The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

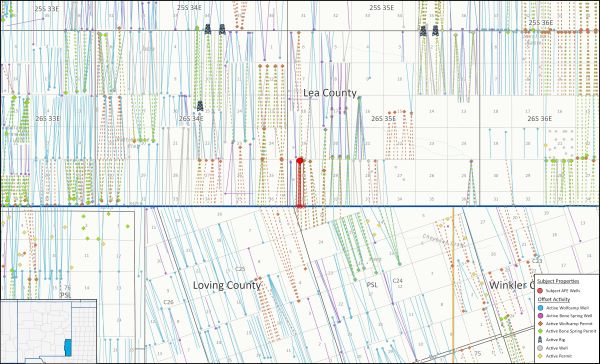

Legacy Income Fund I has retained EnergyNet for the sale of a five well package in Lea County, New Mexico and Loving County, Texas. The lot# 116374 package includes six offset rigs and 902 active offset producers.

Opportunity Highlights:

- Wellbore Only in five Hz Wells:

- Avg. ~0.21% WI / Avg. ~0.16% NRI

- Formations: Third Bone Spring, Wolfcamp A and Wolfcamp B

- Total Participation Cost: $137,996.49

- Seller has Elected to Participate

- Operator: Earthstone Operating, LLC

- 6 Offset Rigs

- 695 Offset Permits

- New Drill: 51 Completed | 13 Drilled/Drilling | 120 DUC | 511 Permitted

- 902 Active Offset Producers

- Select Offset Operators:

- Ameredev Operating, LLC

- COG Operating, LLC

- Devon Energy Production Company, LP

- EOG Resources, Inc.

Bids are due May 22 at 4 p.m. CDT. For complete due diligence, please visit energynet.com or email Zachary Muroff, managing director, at Zachary.Muroff@energynet.com.

Recommended Reading

In Busy Minerals M&A Year, Freehold Grabs $152MM Midland Interests

2024-12-10 - Canadian player Freehold Royalties is getting deeper in the Permian with a CA$216 million (US$152 million) Midland Basin acquisition as minerals buyers intensify M&A in the basin.

Coterra Eyes Wolfcamp D, Penn Shale Upside with $3.95B Permian M&A

2024-11-15 - With $3.95 billion in Permian M&A, Coterra is adding new Delaware Basin locations in the Bone Spring, Harkey and Avalon benches—and eyeing upside from deeper zones.

Orion Acquires SCOOP/STACK Interests, Pursuing Permian Deals

2024-11-11 - Orion Diversified Holding Co. is pursuing negotiations with several oil companies in the Permian Basin to acquire oil and gas assets, the company’s CEO said.

Report: ConocoPhillips Shopping Delaware Basin Assets for $1B Sale

2024-10-30 - ConocoPhillips has laid out a $2 billion divestiture campaign to reduce debt from a blockbuster acquisition of Marathon Oil.

Exxon to Sell Older Permian Assets to Hilcorp in $1B Deal, Sources Say

2024-11-13 - Reuters reported in June that Exxon was auctioning the assets to focus on higher growth shale drilling properties, following the completion of its $60 billion takeover of Pioneer Natural Resources in May.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.