The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Daylight Petroleum retained TenOaks Energy Advisors as its exclusive adviser in connection with the sale of a portfolio of Gulf Coast properties.

Highlights

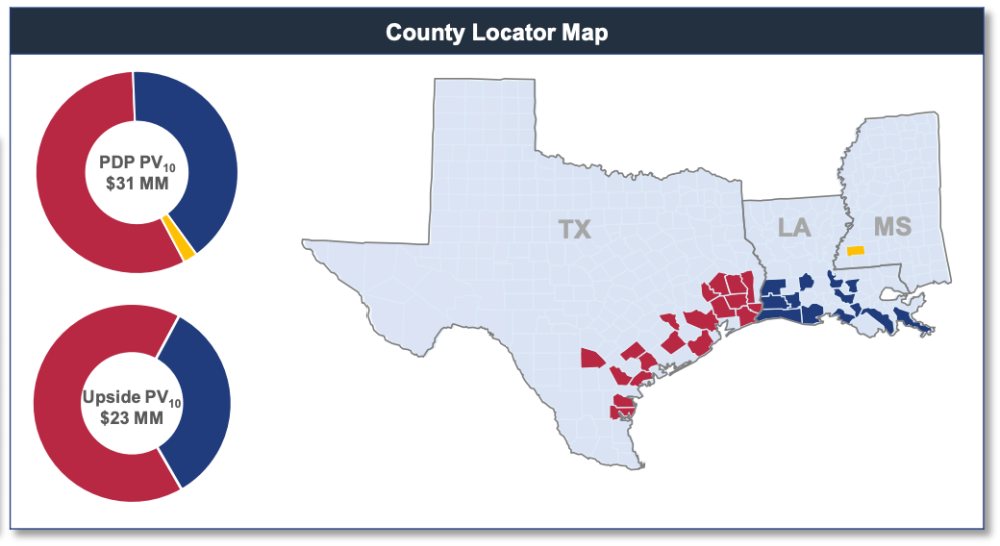

- Operated, HBP footprint (primarily Texas and Louisiana)

- PDP PV-10: $31 million | Next 12-month PDP cash flow: $8 million

- High cash operating margins: 60%

- Low-decline production base

- Net production: ~700 boe/d (70% oil)

- Inventory of 45 low-cost, high-impact development opportunities

- F&D of $4.10 per boe

- Upside PV-20: $15 million

Bids are due by noon CST on Sept. 14. The transaction is expected to have a Sept. 1 effective date.

A virtual data room will be available starting Aug. 11. For information visit tenoaksenergyadvisors.com or contact Trey Bonvino at TenOaks Energy Advisors at 214-420-2331 or Trey.Bonvino@tenoaksadvisors.com.

Recommended Reading

Sheffield: There are More US Oil Plays E&Ps ‘Need to Go After’

2025-03-17 - They may not be another horizontal Wolfcamp or Bone Springs play with tens of billions of barrels, but there’s more onshore E&Ps should explore, former Pioneer Natural Resources CEO Scott Sheffield told Hart Energy at the recent CERAWeek by S&P Global conference.

HIF’s Beck: E-Fuels an Additional Source to Fulfill Rising Demand

2025-03-18 - E-fuels are not a displacement of hydrocarbons but an additional source to fuel growing energy demand, said HIF Global’s Lee Beck at CERAWeek by S&P Global.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.