The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

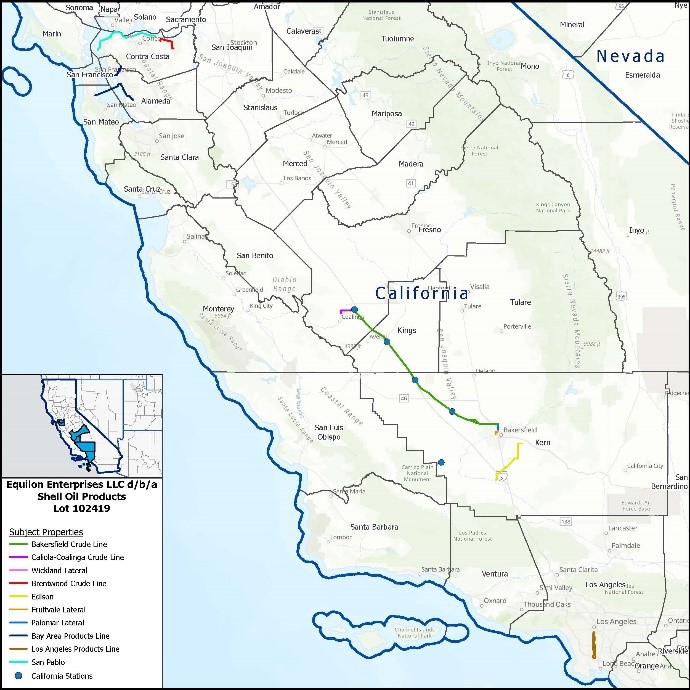

Equilon Enterprises d/b/a Shell Oil Products is offering for sale pipelines and properties in Contra Coasta, Alameda, Fresno, Kings, Kern and Los Angeles Counties, California. Lot# 102419 includes ~239 miles in the California Pipelines, 5 former pump stations covering 13 parcels and ~236 acres, in addition to 3 San Pablo Trunkline properties covering ~2 acres. More information about the offering can be found below. The seller has retained EnergyNet as its exclusive advisor relating to the transaction.

Asset Highlights:

- ~239 Miles in the California Pipelines:

- Can include all or just a portion of the mileage

- Pipelines are Located Across 6 Counties:

- Formerly used for Crude Oil, Low Sulfur Fuel Oil, and Refined Products

- Have a Future Objective of Non-Petroleum Use

- 5 Former Pump Stations Covering 13 Parcels and ~236 Acres

- Can include all or just a portion of the stations/parcels/acreage

- 3 San Pablo Trunkline Properties Covering ~2 Acres

- Associated Right of Way for these lines are located in potential valuable areas, including but not limited to crossing/parallel to roadways, the aqueduct, and waterways.

This is a sealed bid property on EnergyNet.com, Lot# 102419. Bids are due August 10, 2023 at 4:00 pm CDT. For complete due diligence information on this property, please visit http://www.energynet.com or email Cody Felton, Managing Director, at Cody.Felton@energynet.com or Jewell Arias, Buyer Relations, at Jewell.Arias@energynet.com.

Recommended Reading

Antero Stock Up 90% YoY as NatGas, NGL Markets Improve

2025-02-14 - As the outlook for U.S. natural gas improves, investors are hot on gas-weighted stocks—in particular, Appalachia’s Antero Resources.

Back to the Future: US Shale is Growing Up

2025-01-07 - The Patch’s maturity will be tested in 2025 amid ongoing consolidation and geopolitical dissonance.

BP’s Eagle Ford Refracs Delivering EUR Uplift, ‘Triple-Digit’ Returns

2025-02-14 - BP’s shale segment, BPX Energy, is seeing EUR uplifts from Eagle Ford refracs “we didn’t really predict in shale,” CEO Murray Auchincloss told investors in fourth-quarter earnings.

Shale Outlook Appalachia: Natural Gas Poised to Pay

2025-01-09 - Increasing gas demand is expected to rally prices and boost midstream planning as a new Trump administration pledges to loosen permitting—setting the stage for M&A in the Appalachian Basin.

Shale Outlook Eagle Ford: Sustaining the Long Plateau in South Texas

2025-01-08 - The Eagle Ford lacks the growth profile of the Permian Basin, but thoughtful M&A and refrac projects are extending operator inventories.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.