The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Read & Stevens Inc. and First Century Oil Inc. are offering for sale certain operated and nonoperated properties located in the Delaware Basin. The company has retained TenOaks Energy Advisors as its exclusive adviser in connection with the transaction. The company’s preference is for a cash-free, debt-free corporate / entity sale.

Key Considerations:

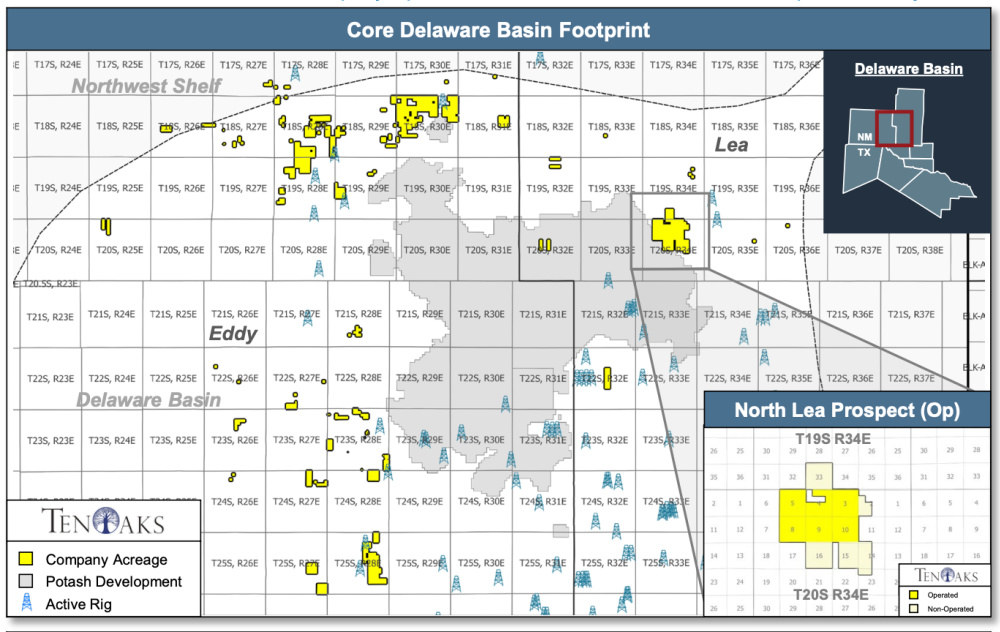

- Premier operated and nonoperated portfolio centered in Lea and Eddy Counties, New Mexico

- Next 12-month PDP cash flow of $20 million anchored by diversified production base (~1,200 net boe/d) of operated and nonoperated interests

- Significant free cash flow potential over the next decade from operated and nonoperated growth

Operated Properties:

- Core operated footprint in Lea County with operational control across six contiguous sections in T20S R34E

- Significant undeveloped potential (153 gross locations) targeting five delineated zones

- Historically undercapitalized asset poised for next stage full-scale pad development by a well-capitalized operator

Nonoperated Properties:

- Unique nonoperated position includes non-op working interests and royalty interests with 19 DUCs / 86 permits / pre-permits (AFEs) on position

- Partnered with well-capitalized operators with multiple rigs on position (Mewbourne Oil Co., Coterra Energy Inc., Occidental Petroleum Corp. and EOG Resources Inc.)

Bids are due mid-September. Closing of the transition is targeted by the fall with an effective date of Nov. 1.

A virtual data room is available. For information visit tenoaksenergyadvisors.com or contact Forrest Salge at TenOaks Energy Advisors at 817-233-4096 or Forrest.Salge@tenoaksadvisors.com.

Recommended Reading

EOG Ramps Gassy Dorado, Oily Utica, Slows Delaware, Eagle Ford D&C

2025-03-16 - EOG Resources will scale back on Delaware Basin and Eagle Ford drilling and completions in 2025.

Formentera Joins EOG in Wildcatting South Texas’ Oily Pearsall Pay

2025-01-22 - Known in the past as a “heartbreak shale,” Formentera Partners is counting on bigger completions and longer laterals to crack the Pearsall code, Managing Partner Bryan Sheffield said. EOG Resources is also exploring the shale.

Expand Lands 5.6-Miler in Appalachia in Five Days With One Bit Run

2025-03-11 - Expand Energy reported its Shannon Fields OHI #3H in northern West Virginia was drilled with just one bit run in some 30,000 ft.

CNOOC Makes Oil, Gas Discovery in Beibu Gulf Basin

2025-03-06 - CNOOC Ltd. said test results showed the well produces 13.2 MMcf/d and 800 bbl/d.

Sabine Oil & Gas to Add 4th Haynesville Rig as Gas Prices Rise

2025-03-19 - Sabine, owned by Japanese firm Osaka Oil & Gas, will add a fourth rig on its East Texas leasehold next month, President and CEO Carl Isaac said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.