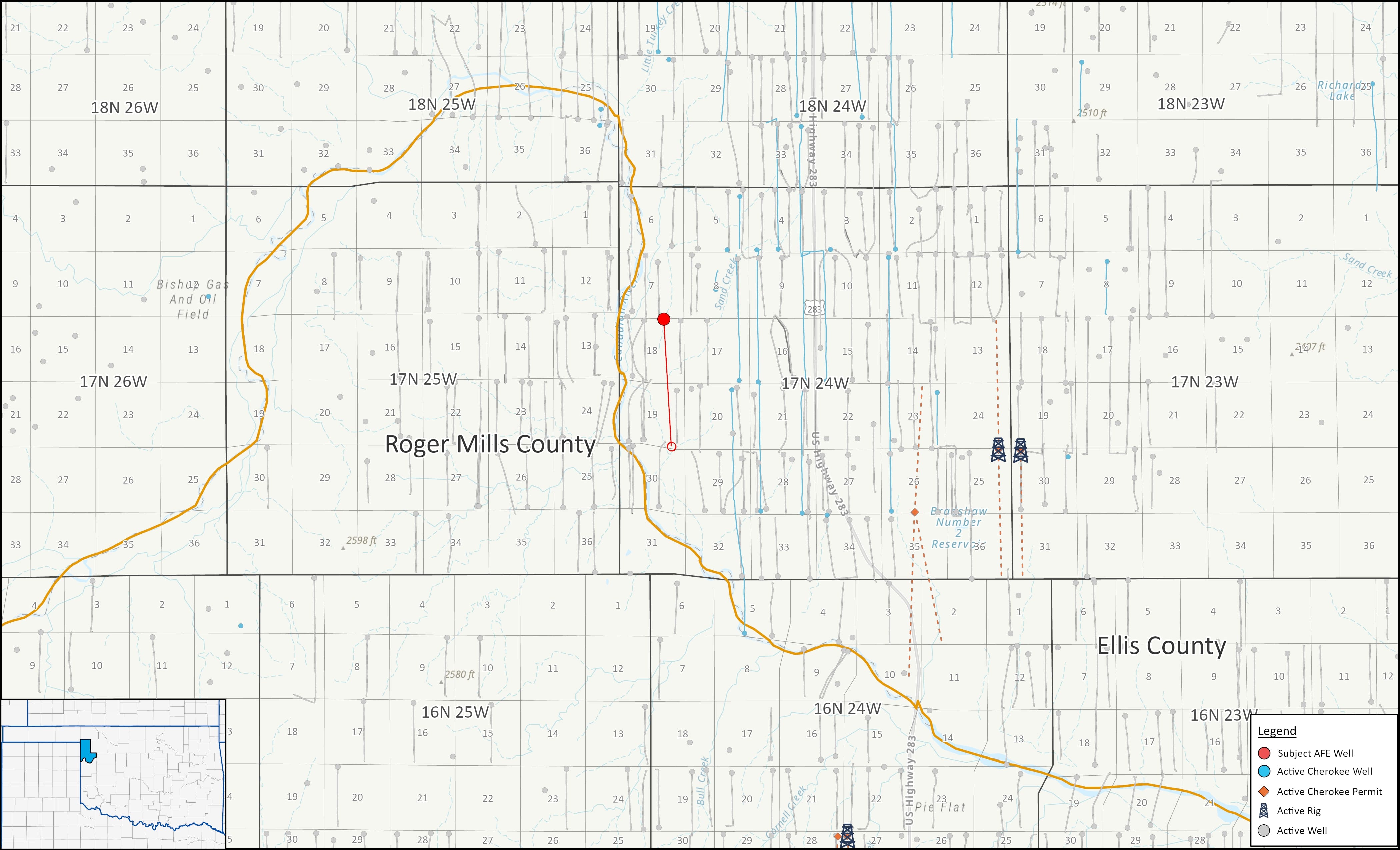

Berlin Resources has retained EnergyNet for the sale of an Anadarko Basin opportunity in the Montgomery 18/19 BO #1H, located in Ellis County, Oklahoma. The Lot # 119245 package includes 0.12% working interest.

Opportunity highlights:

- WI Participation in the Montgomery 18/19 BO #1H Wellbore:

- 0.12% WI / 0.009% NRI

- Projected Formation: Cherokee

- Total Participation Cost: $12,255.56

- Seller Has Elected to Participate

- Operator: Mewbourne Oil Co.

- Offset Activity

- 3 Rigs

- 8 DUCS

- Select Offset Operators:

- Unbridled Resources LLC

- Presidio Petroleum LLC

- Urban Oil & Gas Group

Bids are due June 25 at 4 p.m. CDT. For complete due diligence, please visit energynet.com or email Emily McGinley, managing director, at Emily.McGinley@energynet.com or Jessica Scott, buyer relations, at Jessica.Scott@energynet.com.

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.