The following information is provided by RedOaks Energy Advisors. All inquiries on the following listings should be directed to RedOaks Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

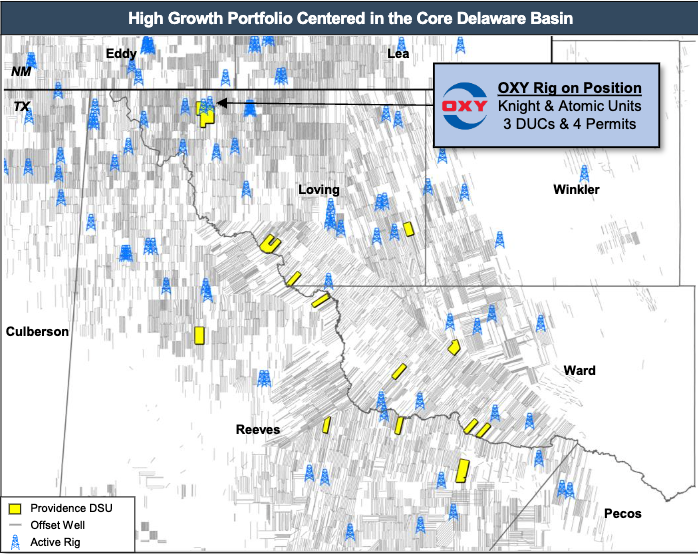

Providence Energy Partners III LP retained RedOaks Energy Advisors for the sale of certain non-operated working interest properties located in the Permian Basin. With 954 net acres in the core of the Delaware and Midland basins, the opportunity has an established production base from 92 horizontal producers generating strong cash flow.

Key Considerations

- Core Delaware / Midland Basin non-operated working interest portfolio

- 954 net acres | 26 DSUs

- Established production base from 92 horizontal producers generates strong cash flow

- NTM CF: $5.6MM

- Current PDP net production: 1,042 Boepd

- Partnered with Permian-focused operators

- Majority operated by OXY, Coterra and CPX | OXY running a rig on position

- Strong economics across stacked targets

- Operators exploiting 5 benches with 120+ undeveloped locations

Bids are due at noon CST on Nov. 19. For complete due diligence information, please visit redoaksenergyadvisors.com or email David Carter, partner, at david.carter@redoaksadvisors.com.

Recommended Reading

Exclusive: Kinder Morgan’s Fore on Pipeline Permitting Momentum in Past Year

2025-04-07 - Kinder Morgan’s Allen Fore, vice president of public affairs, delves into how the Trump administration’s initiatives to achieve energy dominance is a “game changer” for pipeline projects, in this Hart Energy Exclusive interview.

Citgo Stalking Horse Bidder Draws Ire from Investors

2025-04-07 - A court-appointed special master recommended a stalking horse bidder for the parent of Citgo Petroleum, which drew objections from Gold Reserve and other investors.

Infinity’s Utica Oil Output Rising as Play M&A, Expansion Underway

2025-04-07 - Securities analysts expect some M&A may be coming from the growing oil and wet-gas results in eastern Ohio, they report, including by newly public Infinity Natural Resources.

How Elk Range Took the Leap to Buy Oxy’s $905MM D-J Heirloom

2025-04-07 - Elk Range Royalties closed on a $905 million purchase of Occidental’s assets in the Denver-Julesburg Basin in March— a once-in-a-lifetime purchase, CEO Charlie Shufeldt told Hart Energy.

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.