The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

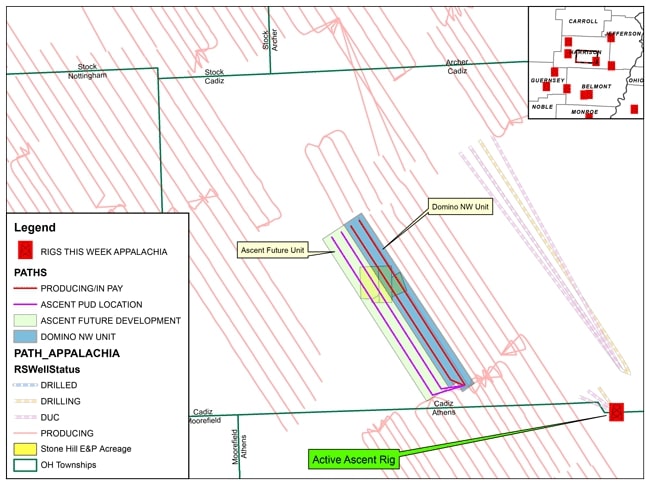

Stone Hill Exploration has retained EnergyNet for the sale of a four well package including two proved developed producing wells in Harrison County, Ohio. The Lot # 119264 package includes a six-month average free cash flow of $59,652 per month.

Opportunity highlights:

- Non-Operated WI in two PDP Utica/Point Pleasant Wells

- Two Additional PUD Utica/Point Pleasant Locations

- Six-month Average Free Cash Flow: $59,652/Month

- Six-month Average 8/8ths Production: 783 bbl/d of oil and 18,529 Mcf/d

- Six-month Average Net Production: 40 bbl/d of oil and 957 Mcf/d

- Operator: Ascent Resources Utica LLC

- 86.36 Net HBP Leasehold Acres

Bids are due Sept. 12 at 4:00 p.m. CDT. For complete due diligence, please visit energynet.com or email Zachary Muroff, managing director, at Zachary.Muroff@energynet.com.

Recommended Reading

Shale Outlook Permian: The Once and Future King Keeps Delivering

2025-01-11 - The Permian Basin’s core is in full-scale manufacturing mode, with smaller intrepid operators pushing the basin’s boundaries further and deeper.

Civitas Makes $300MM Midland Bolt-On, Plans to Sell D-J Assets

2025-02-25 - Civitas Resources is adding Midland Basin production and drilling locations for $300 million. To offset the purchase price, Civitas set a $300 million divestiture target “likely to come” from Colorado’s D-J Basin, executives said.

Langford Enters Midland Basin with Murchison Oil and Gas Deal

2025-01-14 - Langford Energy Partners closed on an acquisition of 8,000 acres in the Midland Basin from Murchison Oil and Gas LLC.

Occidental to Up Drilling in Permian Secondary Benches in ‘25

2025-02-20 - Occidental Petroleum is exploring upside in the Permian’s secondary benches, including deeper Delaware Wolfcamp zones and the Barnett Shale in the Midland Basin.

More Uinta, Green River Gas Needed as Western US Demand Grows

2025-01-22 - Natural gas demand in the western U.S. market is rising, risking supply shortages later this decade. Experts say gas from the Uinta and Green River basins will make up some of the shortfall.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.