The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

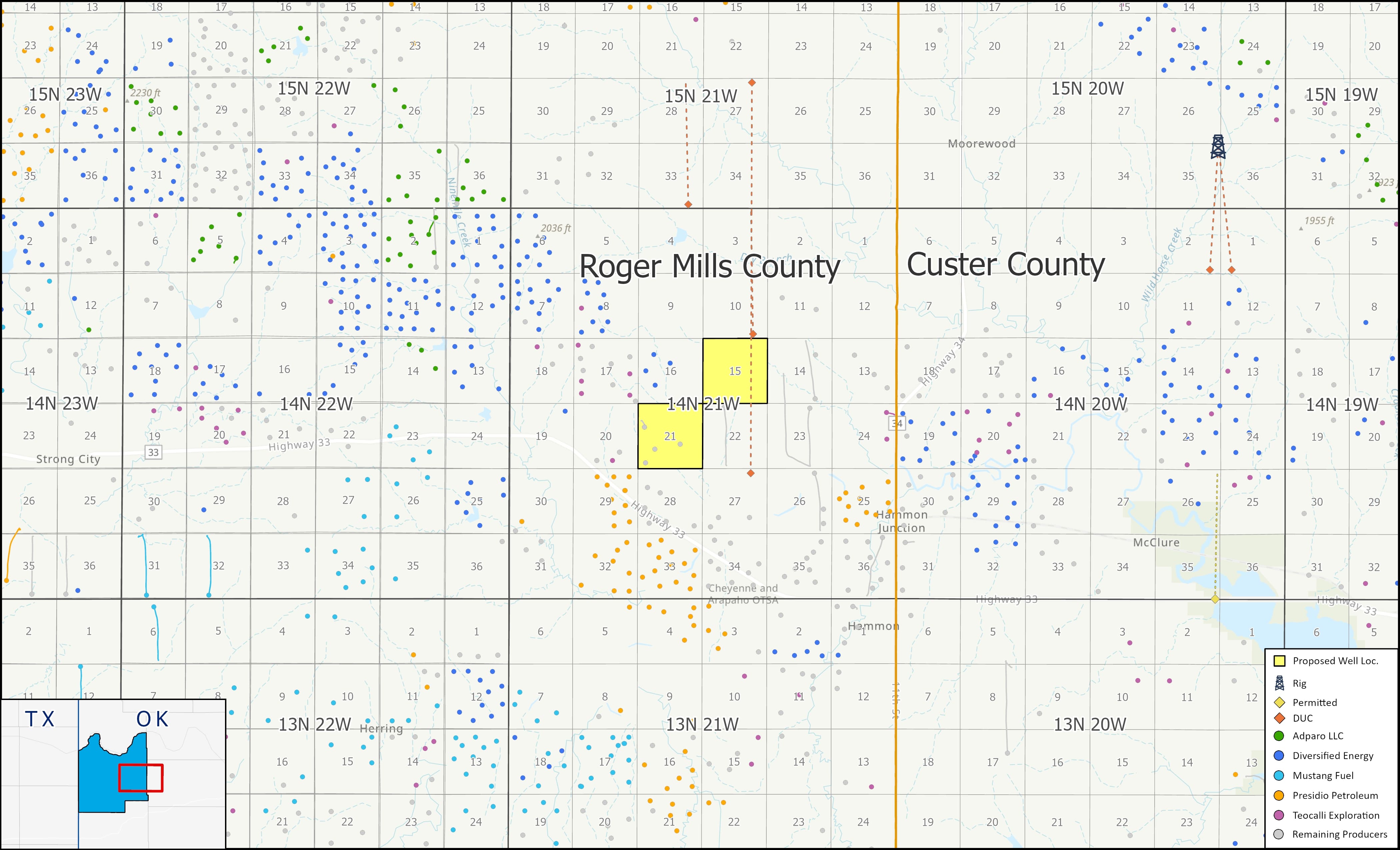

Berlin Resources has retained EnergyNet for the sale of a working interest opportunity in Roger Mills County, Oklahoma. The lot# 124749 package includes 1 rig.

Opportunity Highlights:

- WI Participation Option the Hughes 1-22-15 CHX Wellbore:

- ~0.78% WI / ~0.58% NRI

- Projected Formation: Cherokee

- Total Participation Cost: $93,457.89

- No election due - pooling order has not issued

- Operator: Crawley Petroleum Corporation

- Offset Activity:

- 1 Rig

- 2 DUCs

- 1 Permit

- Select Offset Operators:

- Adparo LLC

- Diversified Energy

- Mustang Fuel

- Presidio Petroleum

Bids are due at 4 p.m. on Dec. 4. For complete due diligence, please visit energynet.com or email Emily McGinley, managing director, at Emily.McGinley@energynet.com, or Jessica Scott, buyer relations manager, at Jessica.Scott@energynet.com.

Recommended Reading

US Crude Oil Stocks, Excluding SPR, Fall to 2-Year Low, EIA Says

2025-01-15 - Crude inventories fell by 2 MMbbl to 412.7 MMbbl in the week ending Jan. 10, the EIA said, compared with analysts' expectations in a Reuters poll for a 992,000-bbl draw.

What's Affecting Oil Prices This Week? (Dec. 16, 2024)

2024-12-16 - For the upcoming week, Stratas Advisors expect oil prices will move sideways with more downside risk than upside potential.

US Crude Stocks Fell Last Week as Exports Jumped, EIA Says

2024-12-18 - Crude inventories fell by 934,000 bbl to 421 MMbbl in the week, the EIA said, compared with analysts' expectations in a Reuters poll for a 1.6-MMbbl-draw.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

Oil Prices Rise in Thin Pre-Holiday Trade

2024-12-24 - Supply and demand changes in December have been supportive of oil price's current less-bearish view so far, analysts say.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.