The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Endeavor Energy Resources LP retained EnergyNet for the sale of a Permian Basin package in an auction closing on Aug. 11.

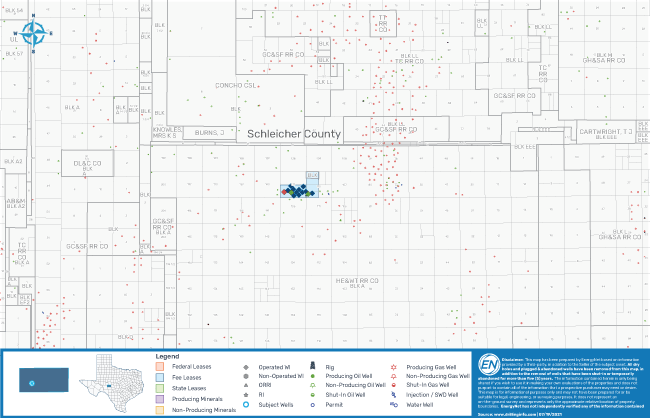

The offering includes operations in 20 wells in Schleicher County, Texas.

Highlights:

- Operations in 20 Wells (Two Leases):

- 80.00% Working Interest / 64.00% Net Revenue Interest in the Wilson -137- Lease

- 80.00% Working Interest / 61.60% Net Revenue Interest in the Wade Lease

- Six-Month Average 8/8ths Production: 39 bbl/d of Oil

- Five-Month Average Net Income: $14,319/Month

- Operator Bond Required

Bids are due by 1:55 p.m. CDT on Aug. 11. For complete due diligence information on any of the packages visit energynet.com or email Lindsay Ballard, vice president of business development, at Lindsay.Ballard@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

EON Deal Adds Permian Interests, Restructures Balance Sheet

2025-02-11 - EON Resources Inc. will acquire Permian overriding royalty interests in a cash-and-equity deal with Pogo Royalty LLC, which has agreed to reduce certain liabilities and obligations owed to it by EON.

Viper to Buy Diamondback Mineral, Royalty Interests in $4.45B Drop-Down

2025-01-30 - Working to reduce debt after a $26 billion acquisition of Endeavor Energy Resources, Diamondback will drop down $4.45 billion in mineral and royalty interests to its subsidiary Viper Energy.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

Origis Secures $1B in New Investments from Brookfield, Antin

2025-01-15 - Brookfield Asset Management is joining Origis Energy’s investor group alongside existing investor and majority owner Antin Infrastructure Partners.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.