The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

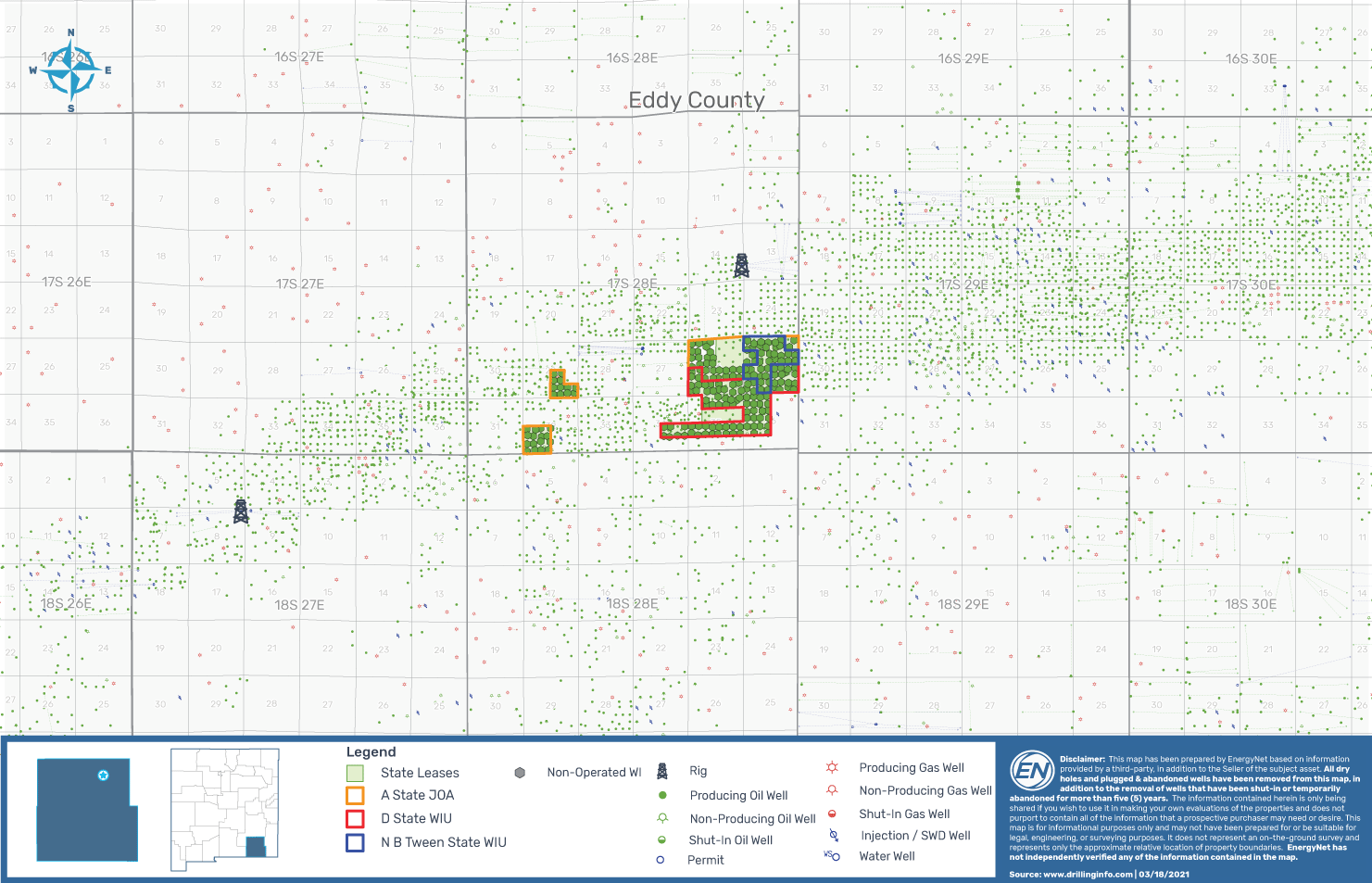

EOG Resources Inc. retained EnergyNet for the sale of two nonop packages of Permian Basin properties in New Mexico’s Eddy County through auctions closing April 14.

The first package comprises nonoperated working interest in 160 wells and the other consists of nonop interest in 205 properties. Both packages include leasehold acreage and are operated by Apache Corp.

EnergyNet is also handling a sealed-bid package for EOG that includes operations, nonoperated working interest and overriding royalty interest in over 100 Permian wells plus roughly 23,000 net leasehold acres in New Mexico’s Chaves, Lea and Roosevelt counties.

For complete due diligence information on any of the packages visit energynet.com or email Lindsay Ballard, vice president of business development, at Lindsay.Ballard@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Lot 73481 - 160 Well Package Highlights:

- Nonoperated Working Interest in the Empire Abo Unit:

- 4.135155% to 0.035651% Working Interest / 2.941241% to 0.035157% Net Revenue Interest

- 118 Producing Wells | Five Active Injection Wells | One Non-Producing Well | 36 Temporarily Abandoned Wells

- Operator: Apache Corporation

- Three-Month Average Net Income: $3,042/Month

- Six-Month Average 8/8ths Production: 492 bbl/d of Oil and 1,263 Mcf/d of Gas

- 557.047 Net Leasehold Acres

Bids are due by 1:30 p.m. CST April 14.

Lot 73482 - 205 Property Package Highlights:

- Nonoperated Working Interest in 205 Properties (197 Wells):

- 18.0556% Working Interest / 13.5417% Net Revenue Interest

- 200 Producing Properties | One Non-Producing Property | Four Temporarily Abandoned Properties

- Eight Wells Completed in Multiple Formations

- Operator: Apache Corp.

- Four-Month Average Net Income: $42,944/Month

- Six-Month Average 8/8ths Production: 4,806 Mcf/d of Gas and 552 bbl/d of Oil

- 411.67 Net Leasehold Acres

Bids are due by 1:45 p.m. CST April 14.

Recommended Reading

Devon Energy Announces Changes to Executive Leadership Team

2025-01-13 - Among personnel moves, Devon Energy announced John Raines and Trey Lowe have been promoted to senior vice president roles.

Magnolia’s Board Adds Ropp as Independent Director

2025-01-07 - Alongside his experience in oil and gas operations, R. Lewis Ropp has a background in finance, capital markets and investment management, Magnolia Oil & Gas said.

SM Energy Adds Petroleum Engineer Ashwin Venkatraman to Board

2024-12-04 - SM Energy Co. has appointed Ashwin Venkatraman to its board of directors as an independent director and member of the audit committee.

Vantage Drilling Names Williams Thomson as New COO

2024-12-31 - Thomson is currently Vantage’s chief commercial officer and CTO and has served the company since 2008.

Devon CEO Muncrief to Retire, COO Gaspar to Take Top Job in March

2024-12-09 - Devon Energy President and CEO Rick Muncrief, who has led Devon during past four years, will retire March 1. The board named COO Clay Gaspar as his successor.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.