The following information is provided by Oil & Gas Asset Clearinghouse LLC. All inquiries on the following listings should be directed to Clearinghouse. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

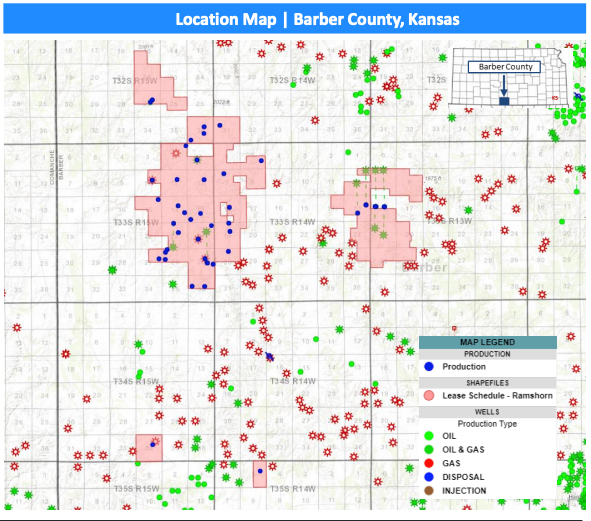

Ramshorn Resources retained Oil & Gas Asset Clearinghouse LLC to market the private sale of an operated working interest package in Kansas’ Barber County.

Highlights:

Asset Overview

- Operated working interest in 50 wells on 19,024 net mineral acres in Barber County, Kansas

- 100% of acreage HBP

- 100% working interest / 83% net revenue interest

- Pipeline and other infrastructure in place to facilitate numerous quantified growth opportunities

- 35 miles of gas pipeline and 35 miles of water pipelines

- Three active gas delivery points to OneOK

Stable Production and Cash Flow

- 23 barrels of oil per month / 622 Mcf of gas per month average net production (May-June)

- $70,000 per month average net operating income (May-June)

- PV-10: $2.7 million (PDP)

Low Risk Development Opportunities

- Low risk development opportunities

- 50 Mississippian vertical PUD locations

- PV-10: $11.8 million

- 19 Woodford horizontal PUD locations

- PV-10: $6.9 million

- 50 Mississippian vertical PUD locations

- De-risked by current production and extensive petrophysical analysis

- 25 sq miles of high-resolution 3D seismic

Bids are due Sept. 30. The transaction is expected to have an Oct. 1 effective date.

A virtual data room is available. For information visit ogclearinghouse.com or contact Tyler Post at tpost@ogclearinghouse.com or 972-736-5814.

Recommended Reading

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

Hess Corp. Bucks E&P Trend, Grows Bakken Production by 7%

2025-01-29 - Hess Corp. “continues to make the most of its independent status,” delivering earnings driven by higher crude production and lower operating costs, an analyst said.

RWE Slashes Investment Upon Uncertainties in US Market

2025-03-20 - RWE introduced stricter investment criteria in the U.S. and cut planned investments by about 25% through 2030, citing regulatory uncertainties and supply chain constraints as some of the reason for the pullback.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.