The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

CPEP Management LLC retained TenOaks Energy Advisors LLC in connection with the potential sale of certain cash-generating wellbore-only properties located in the Delaware Basin.

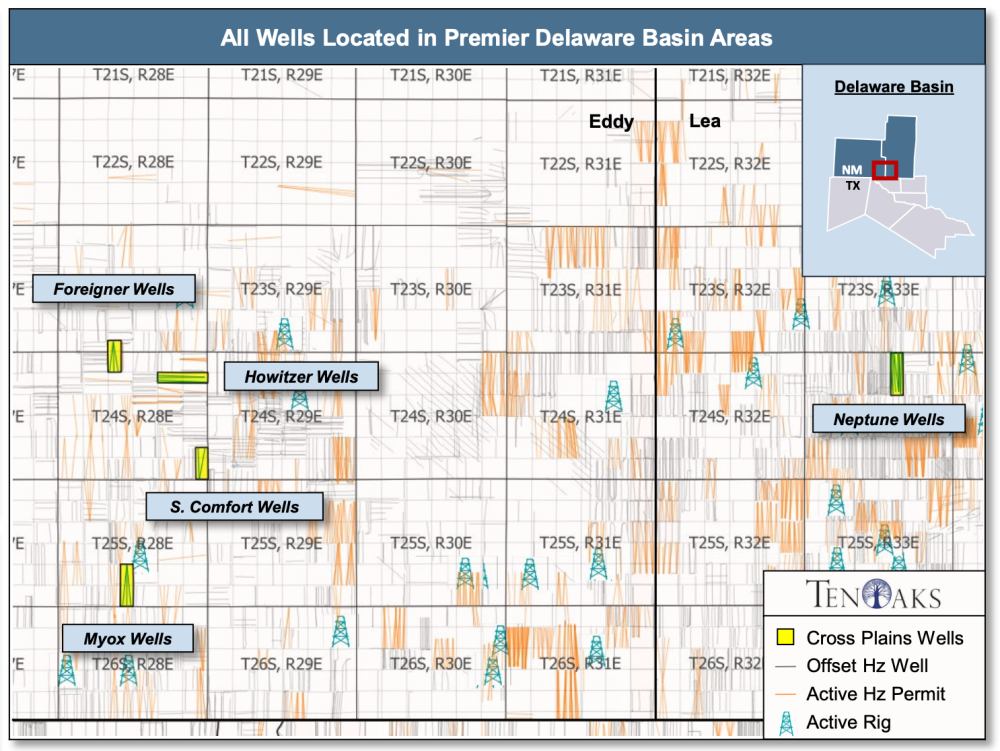

CPEP Management is an affiliate of Cross Plains Energy Partners LLC. The assets are located in New Mexico’s Eddy and Lea County.

Highlights:

- Nonoperated working interests in 20 producing horizontal wells in the core of the Delaware Basin (Eddy and Lea County, N.M.)

- Substantial cash flow and production base:

- Next 12-month Net Cash Flow: $19 million

- Projected Net Production: 2,950 boe/d (61% Liquids)

- Minimal administrative costs / burden

- Partnered with well-established Delaware Basin operators—EOG Resources Inc., Marathon Oil Corp., ConocoPhillips Co. (all wells drilled by Concho Resources) and Mewbourne Oil Co.

- High Net Revenue Interest on multiple wells provides opportunity to monetize Overriding Royalty Interest

Bids are due May 20. The transaction is expected to have a June 1 effective date with a purchase and sales agreement targeted by June 10.

A virtual data room is available. For information visit tenoaksenergyadvisors.com or contact Lindsay Sherrer at TenOaks Energy Advisors at 214-620-4421 or Lindsay.Sherrer@tenoaksadvisors.com.

Recommended Reading

Birch Resources Mows Dean Sandstone for 6.5 MMbbl in 15 Months

2025-01-06 - Birch Resources has averaged 7 MMboe, 92% oil, from just 16 wells in the northern Midland Basin’s Dean Formation in an average of 15 months each, according to new Texas Railroad Commission data.

Coterra’s Rigs ‘Stay Camped Out’ in Delaware Basin Mega-DSU Drilling

2025-02-26 - With 57 wells already in one “row” development, Coterra Energy has 16 more underway, plus rigs at work on two more mega-DSU developments totaling 90 wells.

Civitas Makes $300MM Midland Bolt-On, Plans to Sell D-J Assets

2025-02-25 - Civitas Resources is adding Midland Basin production and drilling locations for $300 million. To offset the purchase price, Civitas set a $300 million divestiture target “likely to come” from Colorado’s D-J Basin, executives said.

SM’s First 18 Uinta Wells Outproducing Industry-Wide Midland, South Texas Results

2025-02-20 - Shallow tests came on with 685 boe/d, 95% oil, while deeper new wells averaged 1,366 boe/d, 92% oil, from two-mile laterals, SM Energy reported.

Exxon’s Dan Ammann: Bullish on LNG as Permian Drilling Enters ‘New Phase’

2025-03-18 - Dan Ammann, Exxon Mobil’s new upstream president, is bullish on the long-term role of LNG in meeting global energy demand. He also sees advantages of scale in the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.