The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Titanium Exploration Partners LLC retained EnergyNet for the sale of an Oklahoma well package through a sealed-bid property, Lot# 95352.

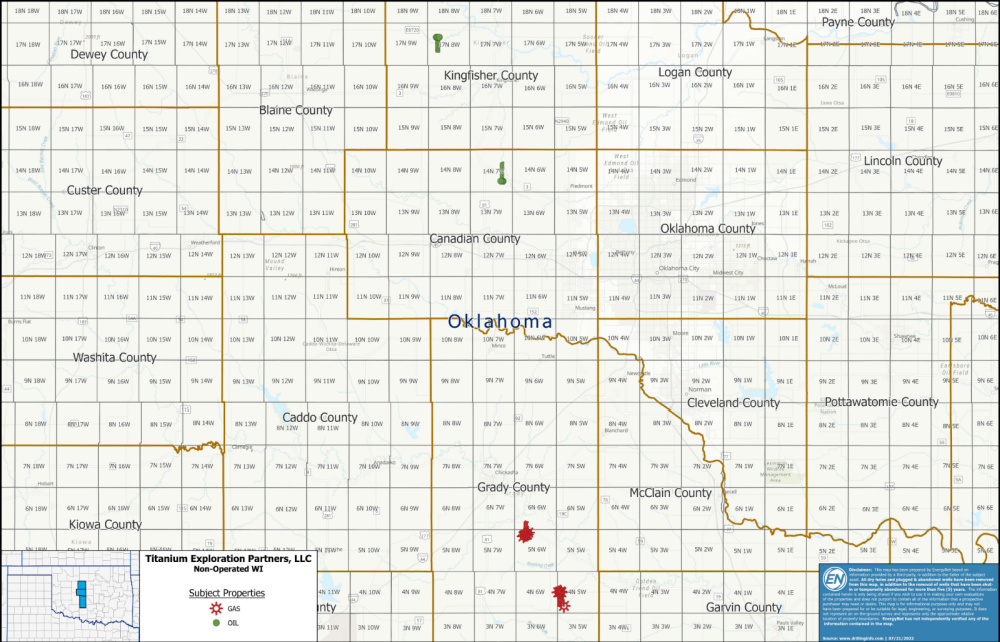

The offering comprises nonoperated working interest in 15 producing horizontal wells across Canadian, Grady and Kingfisher counties, Oklahoma, operated by Continental Resources Inc. and Ovintiv Inc. Production is primarily from prolific Anadarko Basin reservoirs including the Woodford and Mississippian.

Highlights:

- Nonoperated Working Interest in 15 Producing Horizontal Wells:

- 4.582322% to 0.175672% Working Interest / 3.665858% to 0.131754% Net Revenue Interest

- Six-month Average Net Income: $341,751/Month

- Current Average 8/8ths Production: 4,715 bbl/d of oil and 60,283 Mcf/d of gas

- Current Average Net Production: 63 bbl/d of oil and 1,132 Mcf/d of gas

- Operators: Continental Resources Inc. and Ovintiv USA Inc.

- Further Subject to Oklahoma State Sales Tax

Bids are due at 4 p.m. CDT on Sept. 20. The effective date of sale is Sept. 1.

A virtual data room is available. For complete due diligence information visit energynet.com or email Zachary Muroff, managing director, at Zachary.Muroff@energynet.com, or Denna Arias, executive director of acquisitions and divestments, at Denna.Arias@energynet.com.

Recommended Reading

Shell Adds Two Members to Executive Committee

2025-01-23 - Shell has named Andrew Smith and Machteld de Haan as members of its executive committee, effective April. 1.

Talos Selects Longtime Shell Exec Paul Goodfellow as President, CEO

2025-02-03 - Shell veteran Paul Goodfellow’s selection as president, CEO and board member of Talos Energy comes after several months of tumult in the company’s C-suite.

BP Cuts Renewable Investment, Boosts Oil and Gas in Strategy Shift

2025-02-26 - BP aims to grow oil and gas production to between 2.3 MMboe/d and 2.5 MMboe/d in 2030.

BP Cuts Over 5% of Workforce to Reduce Costs

2025-01-16 - BP will cut over 5% of its global workforce as part of efforts to reduce costs and rebuild investor confidence.

Baker Hughes Appoints Ahmed Moghal to CFO

2025-02-24 - Ahmed Moghal is taking over as CFO of Baker Hughes following Nancy Buese’s departure from the position.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.