The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Ridgefield Energy Partners LLC retained Detring Energy Advisors to market for sale its oil and gas nonoperated working interest and mineral and royalty interest concentrated in the core of the Delaware Basin.

The assets offer an opportunity, according to Detring, to acquire exposure to best-in-class, well-capitalized operators focusing significant horizontal activity on Ridgefield’s footprint plus robust near-term PDP cash flow with imminent growth driven by significant DUC/permit inventory. Detring added that the offering also includes substantial undeveloped inventory across multiple highly-economic Bone Spring and Wolfcamp horizons.

Ridgefield anticipates selling the asset packages separately, but is open to selling the assets on a combined basis.

Highlights:

Package #1: Ridgefield Nonoperated Working Interest

- Robust Cash Flow ($18 million PDP plus DUC next 12-month) and Production (1,780 boe/d | 75% Liquids)

- 181 PDP wells generate significant and reliable liquid-weighted production

- PDP PV-10: $48 million

- 13 DUCs anticipated online by first-quarter 2022 and multiple recent permits drive continued production growth into 2022

- Ridgefield’s nonop assets fund future capital requirements well within PDP cash flow base

- 181 PDP wells generate significant and reliable liquid-weighted production

- >700 Highly-Economic Undeveloped Locations

- Tremendous upside value remaining with ~80% of net reserves undeveloped

- Robust type curves with 200+ boe/d per thousand ft IP (average) and average IRRs of well in excess of 100% for all major targets ensures continued development focus by operators

- Operating partners are premier, well-capitalized E&P operators including Chevron, Occidental Petroleum, Colgate Energy and ConocoPhillips

Package #2: Ridgefield Minerals and Royalty Interest

- Meaningful Cash Flow (PDP plus DUC next 12-month cash flow of $3.4 million) with Line-of-Sight Development

- Consistent activity from operators provides line-of-sight to high certainty, near-term development underwritten by recent DUCs (21) and permits (15)

- 162 producing wells provide stable cash flow base from liquid-weighted production

- Net Production: ~265 boe/d (~80% liquids)

- PDP PV-10: $9 million

- Substantial on-mineral and offsetting rig activity pointing to strong continued growth beyond line-of-sight DUCs and Permits

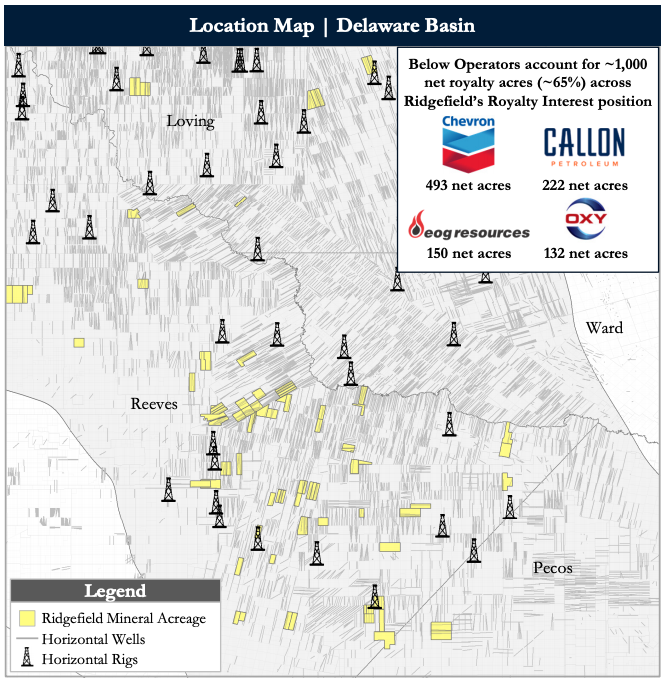

- Compelling portfolio of ~1,600 net royalty acres (95% Reeves | 4% Loving | 1% Pecos) in the core of the Delaware Basin

- Position being developed by premier, well-capitalized operators (Chevron, Occidental Petroleum, Pioneer Natural Resources, EOG Resources)

- ~50,500 gross acre footprint ensures consistent activity

- Position overlays the most active, over-pressured core of the highest-returning basin in the Lower 48

- >750 remaining high returning locations

Process Summary:

- Ridgefield anticipates divesting the assets in two separate transactions

- Evaluation materials available via the Virtual Data Room on Aug. 18

- Proposals due on Sept. 15

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Utica Liftoff: Infinity Natural Resources’ Shares Jump 10% in IPO

2025-01-31 - Infinity Natural Resources CEO Zack Arnold told Hart Energy the newly IPO’ed company will stick with Ohio oil, Marcellus Shale gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.