The following information is provided by Meagher Energy Advisors. All inquiries on the following listings should be directed to Meagher. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

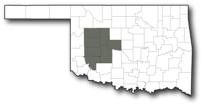

Olifant Energy II LLC and OLIPDP I LLC retained Meagher Energy Advisors for the sale of operated STACK production and leasehold in Oklahoma’s Blaine, Custer and Caddo counties.

Highlights:

- 34,469 Mcfe/d September net production consisting of 76% Gas and 20% NGL. 90% of production comes from 29 operated horizontal wells.

- September estimated EBITDA of $3.3MM with a 68% profit margin and a 12-month forecast total PDP net cashflow of $31.6 million.

- 20,000 de-risked, high working interest HBP net acres in core STACK. Concentrated in most active parts of the basin with rigs offsetting acreage.

- 108 Bcfe in PDP reserves representing an 8.5-year R/P ratio. 1P reserves of 410 BCFE for a 32.6 year R/P ratio. Near-term PDP declines approximately 20%.

- 35 operated horizontal locations with reserves totaling 303 Bcfe (73% Gas). Additional 3,000 nonoperated net undeveloped acres.

For information visit meagheradvisors.com or contact Nick Asher, vice president of business development, at nasher@meagheradvisors.com.

Recommended Reading

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

CNOOC Makes Oil, Gas Discovery in Beibu Gulf Basin

2025-03-06 - CNOOC Ltd. said test results showed the well produces 13.2 MMcf/d and 800 bbl/d.

US Drillers Add Oil, Gas Rigs for Second Week in a Row, Baker Hughes Says

2025-02-07 - Despite this week's rig increase, Baker Hughes said the total count 6% below this time last year.

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.