The following information is provided by Indigo Energy Advisors. All inquiries on the following listings should be directed to Indigo Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

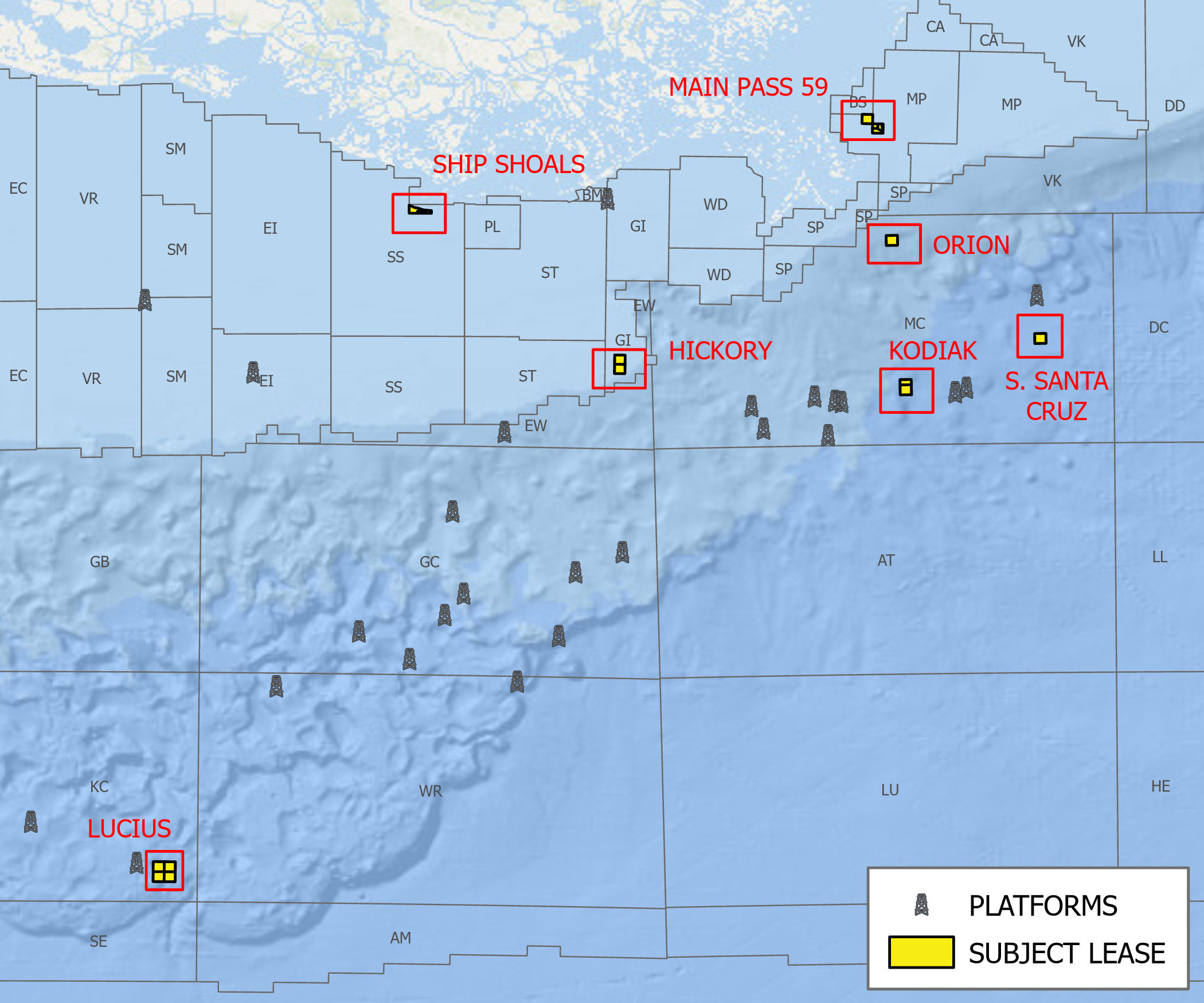

BP Exploration & Production Inc. retained Indigo Energy Advisors for an offshore overriding royalty interest acquisition opportunity in the Gulf of Mexico and Louisiana.

The Lot #120281 opportunity includes 100% HBP royalty interest and had an average net production of approximately 1,100 boe/d in first-quarter 2024.

Opportunity Highlights

- Unique Overriding Royalty Interest

- Opportunity to acquire multiple lease level overrides within the Gulf of Mexico

- 100% HBP royalty interest

- Net production of ~1,100 boepd Q1 2024 average

- Successful workover within the Kodiak Field is online but production data is not reflected in the previously mentioned net production

- Meaningful Investment Platform

- Rare opportunity for Gulf of Mexico exposure with no working interest obligations

- Exposure to leading offshore operators such as Talos, Kosmos, Occidental, and Murphy

- Lease level overrides provide exposure to future development and exploration across premier properties within the Gulf of Mexico

- Kodiak-3 workover successfully completed in July 2024 and performing above operator's expectations

- 2 new-drill opportunities forecasted within Lucius in 2025

- 1 remaining prospect within South Santa Cruz modeled in 2026

- Premium Oily Asset

- Favorable geographic location to Gulf Coast market supports basis differentials above WTI

- Production weighted average royalty ownership of ~2.33%

- Low Decline Conventional Asset

- Shallow PDP NTM production decline of ~7.1%

- Robust producing asset NTM cash flow of ~ $23,100,000

- Additional forecasted upside NTM cash flow of ~ $6,800,000

- Long life nature of asset ensures steady returns

Bids are due at 4:00 p.m. CST on Nov. 12. For complete due diligence information, please visit indigo.energynet.com or email Cody Felton, managing director, at Cody.Felton@energynet.com.

Recommended Reading

E&P Highlights: Jan. 13, 2025

2025-01-13 - Here’s a roundup of the latest E&P headlines, including Chevron starting production from a platform in the Gulf of Mexico and several new products for pipelines.

E&P Highlights: Feb. 10, 2025

2025-02-10 - Here’s a roundup of the latest E&P headlines, from a Beetaloo well stimulated in Australia to new oil production in China.

Production Begins at Shell’s GoM Whale Facility

2025-01-09 - Shell’s Whale floating production facility in the Gulf of Mexico has reached first oil less than eight years after the field’s discovery of 480 MMboe of estimated recoverable resources.

Talos Energy’s Katmai West #2 Well Hits Oil, Gas Pay in GoM

2025-01-15 - Combined with the Katmai West #1 well, the Katmai West #2 well has nearly doubled the Katamai West Field’s proved EUR to approximately 50 MMboe gross, Talos Energy said.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.