The following information is provided by Sayer Energy Advisors. All inquiries on the following listings should be directed to Sayer Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

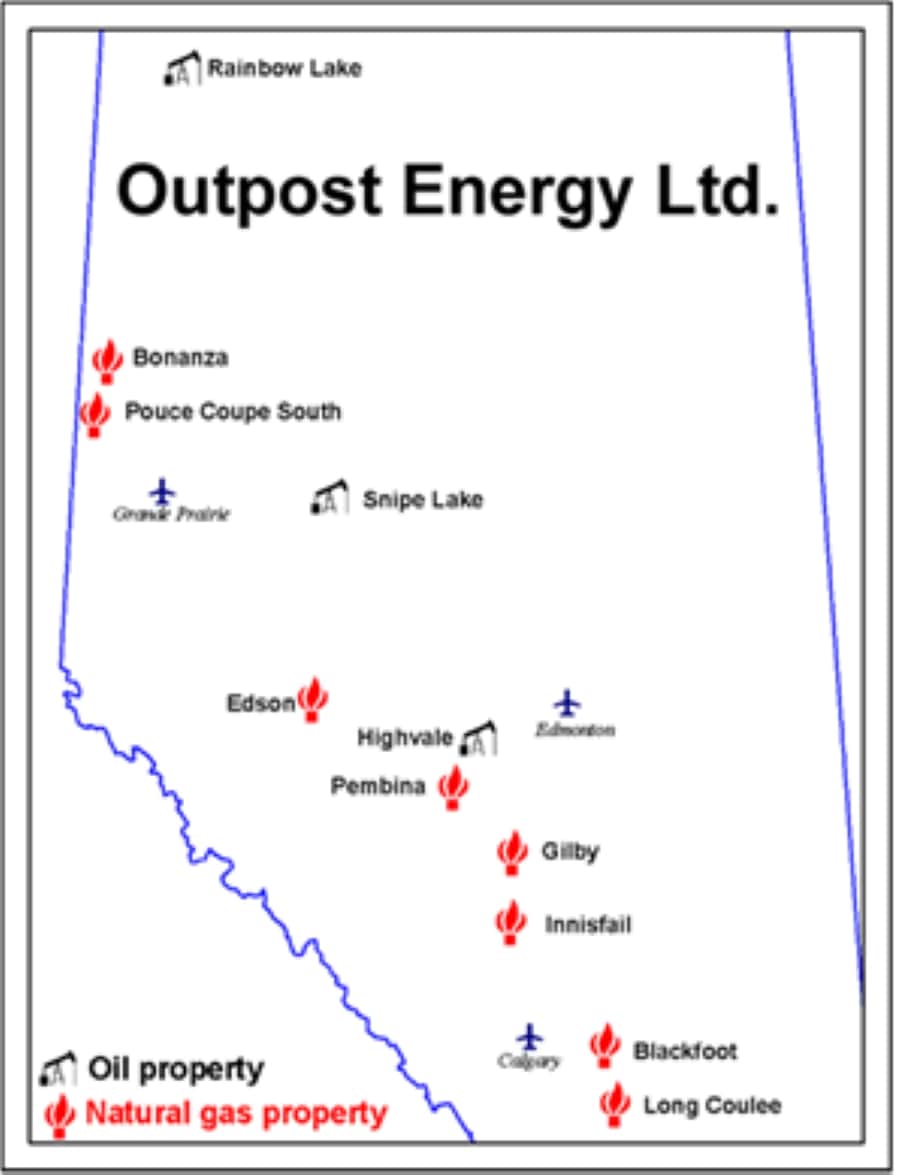

Outpost Energy has retained Sayer Energy Advisors for a corporate sale process on properties in Alberta.

Opportunity highlights:

- Forecasted average daily sales production net to Outpost from the Properties on a proved developed producing basis for the year ended Dec. 31,2024 is approximately 395 boe/d, consisting of approximately 2.0 MMcf/d of natural gas and 57 bbl/d of oil and natural gas liquids.

- Forecasted operating income net to Outpost on a proved developed producing basis for the year ended December 31, 2024 is approximately $1.4 million.

- The Company has minimal bank debt and positive working capital. As at Dec. 31, 2022, Outpost had total unused Canadian income tax pools of approximately $483,000.

- As of Feb. 3, 2024, Outpost had a deemed net asset value of $6.4 million (deemed assets of $11.1 million and deemed liabilities of $4.8 million), with an LMR ratio of 2.33.

Bids are due April 4 at noon. For complete due diligence, please visit sayeradvisors.com, or email Tom Pavic, president, at TPavic@sayeradvisors.com.

Recommended Reading

Aethon Dishes on Western Haynesville Costs as Gas Output Roars On

2025-01-22 - Aethon Energy’s western Haynesville gas wells produced nearly 34 Bcf in the first 11 months of 2024, according to the latest Texas Railroad Commission data.

DUCs Fly the Coop: Big Drawdowns from the Midland to Haynesville

2025-02-14 - The Midland Basin depleted its inventory of excess DUCs the most last year, falling from two months of runway to one during the past year, according to a report by Enverus Intelligence Research.

Coterra to Rig Back up in Marcellus to Arrest Decline

2025-02-26 - “This increase in activity is from zero to ‘some’ activity. I wouldn't characterize this as ‘leaning into’ a gas market,” Shane Young, Coterra Energy’s CFO, told investors.

Matador Touts Cotton Valley ‘Gas Bank’ Reserves as Prices Increase

2025-02-21 - Matador Resources focuses most of its efforts on the Permian’s Delaware Basin today. But the company still has vast untapped natural gas resources in Louisiana’s prolific Cotton Valley play, where it could look to drill as commodity prices increase.

Operators Look to the Haynesville on Forecasts for Another 30 Bcf/d in NatGas Demand

2025-03-01 - Futures are up, but extra Haynesville Bcfs are being kept in the ground for now, while operators wait to see the Henry Hub prices. A more than $3.50 strip is required, and as much as $5 is preferred.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.