The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Singer Bros. LLC retained TenOaks Energy Advisors as its exclusive adviser in connection with the sale of its mineral and nonop portfolio.

Highlights:

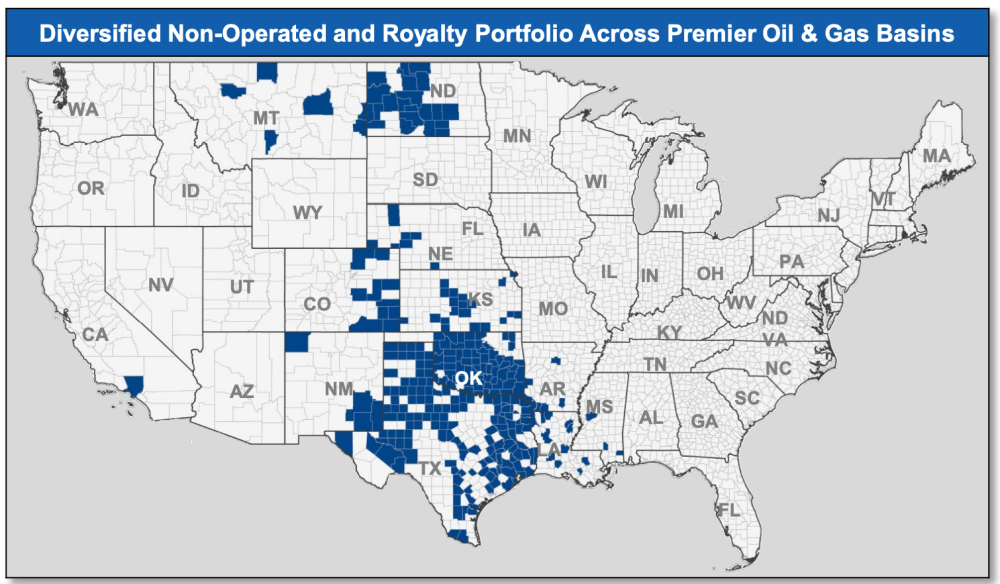

- Diversified, nonop working interest and mineral portfolio constructed over decades

- ~61,000 net mineral acre footprint provides valuable exposure to diverse Midcontinent plays

- Next 12-month PDP Cash Flow: $3.4 million

- Singer asset base delivers consistent cash flow across varied market environments

Bids are due in late October. The transaction is expected to have an effective date of Sept. 1.

A virtual data room is available. For information visit tenoaksenergyadvisors.com or contact Mariana Castaneda at TenOaks Energy Advisors at 972-822-3817 or Mariana.Castaneda@tenoaksadvisors.com.

Recommended Reading

Crescent Energy Closes $905MM Acquisition in Central Eagle Ford

2025-01-31 - Crescent Energy’s cash-and-stock acquisition of Carnelian Energy Capital Management-backed Ridgemar Energy includes potential contingency payments of up to $170 million through 2027.

Petro-Victory Buys Oil Fields in Brazil’s Potiguar Basin

2025-02-10 - Petro-Victory Energy is growing its footprint in Brazil’s onshore Potiguar Basin with 13 new blocks, the company said Feb. 10.

Report: Diamondback in Talks to Buy Double Eagle IV for ~$5B

2025-02-14 - Diamondback Energy is reportedly in talks to potentially buy fellow Permian producer Double Eagle IV. A deal could be valued at over $5 billion.

Apollo Funds Acquires NatGas Treatment Provider Bold Production Services

2025-02-12 - Funds managed by Apollo Global Management Inc. have acquired a majority interest in Bold Production Services LLC, a provider of natural gas treatment solutions.

Constellation Bets Big on NatGas in $16.4B Deal for Calpine

2025-01-10 - Constellation Energy will acquire Calpine Corp. in a $26.6 billion deal, including debt, that will give the pure-play nuclear company the largest natural gas power generation fleet.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.