The following information is provided by EN Indigo. All inquiries on the following listings should be directed to EN Indigo. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

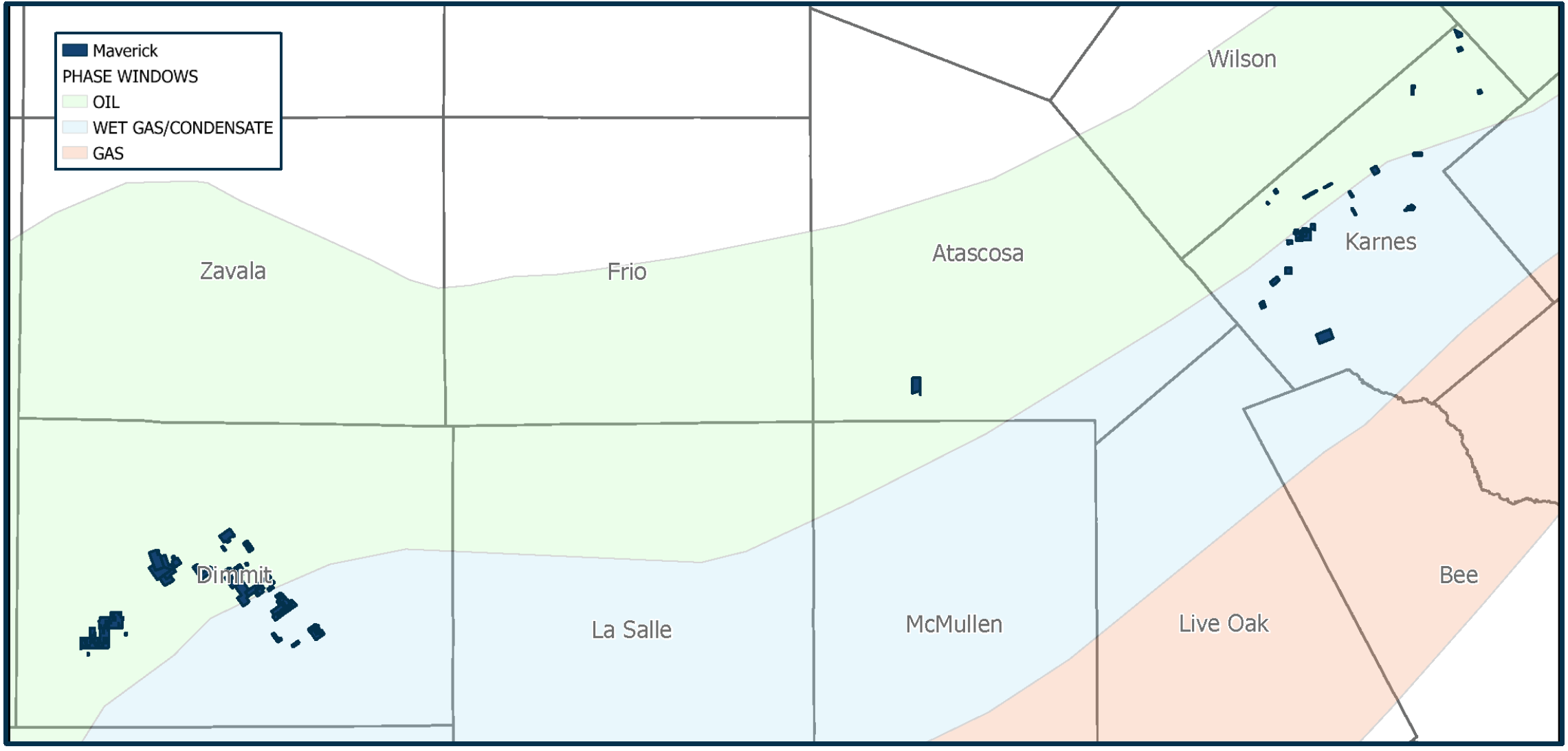

Maverick ORRI, LP (Maverick) is offering for sale overriding royalty interests (“ORRI”) in Atascosa, Dimmit, and Karnes Counties, Texas. Lot# 106170 includes 389 active wells with 2.58% average wellbore NRI, 642 boe/d LTM average net production, an estimated LTM cash flow of $1.2 million per month, 37,402 gross acres, more than 600 undeveloped locations remaining, and a projected NTM cash flow of $13.2 million. Maverick retained EN Indigo as the exclusive advisor for this transaction.

Asset Highlights:

- 389 active wells with 2.58% average wellbore NRI

- 642 boe/d LTM average net production (79% liquids)

- Leading operators such as EOG, Marathon, ConocoPhillips and Devon

- $1.2MM / mo. LTM average cash flow

- More than 600 undeveloped locations remaining

- 37,402 gross acres 100% HBP

- $13.2MM projected NTM cash flow (1)

- Certain ORRI assets feature WI conversion option with compelling economics

Bids for Lot# 106170 are due on June 29 at 4:00 p.m. CDT. For complete due diligence information on this property, please visit http://www.energynet.com or email Zachary Muroff, Managing Director, at Zachary.Muroff@energynet.com or Reilly Bilton, Director of Engineering at EnergyNet Indigo, at Reilly.Bilton@energynet.com.

Recommended Reading

Shale Outlook: Power Demand Drives Lower 48 Midstream Expansions

2025-01-10 - Rising electrical demand may finally push natural gas demand to catch up with production.

Glenfarne Signs on to Develop Alaska LNG Project

2025-01-09 - Glenfarne has signed a deal with a state-owned Alaskan corporation to develop a natural gas pipeline and facilities for export and utility purposes.

Howard Energy Clinches Deal for EPIC's Ethylene Pipeline

2025-01-09 - Howard Energy Partners’ purchase of EPIC Midstream Holdings ethylene pipeline comes days after EPIC agreed to sell midstream NGL assets to Phillips 66 for $2.2 billion.

Plains’ $725MM in Deals Add Eagle Ford, Permian Infrastructure

2025-01-08 - Plains All American Pipeline’s executed transactions with EnCap Flatrock Midstream in the Eagle Ford and Medallion Midstream in the Delaware Basin, among other moves.

Williams Cos. Prices $1.5B of Senior Notes

2025-01-07 - Williams Cos. said proceeds from the offering for near-term debt reduction and corporate needs.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.