The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Cavallo Mineral Partners LLC retained Detring Energy Advisors to market for sale its minerals and royalty interests across the prolific Appalachian Basin.

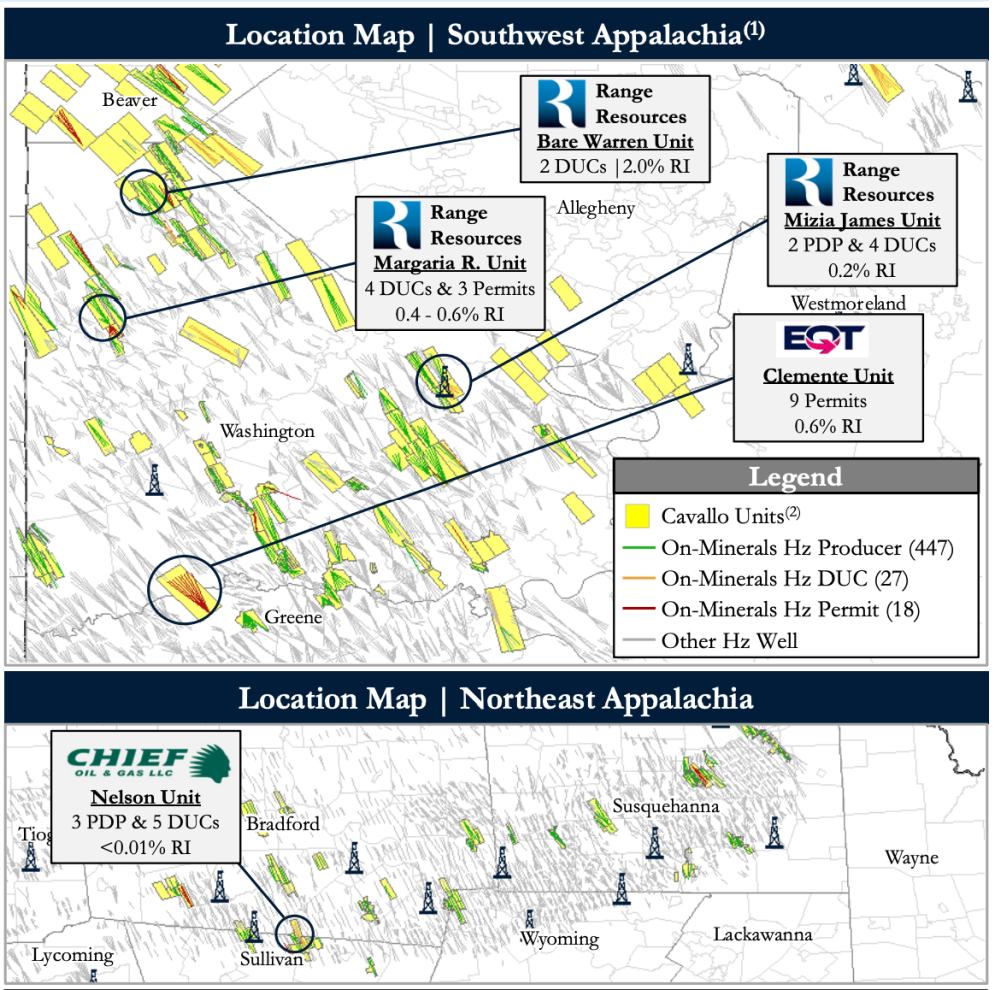

The assets offer an attractive opportunity, Detring said, to acquire roughly 9,500 net royalty acres (96% minerals) consolidated in both the southwest and northeast cores of the play under premier, well-capitalized operators with about 450 horizontal PDP wells and 50 near-term development wells generating $18 million in next 12-month cash flow. Additionally, Detring said the package includes about 400 highly-economic Lower Marcellus and Utica development locations in addition to substantial untapped reserves in the Upper Marcellus and Upper Devonian, which are in early-stage development across the position.

Asset Highlights:

- $18 Million Cash Flow (next 12-month) | ~9 MMcfe/d Net Production (~25% Liquids)

- $37 million PDP PV10 from ~450 horizontal producers

- 27 DUCs and 18 permitted locations provide line-of-sight to continued near-term development

- PDP+DUC+Permit PV-10 and net reserves of $50 million and 28 Bcfe, respectively

- ~9,500 Net Royalty Acres

- 78% Southwest Appalachia (Southwestern Pennsylvania, West Virginia, and Eastern Ohio) and 22% Northeastern Pennsylvania

- Diversified exposure to premier, well-capitalized Appalachia operators including Range Resources, EQT, Coterra Energy, Chesapeake Energy and Southwestern Energy

- World-Class Inventory of ~400 Undeveloped Lower Marcellus and Utica/Point Pleasant Locations

- Compelling well performance and economics ensure continued development with EUR’s as high as ~5 Bcfe/Mft

- Average operator IRR >100% for all zones (~4-8 month payout)

- Total 3P PV-10 and net reserves of $143MM and 104 Bcfe, respectively ($337 million PV0)

Process Summary:

- Evaluation materials are available via the Virtual Data Room on June 6

- Bids are due on July 13

For information visit detring.com or contact Matt Loewenstein at matt@detring.com or 713-595-1003.

Recommended Reading

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

Sintana Reports Two Discoveries Offshore Namibia

2025-01-06 - Sintana Energy Inc. said the Mopane-2A well found gas condensate in one reservoir and light oil in a smaller one.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.