The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

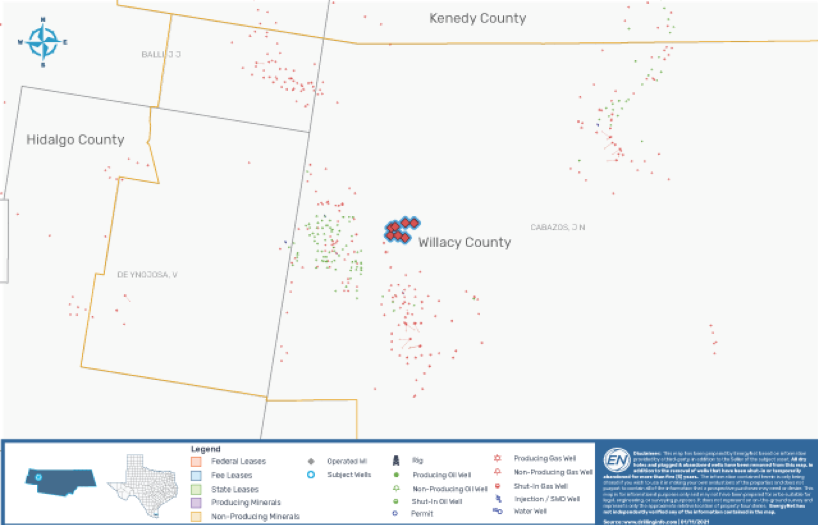

Safari Production Co. Inc. retained EnergyNet for the sale of the Petru, V.A. Lease in South Texas through an auction closing Feb. 14. The package includes 100% gross working interest with operations plus 720 net leasehold acres in Willacy County, Texas.

Highlights:

- Operated Working Interest in Petru, V.A. Lease:

- 100.00% Working Interest / 78.423558% Net Revenue Interest

- Five Producing Wells | Two Non-Producing Wells

- Six-Month Average 8/8ths Production: 558 Mcf/d of Gas and 16 bbl/d of Oil

- The Petru 6 began producing 600+ Mcf/d in mid November

- Five-Month Average Net Income: $31,449/Month

- Projected December 2020 Net Income: $100,118

- 720.00 Net Leasehold Acres

- Operator Bond Required

Bids are due by 1:35 p.m. CST Feb. 14. For complete due diligence information on either package visit energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Gevo Completes $210MM Red Trail Assets Deal for Ethanol Plant

2025-02-05 - Gevo has renamed an ethanol production plant and CCS assets acquired from Red Trail Energy as “Net-Zero North.”

Ring Sells Non-Core Vertical Wells as it Closes in on Lime Rock

2025-03-06 - Ring Energy Inc. said it sold non-core vertical wells with high operating costs as it works to close an acquisition of Lime Rock Resources IV’s Central Basin Platform assets.

Coterra Energy Closes Pair of Permian Basin Deals for $3.9B

2025-01-28 - Coterra Energy Inc. purchased Delaware Basin assets from Franklin Mountain Energy and Avant Natural Resources for $3.9 billion.

On The Market This Week (Jan. 20, 2025)

2025-01-24 - Here is a roundup of marketed oil and gas interests in the Delaware Basin, Midcontinent and Bakken from select sellers.

Coterra Notches Year-End Permian Deal for $43MM

2024-12-31 - Coterra Energy will buy an additional 1,650 net royalty acres from Sandia Minerals LLC, the interests of which are owned by Franklin Mountain Royalty Investments, for $43 million.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.