The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

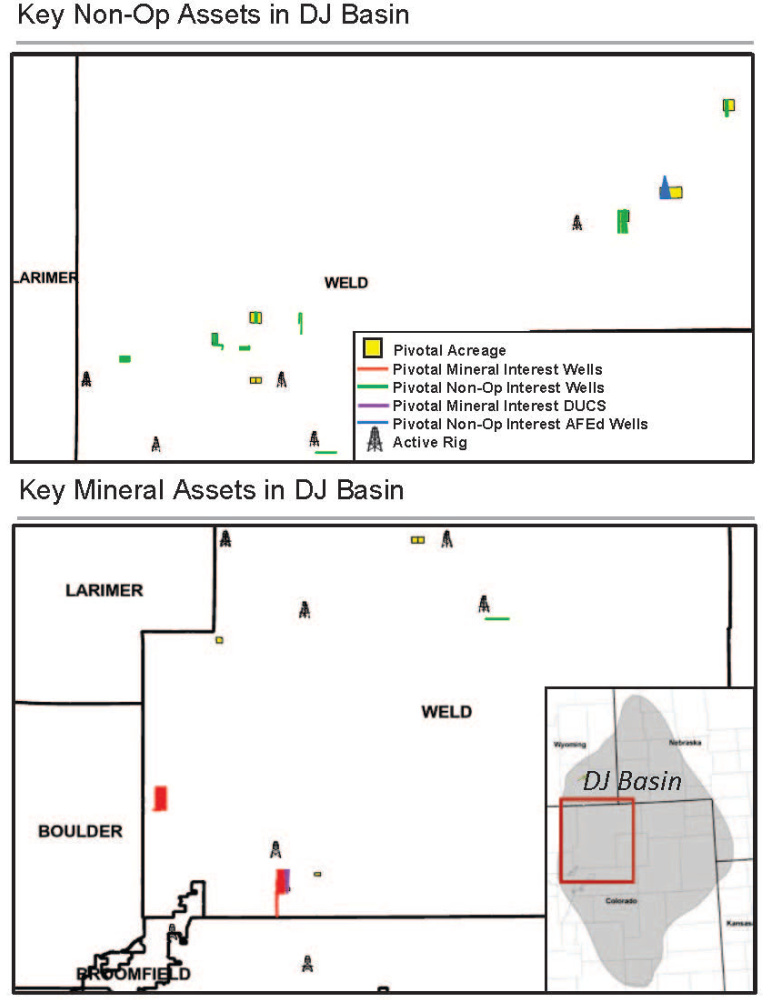

Pivotal Petroleum Partners LP retained Eagle River Energy Advisors LLC as its exclusive adviser to divest certain nonoperated working interest and mineral assets and associated lands in the Denver-Julesburg (D-J) Basin of Colorado.

Highlights:

Producing Assets in the D-J Basin

- ~150 boe/d net production (2Q 2021 average)

- Nonop and Mineral production (90% Nonop / 10% Mineral)

- $1.3 million annualized cash flow (2Q 2021)

- 80 existing PDP wells (51 Nonop / 29 Mineral)

Highly Diversified Production Profile

- Diversified production stream (36% Oil / 35% Gas / 29% NGL)

- Asset spread across Weld County

- Highly diversified production stream by well vintage

- Existing well production from the Niobrara and Codell

- Multiple experienced operators including Extraction Oil & Gas, PDC Energy, Occidental Petroleum, Chevron, Fundare Resources and Verdad Resources

Producing Assets with Additional Upside

- Near term development including seven DUCs and eight AFEd wells

- Robust 100+% type well IRRs

- Additional upside of 30 PUD locations

- Operational upside with four PDSI wells

- 167 net Nonop acres and 173 net Royalty acres

Bids are due by 4 p.m. CT on Nov. 16. The effective date of the transaction is Dec. 1.

A virtual data room will be available starting Oct. 20. For information contact Chris Martina, technical director at Eagle River, at 720-726-6092 or cmartina@eagleriverea.com.

Recommended Reading

Pioneer Energy’s Tech Offers More Pad Throughput, Fewer Emissions

2025-01-14 - Pioneer Energy’s Emission Control Treater technology reduces emissions and can boost a well’s crude yield by 5% to10%, executives say.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

Momentum AI’s Neural Networks Find the Signal in All That Drilling Noise

2025-02-11 - Oklahoma-based Momentum AI says its model helps drillers avoid fracture-driven interactions.

Pair of Large Quakes Rattle Texas Oil Patch, Putting Spotlight on Water Disposal

2025-02-19 - Two large earthquakes that hit the Permian Basin, the top U.S. oilfield, this week have rattled the Texas oil industry and put a fresh spotlight on the water disposal practices that can lead to increases in seismic activity, industry consultants said on Feb. 18.

Digital Twins ‘Fad’ Takes on New Life as Tool to Advance Long-Term Goals

2025-02-13 - As top E&P players such as BP, Chevron and Shell adopt the use of digital twins, the technology has gone from what engineers thought of as a ‘fad’ to a useful tool to solve business problems and hit long-term goals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.