The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Eagle River Energy Advisors LLC has been exclusively retained by Merced Capital LP to divest certain nonoperated working interest wellbore only assets in Texas, New Mexico and Oklahoma.

Highlights:

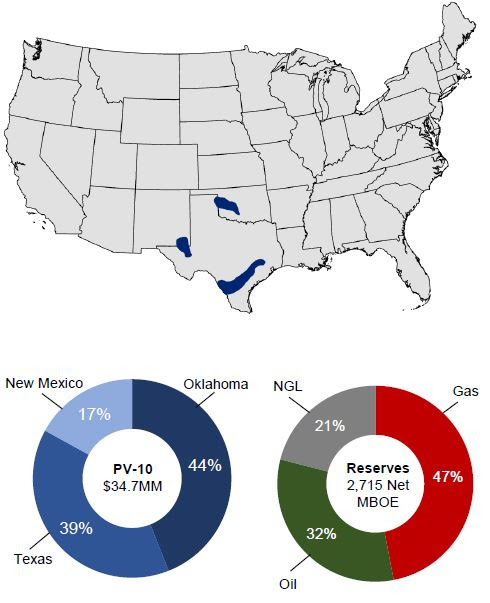

- Multibasin Working Interest Assets

- ~985 boe/d net production (four-month average)

- Diversified reserve base (Gas 47% / Oil 32% / NGL 21%)

- $7.6 million annualized cash flow (four-month average)

- 22 existing nonoperated PDP wells (wellbore only)

- Highlight Diversified Production Profile

- Asset diversification across Karnes, Gonzales and La Salle counties in Texas, Dewey and Blaine counties in Oklahoma, and Lea County in New Mexico

- Highly diversified production stream by well vintage

- Existing well production from the Eagle Ford, Bone Springs and Mississippian formations

- Multiple experienced operators including Marathon Oil, 1776 Energy, Prima Exploration and Staghorn Petroleum

- Engineered Reserves

- ~2,715 Net Mboe / $34.7 million PV-10

- Oklahoma: $15.2 million PV-10 (44%)

- Texas: $13.4 million PV-10 (39%)

- New Mexico: $6.1 million PV-10 (17%)

Bids are due 4 p.m. MT on Dec. 8. The effective date of the transaction is Dec. 1.

A virtual data room will be available starting Nov. 10. For information contact Chris Martina, technical director at Eagle River, at 720-726-6092 or cmartina@eagleriverea.com.

Recommended Reading

Boardwalk Project Steps Up in Competitive Southeast Market

2024-12-12 - Boardwalk Pipelines' Kosciusko Junction project has reached FID as power generation and data centers’ energy demand pull natural gas to the eastern Gulf Coast.

Intensity Infrastructure Partners Pitches Open Season for Bakken NatGas Egress

2025-02-04 - Analysts note the Bakken Shale’s need for more takeaway capacity as Intensity Infrastructure Partners launches an open season for a potential 126-mile natural gas transport line out of the basin.

Kinder Morgan to Build $1.7B Texas Pipeline to Serve LNG Sector

2025-01-22 - Kinder Morgan said the 216-mile project will originate in Katy, Texas, and move gas volumes to the Gulf Coast’s LNG and industrial corridor beginning in 2027.

Glenfarne Signs on to Develop Alaska LNG Project

2025-01-09 - Glenfarne has signed a deal with a state-owned Alaskan corporation to develop a natural gas pipeline and facilities for export and utility purposes.

Shale Outlook: Power Demand Drives Lower 48 Midstream Expansions

2025-01-10 - Rising electrical demand may finally push natural gas demand to catch up with production.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.