The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

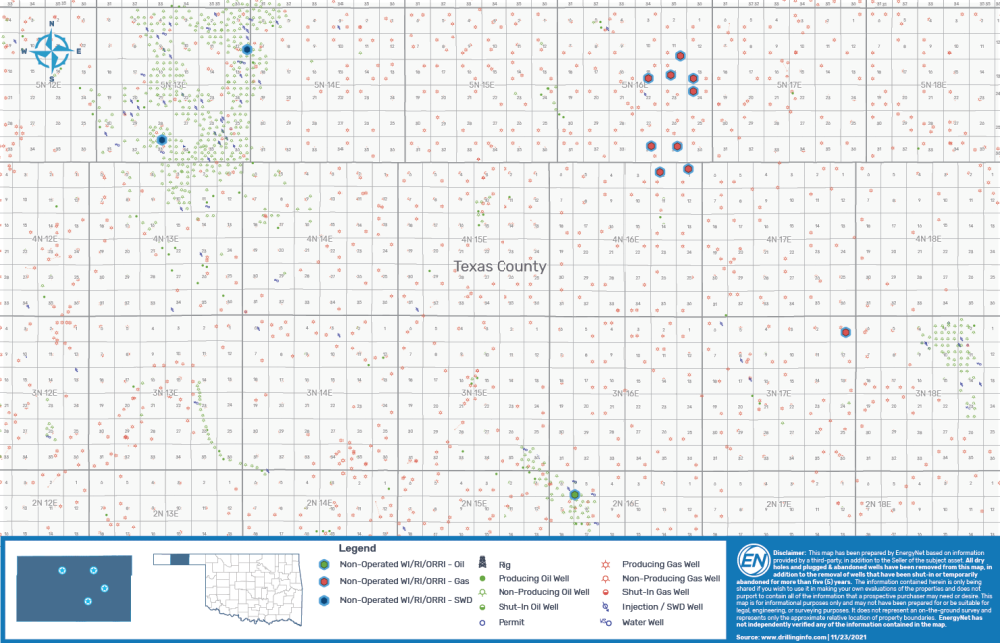

Pantera Energy Co. retained EnergyNet for the sale of a nonoperated and royalty property package located in the Oklahoma Panhandle through an auction closing Dec. 15.

The offering comprises 13 properties and includes nonoperated working interest, overriding royalty interest (ORRI) and royalty interest in Oklahoma’s Texas County.

Highlights:

- Nonoperated Working Interest in Seven Producing Properties:

- 56.25% to 1.00% Working Interest / 49.21875% to 0.875% Net Revenue Interest

- An Additional ORRI in Three Properties

- An Additional Royalty Interest in the West Hough Morrow Unit

- ORRI in Six Producing Properties:

- 19.14063% to 6.3802% ORRI

- Six-month Average 8/8ths Production: 69 bbl/d of Oil and 277 Mcf/d of Gas (Includes Unit Production)

- Six-month Average Net Income: $53,961/Month

- Select Operators include BCE-Mach III LLC, Breitburn Operating LP and XTO Energy Inc.

- Further Subject to Oklahoma State Sales Tax

- Lien to be Released at Closing

Bids are due by 2:30 p.m. CST on Dec. 15. For complete due diligence information on any of the packages visit energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: Feb. 10, 2025

2025-02-10 - Here’s a roundup of the latest E&P headlines, from a Beetaloo well stimulated in Australia to new oil production in China.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.