The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Catamount Energy Partners LLC retained EnergyNet for the sale of multiple asset packages located in southwest Colorado through three, separate auctions closing Sept. 1.

The asset packages include nonoperated working interest, overriding royalty interest (ORRI) and royalty interest in wells located in Colorado’s Archuleta and La Plata counties.

For complete due diligence information on any of the packages visit energynet.com or email Lindsay Ballard, vice president of business development, at Lindsay.Ballard@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

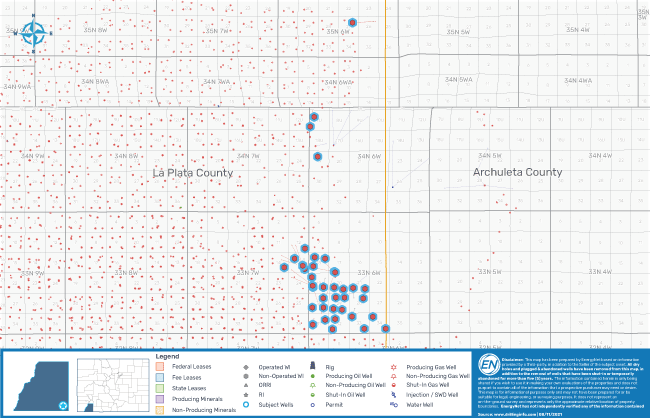

Lot 83157 - 53 Well Package (Nonoperated Working Interest, ORRI and Royalty Interest) in La Plata County, Colorado

Highlights:

- Nonoperated Working Interest in 51 Wells:

- 6.81503% to 1.627% Working Interest / 5.66235% to 1.32904% Net Revenue Interest

- An Additional 0.03597% ORRI and 0.0318% Royalty Interest in 48 Wells

- 37 Producing | Four Non-Producing | Seven Shut In | Three Unknown

- 0.35945% Royalty Interest in Two Producing Wells

- Six-month Average 8/8ths Production: 28,863 Mcf/d

- Eight-month Average Net Income: $38,379 per Month

- Operator: Simcoe LLC

Bids are due by 1:50 p.m. CDT on Sept. 1.

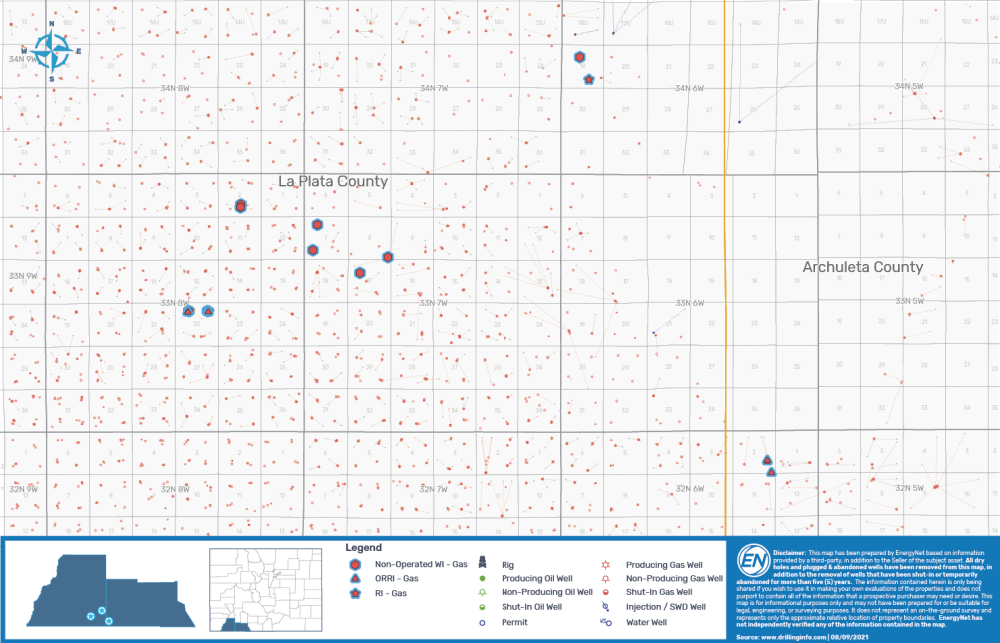

Lot 83158 - 18 Well Package (Nonoperated Working Interest, ORRI and Royalty Interest) in Archuleta and La Plata counties, Colorado

Highlights:

- Nonoperated Working Interest in 10 Producing Wells:

- 25.00% to 0.03254% Working Interest / 21.875% to 0.02685% Net Revenue Interest

- An Additional 1.5625% to 0.0588% Royalty Interest in Six Wells

- ORRI in Six Producing Wells:

- 1.8375% to 1.33321% ORRI

- An Additional 0.0549% Royalty Interest in Two Wells

- 0.07841% to 0.05439% Royalty Interest in Two Producing Wells

- Six-month Average 8/8ths Production: 9,180 Mcf/d

- 12-month Average Net Income: $36,523 per Month

- Operator: Simcoe LLC

Bids are due by 1:55 p.m. CDT on Sept. 1.

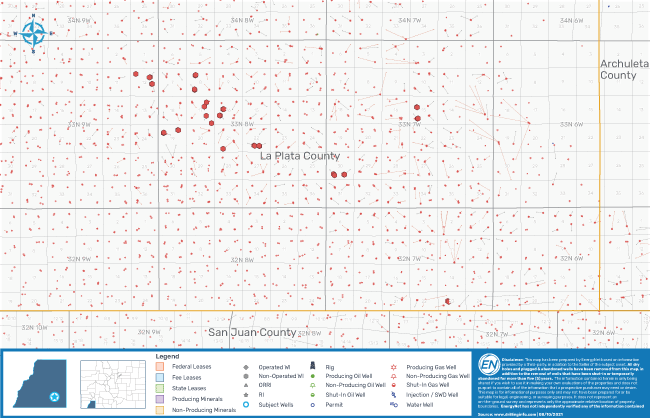

Lot 83159 - 36 Well Package (Nonoperated Working Interest, ORRI and Royalty Interest) in La Plata County, Colorado

Highlights:

- Nonoperated Working Interest in 14 Producing Wells:

- 50.83333% to 8.493368% Working Interest / 44.411084% to 7.4317% Net Revenue Interest

- An Additional 0.015106% Royalty Interest in the Crigler Unit MV Gas Unit 1A

- One Wellbore Only Interest

- ORRI in 18 Wells:

- 10.9375% to 0.00707% ORRI

- 12 Producing | Five Shut In | One Non-Producing

- One Wellbore Only Interest

- 0.007629% Royalty Interest in Four Producing Wells

- Six-month Average 8/8ths Production: 5,855 Mcf/d

- Seven-month Average Net Income: $32,261 per Month

- Operator: Red Willow Production Co.

Bids are due by 2 p.m. CDT on Sept. 1.

Recommended Reading

Gas-Fired Power Plant to be Built Close to Austin, Texas

2025-02-06 - The project, to be built by Argan subsidiary Gemma Power Systems, is expected to hook up to the ERCOT grid in 2028.

EIA Reports Big NatGas Withdrawal, as Expected

2025-02-27 - According to the EIA’s weekly storage report, natural gas levels are 238 Bcf below the five-year average and 561 Bcf below the level from the same time last year.

Commercial Operations at Calcasieu Pass LNG to Begin in April

2025-02-18 - Venture Global started selling LNG at the plant in 2022, angering its long-term customers.

EnCap Portfolio Company to Develop NatGas Hub with DRW Energy

2025-01-21 - EnCap Flatrock Midstream portfolio company Vecino Energy Partners LLC and DRW Energy Trading LLC will be developing an intrastate natural gas storage hub together.

EIA: NatGas Storage Withdrawal Misses Forecasts by 20 Nearly Bcf

2025-01-23 - Natural gas prices fell following the release of the U.S. Energy Information Administration’s weekly storage report showing a near-20 Bcf miss on analysts’ expectations.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.