The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

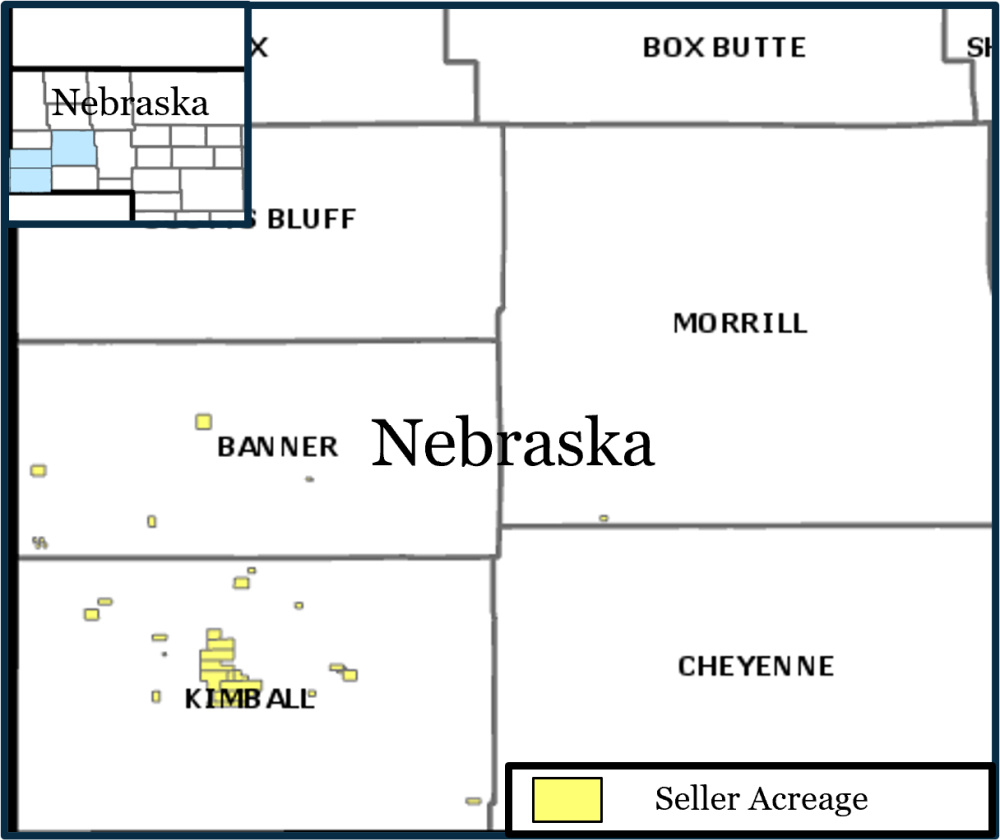

Eagle River Energy Advisors LLC has been exclusively retained by Evertson Operating Co. Inc. to divest certain operated working interest assets in the Denver-Julesburg (D-J) Basin of Nebraska.

The offering includes 14,660 net acres with 47 PDP, 11 injection and three saltwater disposal wells. Production is 351 net bbl/d of oil with a PDP PV-10 of $30.8 million. The assets generated a last 12-month net cash flow of $8 million.

Asset Overview:

- Diversified Shallow Decline Oil Production

- Net production of 351 boe/d (99% oil)

- Historical shallow decline of ~8% per year

- Production from conventional reservoirs (primarily J sand)

- Well diversified across 47 PDP wells

- Active EOR program on six units

- Highly Profitable Asset

- Low operating costs of $14.42/BO

- Last 12-month net cash flow of $8 million

- PDP PV-10 of $30.8 million

- Little near-term P&A liability, only five operated temporarily abandoned wells

- High Operational Control and Drilling Upside

- Large footprint with 19,380 gross and 14,660 net acres

- 530 Miles of 3D Seismic Data (98% unleased) included

- Potential for both conventional and unconventional exploration targets

- Favorable regulatory climate in Nebraska

Bids are due by 4 p.m. MT on Oct. 11. The transaction effective date is Nov. 1.

A virtual data room will be available starting Sept. 12. For information contact Chris Martina, technical director at Eagle River, at 720-726-6092 or cmartina@eagleriverea.com.

Recommended Reading

Panama Canal Traffic Rose in Dec, but Waterway Still Has Empty Slots

2025-01-13 - Some vessels, including LNG tankers, have continued using alternative routes due to the canal's increase in passage fees in the last decade.

Overbuilt Fleet of LNG Tankers Sinking Cargo Transport Rates

2025-01-30 - LNG shipping rates are at historic lows as a flooded transport market waits for projects to come online and more cargoes to move.

Enbridge CEO: Tariffs Not a Concern but Present Chance for Reform in Canada

2025-02-14 - Enbridge’s CEO Greg Ebel says the company doesn’t see a major effect on its business with such a “hard-wired” system.

Kinder Morgan Reaches FID for $1.4B Mississippi NatGas Pipeline

2024-12-19 - Kinder Morgan plans to keep boosting its capacity to the Southeast and is moving forward with a 206-mile pipeline with an initial capacity of 1.5 Bcf/d.

High Court Hears Potentially Influential Uinta Basin Case

2024-12-11 - U.S. Supreme Court justices heard arguments over a Utah railroad that could have big implications for the energy sector’s adherence to environmental requirements.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.