The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

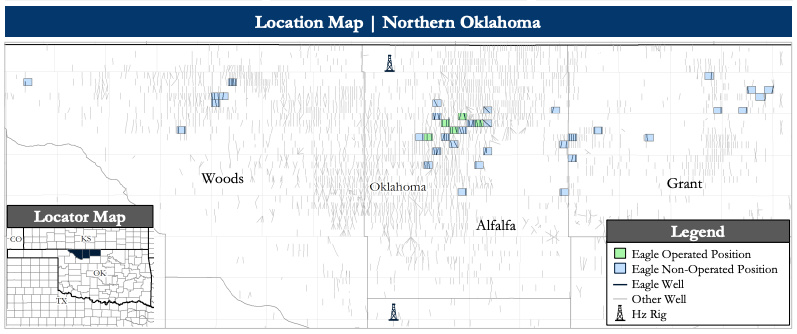

Eagle Resources Group LLC is offering for sale its oil and gas producing properties, leasehold, minerals and related assets located in Woods, Alfalfa and Grant counties, Oklahoma. The assets comprise a roughly 5,800 net-acre position 100% HBP with 53 horizontal PDP Mississippi Lime wells producing 3.2 MMcfe/d on a well established, low-decline of about 10% generating $6 million in next 12-month cash flow fully funding 45 highly economic development locations.

Eagle has retained PetroDivest Advisors as its exclusive adviser relating to the transaction.

Highlights:

- Operated Properties (1,750 Mcfe/d Net Production | 2,700 Net Acres)

- 13 low-decline horizontal PDP wells with next 12-month decline of 10% making $3.2 million next 12-month operating cash flow

- PDP PV-10: $12.5 million

- PDP Net Reserves: 8.4 Bcfe

- Average 72.4% Working Interest | 56.4% Net Revenue Interest

- Operated saltwater disposal system provides additional income stream and reduces overall LOE cost

- 13 low-decline horizontal PDP wells with next 12-month decline of 10% making $3.2 million next 12-month operating cash flow

- Nonoperated Properties (1,400 Mcfe/d Net Production | 3,100 Net Acres)

- 40 low-decline horizontal PDP wells with next 12-month decline of 13% making $2.7 million next 12-month operating cash flow

- PDP PV-10: $9.9 million

- PDP Net Reserves: 5.3 Bcfe

- Avg 18.0% Working Interest | 14.4% Net Revenue Interest

- Focused, well-capitalized nonop partners including SandRidge, Mach, Chaparral and others

- 40 low-decline horizontal PDP wells with next 12-month decline of 13% making $2.7 million next 12-month operating cash flow

- Undeveloped Inventory (45 Highly Economic Miss Lime PUDs)

- Leasehold 100% HBP

- Two operated and 43 nonoperated gross locations targeting the Mississippi Lime

- Undeveloped PV-10: $21.2 million

- Undeveloped Net Reserves: 12.4 Bcfe

- De-risked development locations primed for full unit drill out

- Robust economic returns with individual well payouts of about nine months

Process Summary:

- Evaluation materials are available via the Virtual Data Room on July 13

- Bids are due on Aug. 17

For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

McKinsey: Big GHG Mitigation Opportunities for Upstream Sector

2024-11-22 - Consulting firm McKinsey & Co. says a cooperative effort of upstream oil and gas companies could reduce the world’s emissions by 4% by 2030.

E&P Highlights: Dec. 30, 2024

2024-12-30 - Here’s a roundup of the latest E&P headlines, including a substantial decline in methane emissions from the Permian Basin and progress toward a final investment decision on Energy Transfer’s Lake Charles LNG project.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

Analysts’ Oilfield Services Forecast: Muddling Through 2025

2025-01-21 - Industry analysts see flat spending and production affecting key OFS players in the year ahead.

E&P Highlights: Jan. 6, 2025

2025-01-06 - Here’s a roundup of the latest E&P headlines, including company resignations and promotions and the acquisition of an oilfield service and supply company.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.