The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

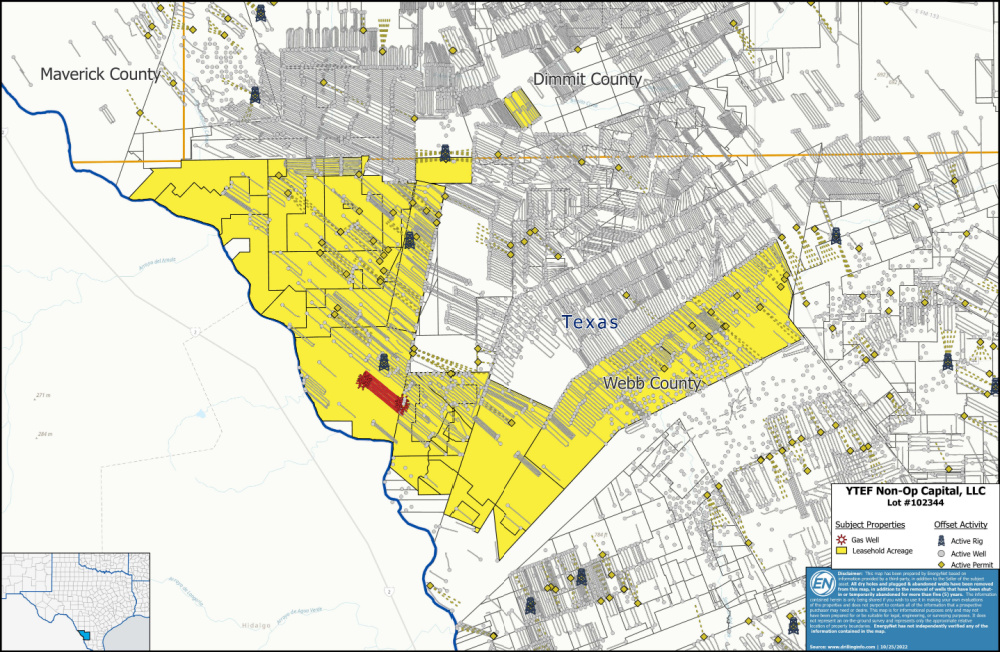

YTEF Non-Op Capital LLC, an affiliate of Millennial Energy Partners, retained EnergyNet for the sale of a six-well package in Webb County, Texas, through an auction closing Dec. 7. The package, Lot# 90764, includes nonoperated working interest in the wellbores of six producing wells operated by SM Energy Co.

Highlights:

- Nonoperated Working Interest in the Wellbores of Six Producing Wells:

- 2.50% Working Interest / 1.875% Net Revenue Interest

- 10-Month Average Net Income: $62,559/Month

- Six-Month Average 8/8ths Production: 289 bbl/d of Oil and 10,770 Mcf/d of Gas

- Six-Month Average Net Production: 5 bbl/d of Oil and 202 Mcf/d of Gas

- Operator: SM Energy Co.

Bids are due at 2:55 p.m. CDT on Dec. 7. For complete due diligence information visit energynet.com or email Cody Felton, managing director, at Cody.Felton@energynet.com, or Jewell Arias, buyer relations / transactions manager, at Jewell.Arias@energynet.com.

Recommended Reading

In Inventory-Scarce Permian, Could Vitol’s VTX Fetch $3B?

2025-03-28 - With recent Permian bids eclipsing $6 million per location, Vitol could be exploring a $3 billion sale of its shale business VTX Energy Partners, analysts say.

Hirs: Investing for 2025—Growth by Acquisition

2025-01-29 - Fundamentals will push against increased production and a buyers’ market will rule.

‘Golden Age’ of NatGas Comes into Focus as Energy Market Landscape Shifts

2025-03-31 - As prices rise, M&A interest shifts to the Haynesville Shale and other gassy basins.

Civitas Makes $300MM Midland Bolt-On, Plans to Sell D-J Assets

2025-02-25 - Civitas Resources is adding Midland Basin production and drilling locations for $300 million. To offset the purchase price, Civitas set a $300 million divestiture target “likely to come” from Colorado’s D-J Basin, executives said.

Exxon Sits on Undeveloped Haynesville Assets as Peers Jockey for Inventory

2025-04-09 - Exxon Mobil still quietly holds hundreds of locations in the Haynesville Shale, where buyer interest is strong and inventory is scarce.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.