The following information is provided by Detring Energy Advisors. All inquiries on the following listings should be directed to Detring Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

A private seller has retained Detring Energy Advisors for the sale of its mineral and royalty interests in the Permian and Powder River basins. The package includes 800 undeveloped locations.

Opportunity Highlights:

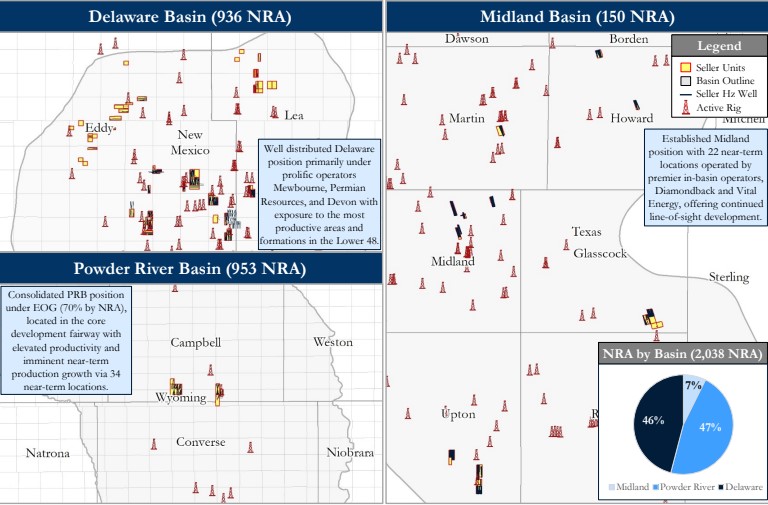

- 2,038 Net Acre Position | Broad, High-Activity Footprint

- Expansive position with statistical coverage provides exposure to consistent on-minerals activity

- Last 6-month average ~12 spuds/month on-minerals as operators continue pad development across multiple zones

- Expansive position with statistical coverage provides exposure to consistent on-minerals activity

-

- Assets evenly distributed across the Permian and Powder River Basins, under highly active, well capitalized in-basin operators

- Exposure to premier operators EOG, Mewbourne, Permian Resources, and Devon ensures sustained activity and development

- Assets evenly distributed across the Permian and Powder River Basins, under highly active, well capitalized in-basin operators

- Robust $10MM NTM Cash Flow | Rapidly Growing Development

- 516 producing wells (~430 horizontal) offer a stable, low-decline production base, underpinning future growth

- PDP Net Production: 280 Boed (76% liquids)

- 516 producing wells (~430 horizontal) offer a stable, low-decline production base, underpinning future growth

-

-

- PDP PV8: $17MM

-

-

- Substantial operator activity results in rapid growth underwritten by recent DUCs (81) and permits (68)

- DUC and permit inventory provides 11 months of line-of-sight growth

- Substantial operator activity results in rapid growth underwritten by recent DUCs (81) and permits (68)

- ~800 Undeveloped Locations | Assets <40% Developed

- World-class, repeatable well results facilitate the full development of all available targets over time

- Average ROI-Disc. >2x across all 15+ formations demands allocation of operator capital

- World-class, repeatable well results facilitate the full development of all available targets over time

-

- Significant remaining inventory drives long-term growth for coming decades

- 3P Net Reserves: 3.1MMBoe

- Significant remaining inventory drives long-term growth for coming decades

-

-

- 3P PV10: $66MM ($138MM PV0)

-

Bids are due May 22. For complete due diligence, please visit detring.com or email Melinda Faust, managing director, at mel@detring.com or Jonathan Bristal at jonathan@detring.com.

Recommended Reading

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

Berry Announces Jeff Magids as New CFO

2025-01-21 - Jeff Magids was appointed as Berry Corp.’s new CFO on Jan. 21 in replacement of Mike Helm, effective immediately.

Q&A: Patterson’s OFS Perspective on the Shale Boom, Pandemic and Current Upswing

2025-02-27 - Former Basic Energy Services CEO Roe Patterson details his perspective on the shale boom and the lessons learned to get back to the current upswing in the industry.

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

Viper Makes Leadership Changes Alongside Diamondback CEO Shakeup

2025-02-21 - Viper Energy is making leadership changes alongside a similar shake-up underway at its parent company Diamondback Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.