The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

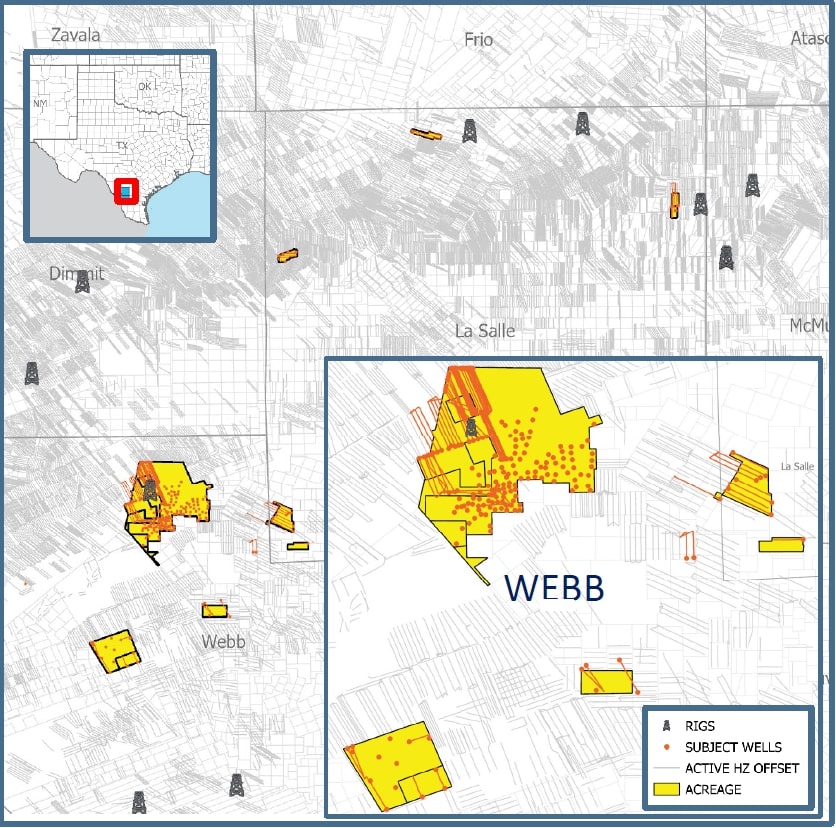

Excess Energy has retained EnergyNet for the sale of a Austin Chalk and Eagle Ford Shale, 207 well package in La Salle and Webb counties, Texas. The lot# 115862 package includes a four-month average net income of $50, 856 per month.

Opportunity Highlights:

- 679.70 Net Mineral Acres

- Royalty Interest in 196 Wells:

- Avg RI ~0.25%

- An Additional ORRI in 19 Wells

- Overriding Royalty Interest in 11 Wells:

- Avg ORRI ~0.34%

- Nine DUCs & 18 Permits

- Four-Month Average Net Income: $50,856/Month

- Six-Month Average 8/8ths Production: 141,262 MCFPD and 7,855 BOPD

- Six-Month Average 8/8ths Production: 427 MCFPD and 12 BOPD

- Select Operators:

- EOG Resources, Inc.

- Escondido Resources Oper Co, LLC

- INEOS Usa Oil & Gas LLC

- Lewis Petro Properties, Inc.

Bids are due June 6 at 4 p.m. CDT. For complete due diligence, please visit energynet.com or email Zachary Muroff, managing director, at Zachary.Muroff@energynet.com.

Recommended Reading

US NatGas in Storage Grows for Second Week

2025-03-27 - The extra warm spring weather has allowed stocks to rise, but analysts expect high demand in the summer to keep pressure on U.S. storage levels.

Arc Resources to Supply Exxon with LNG Offtake from Cedar LNG

2025-03-11 - Exxon Mobil Asia Pacific Pte. Ltd. has agreed to buy 1.5 million tonnes per annum of ARC Resources’ LNG offtake from the Cedar LNG Project when the facility begins commercial operations.

Bernstein Expects $5/Mcf Through 2026 in ‘Coming US Gas Super-Cycle’

2025-01-16 - Bernstein Research’s team expects U.S. gas demand will grow from some 120 Bcf/d currently to 150 Bcf/d into 2030 as new AI data centers and LNG export trains come online.

Predictions 2025: Downward Trend for Oil and Gas, Lots of Electricity

2025-01-07 - Prognostications abound for 2025, but no surprise: ample supplies are expected to keep fuel prices down and data centers will gobble up power.

Bottlenecks Holding US Back from NatGas, LNG Dominance

2025-03-13 - North America’s natural gas abundance positions the region to be a reliable power supplier. But regulatory factors are holding the industry back from fully tackling the global energy crisis, experts at CERAWeek said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.