The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

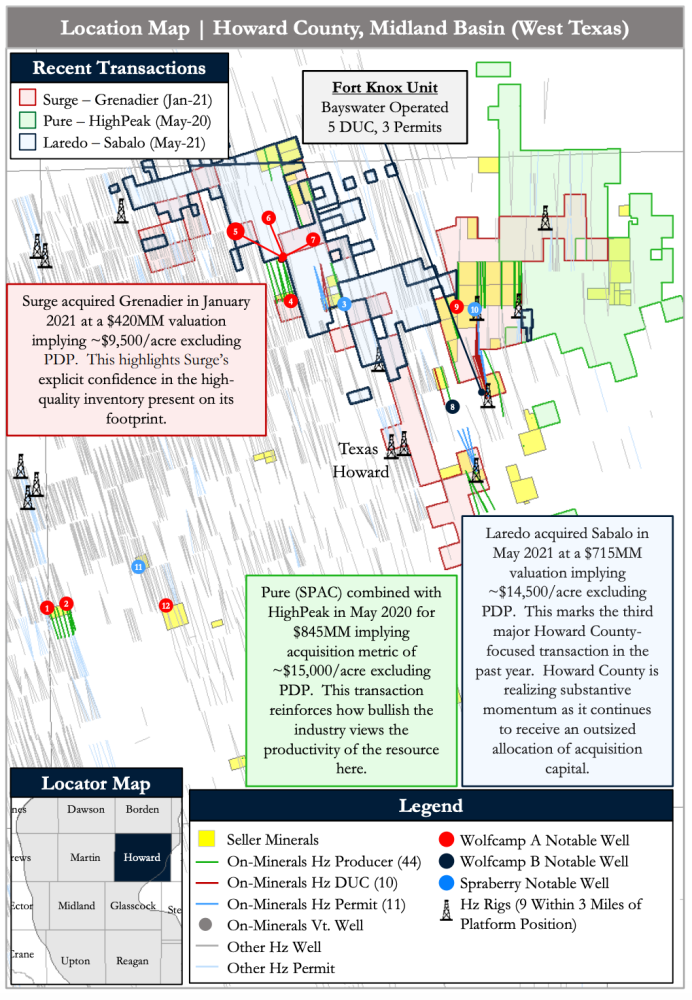

A private seller retained PetroDivest Advisors as the exclusive adviser in connection with the offering for sale of its oil and gas mineral and royalty interests in Howard County, Texas, of the Midland Basin.

The assets offer an attractive opportunity, PetroDivest said, to acquire a concentrated position with access to multiple benches across the prolific Wolfcamp and Spraberry horizons with exposure to premier operators drilling extended laterals utilizing next-gen completion techniques plus substantial near-term cash flow from 44 horizontal PDP and 21 horizontal DUCs/permits.

Highlights:

- 796 Net Royalty Acres – 100% Minerals

- Prolific stacked-pay in the deep over-pressured core of one of the most active basins in the US

- Net Production: ~5 boe/d

- Next 12-month Cash Flow: ~$0.4 million

- Prolific stacked-pay in the deep over-pressured core of one of the most active basins in the US

- Substantial cash flow growth with near-term DUC/Permit development

- Average ~10,000 ft laterals substantially accelerate mineral cash flow & value

- High-quality acreage across Howard County with exposure to premier operators

- Top operators include Diamondback Energy Inc., Ovintiv Inc., Surge Energy, Laredo Petroleum Inc. and Bayswater E&P LLC

- Assets include 44 active producing horizontal plus 21 horizontal DUCs/Permits

Process Summary:

- Evaluation materials available via the Virtual Data Room on May 26

- Offers due on June 23

PetroDivest anticipates the sign and close occurring by July 30. For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

Stonepeak Backs Longview for Electric Transmission Projects

2025-03-24 - Newly formed Longview Infrastructure will partner with Stonepeak as electric demand increases from data centers and U.S. electrification efforts.

More Players, More Dry Powder—So Where are the Deals?

2025-03-24 - Bankers are back and ready to invest in the oil and gas space, but assets for sale remain few and far between, lenders say.

RWE Slashes Investment Upon Uncertainties in US Market

2025-03-20 - RWE introduced stricter investment criteria in the U.S. and cut planned investments by about 25% through 2030, citing regulatory uncertainties and supply chain constraints as some of the reason for the pullback.

TXO Partners CEO Bob R. Simpson to Retire

2025-03-20 - Gary D. Simpson and Brent W. Clum will serve as co-CEOs, effective April 1. Bob R. Simpson will remain chairman of the board, TXO said.

US Oil Company APA Lays Off Nearly 15% of Staff, Bloomberg News Reports

2025-03-19 - The news comes days after APA and its partners announced a successful oil discovery on their shared acreage in Alaska's North Slope.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.