The following information is provided by Opportune Partners LLC. All inquiries on the following listings should be directed to Opportune. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

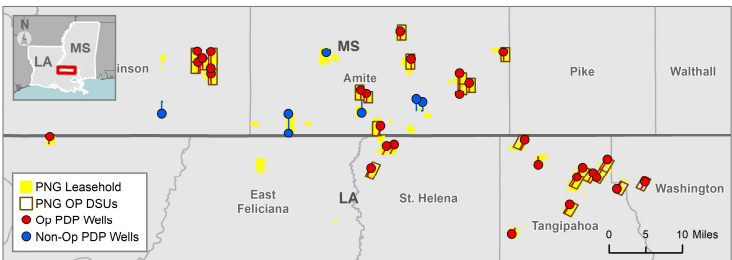

Paloma Natural Gas LLC retained Opportune Partners LLC as its exclusive financial advisor for the sale of certain oil and gas assets in Mississippi and Louisiana. The assets include net production of 544 boe/d (100% oil) across 49,000 gross (34,200 net) acres from 37 gross producers.

Asset highlights:

- Net production of 544 Boe/d (100% oil) from 37 gross producers

- PDP PV10 of ~$22.7MM with NTM operating cash flow of $7.5 MM

- Access to premium Gulf Coast pricing

- 49,000 gross and 34,200 net acres

- Avg. WI and NRI of 66.9% and 50.9%, respectively

Bids are due March 2. The Virtual Data Room will be available beginning Jan. 17, and Opportune will be available for Q&A sessions beginning Jan. 23. Send executed confidentiality agreement and any Q&A regarding the properties to PalomaNG@Opportune.com.

Recommended Reading

LNG, Data Centers, Winter Freeze Offer Promise for NatGas in ‘25

2025-02-06 - New LNG export capacity and new gas-fired power demand have prices for 2025 gas and beyond much higher than the early 2024 outlook expected. And kicking the year off: a 21-day freeze across the U.S.

Gas-Fired Power Plants Create More Demand for Haynesville Shale

2025-03-04 - Expansions and conversions of Gulf Coast power plants are taking advantage of the plentiful Haynesville Shale gas.

Kissler: Is it Time to Worry About Crude Prices?

2025-03-14 - Oil trends will hinge on China’s economy, plans to refill the SPR and how tariff threats play out.

Hirs: America Confronts Sovereign Risk with Recession on the Horizon

2025-03-21 - The risk to U.S. oil and gas production comes from within, and a recession looms on the horizon.

Segrist: American LNG Unaffected by Cut-Off of Russian Gas Supply

2025-02-24 - The last gas pipeline connecting Russia to Western Europe has shut down, but don’t expect a follow-on effect for U.S. LNG demand.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.