The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

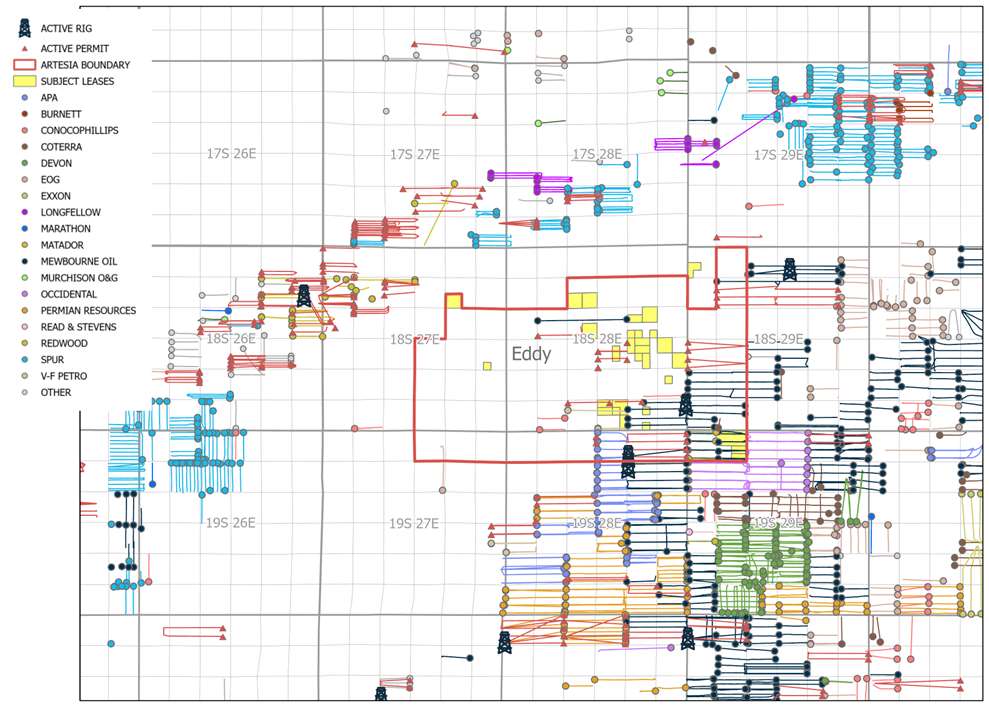

Chevron USA Inc. and Chevron MidContinent LP retained EnergyNet for a northern Delaware Basin opportunity with operations, non-operated WI and HBP Leasehold in Eddy County, New Mexico. The bid property is Lot# 105871 on EnergyNet’s website.

Opportunity highlights:

- Premium Eddy County, New Mexico Position

- ~2,134 net acre position, in the northern area of the Delaware Basin in Eddy County, New Mexico

- Future development of 37 10,000' laterals

- Chevron is delivering 75% 8/8ths gross NRI and retaining surface acreage

- Gross Bone Spring thickness of greater than 300' with high TOC and porosity across the acreage position

- Delineated, Premium Inventory Potential Across Several Zones

- 37 gross repeatable drilling locations included across the position in Eddy County, New Mexico

- 18 locations in the 2nd Bone Spring at 1,320' spacing

- 19 locations in the 3rd Bone Spring at 1,320' spacing

- Further potential upside of 27 locations at 1,320' spacing in the Avalon

- 37 gross repeatable drilling locations included across the position in Eddy County, New Mexico

- Predictable Production and Cash Flow

- PDP production of ~1,818 net boe/d (June 2023E)

- Midstream infrastructure in place with ample takeaway capacity supports full development plan

- No MVCs or drilling commitments

- NTM PDP Cash Flow of ~ $11 MM

Bids are due July 27, 2023, at 4:00 PM CDT. For complete due diligence information on this property, please visit http://www.energynet.com or email Cody Felton, Managing Director, at Cody.Felton@energynet.com or Reilly Bliton, Director of Engineering at EnergyNet Indigo, at Reilly.Bliton@energynet.com.

Recommended Reading

Phillips 66 Buys EPIC’s Permian NGL Midstream Assets for $2.2B

2025-01-07 - Phillips 66 will buy EPIC’s NGL assets, including a 175,000 bbl/d pipeline that links production supplies in the Delaware and Midland basins and the Eagle Ford Shale to Gulf Coast fractionation complexes.

CNX’s $505MM Bolt-On Adds Marcellus, Deep Utica in Pennsylvania

2024-12-05 - CNX Resources CEO Nick Deluliis said the deal to buy Apex Energy underscores CNX’s confidence in the stacked pay development opportunities unlocked in the deep Utica.

Talos Sells More of Mexican Subsidiary to Billionaire Carlos Slim

2024-12-17 - Talos Energy has agreed to sell another 30.1% interest in subsidiary Talos Mexico to entities controlled by billionaire Carlos Slim, whose companies also own at least 24% of Talos Energy’s common stock.

Constellation Bets Big on NatGas in $16.4B Deal for Calpine

2025-01-10 - Constellation Energy will acquire Calpine Corp. in a $26.6 billion deal, including debt, that will give the pure-play nuclear company the largest natural gas power generation fleet.

Crescent Energy Bolts On $905MM Central Eagle Ford Acreage

2024-12-03 - Crescent Energy will purchase Eagle Ford assets from Carnelian Energy Capital Management-backed Ridgemar Energy for $905 million, plus WTI-based contingency payments of up to $170 million.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.