The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

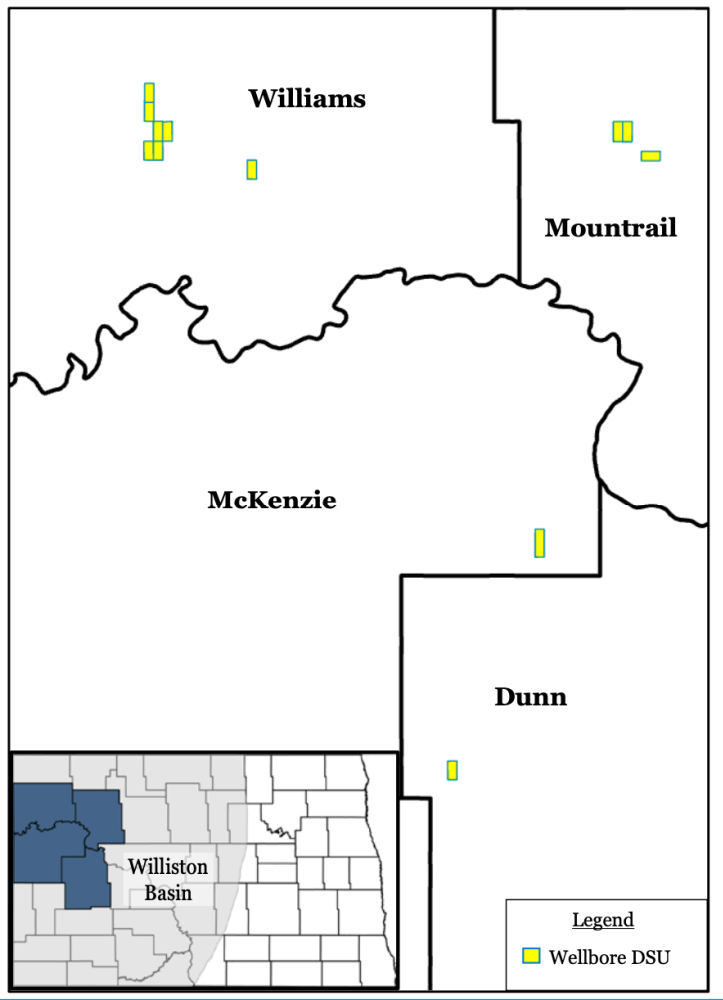

Eagle River Energy Advisors LLC has been exclusively retained by a private seller to divest certain wellbore only, nonoperated working interests in North Dakota.

The assets provide the opportunity to acquire a significant oil-weighted production stream that generated $2 million of annualized cash flow from 123 boe/d of net production. Additionally, this package is diversified by well count, well vintage, commodity and operator with locations spread across multiple counties in North Dakota. Lastly, these assets exhibit both low lifting costs ($11.42/boe) and high net operating margin realizing 80% of revenue.

Highlights:

- Significant Oil Weighted Production Base

- 61 gross PDP (1.5 Net) wells generating 123 boe/d Net

- Oil weighted production (Oil 75% / Gas 11% / NGL 14%)

- $2 million annualized cash flow

- April net cash flow of $200,000

- Stable Cash Flow from Diversified Production

- Stable production with over 40% of wells producing 7+ years

- Diversified leading operators with Continental Resources, Enerplus, Oasis Petroleum, Whiting Petroleum and WPX Energy (Devon Energy)

- Producing from Bakken and Three Forks formations with strong refrac potential

- Spread across four core counties in the heart of the Williston Basin

- High Margin Production

- Low lifting cost ($11.42 / boe) leading to high margin production

- Deducts: $3.72 / boe & LOE: $7.70 / boe

- High net operating margin realizing 80% of revenue

- Low Oil differential of -$2.72 to WTI

- Low lifting cost ($11.42 / boe) leading to high margin production

Bids are due at 4 p.m. MT on June 2. The transaction effective date is July 1.

A virtual data room will be available starting May 16 For information contact Chris Martina, technical director at Eagle River, at 720-726-6092 or cmartina@eagleriverea.com.

Recommended Reading

GA Drilling Moves Deep Geothermal Tech Closer to Commercialization

2025-02-19 - The U.S. Department of Energy estimates the next generation of geothermal projects could provide some 90 gigawatts in the U.S. by 2050.

Black & Veatch to Build Two Battery Storage Projects in UK

2025-02-11 - Serving as the projects’ owner’s engineer and technical advisor, Black & Veatch will review and provide technical advice, construction monitoring and schedule tracking services.

Ørsted, PGE Greenlight Baltica 2 Wind Project Offshore Poland

2025-01-29 - Ørsted said Baltica 2 is expected to be fully commissioned in 2027.

Energy Transition in Motion (Week of March 21, 2025)

2025-03-21 - Here is a look at some of this week’s renewable energy news, including a move by U.S. President Donald Trump to boost domestic production of critical minerals.

TotalEnergies, STMicroelectronics Ink 1.5 TWh Renewable Power Deal

2025-01-28 - As part of the 15-year contract, TotalEnergies will provide solar and wind power to New York-based STMicroelectronics.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.